General Electric (NYSE: GE) stock price plunged more than 42% this year as coronavirus pandemic has devastated its future fundamentals. The longtime stockholder has started exiting their positions after the chief executive officer said the macro environment could deteriorate further before recovering.

Longtime shareholder Trian Fund sold 15.5M shares at the end of the last month, representing 26% of its overall holdings. Trian’s investment went wrong in GE as the shares of the struggling Industrial Conglomerates dropped 33% each year on average since Trian Fund initiated a stake in GE.

Along with the slowing demand for power and Renewable Energy, the company’s aviation businesses hit hardest by the COVID-19 related disruptions.

Teal Group analyst Richard Aboulafia forecasts a 75% decline in demand for airplane maintenance and spare parts, while International Air Transport Association said airlines would lose $84B in 2020.

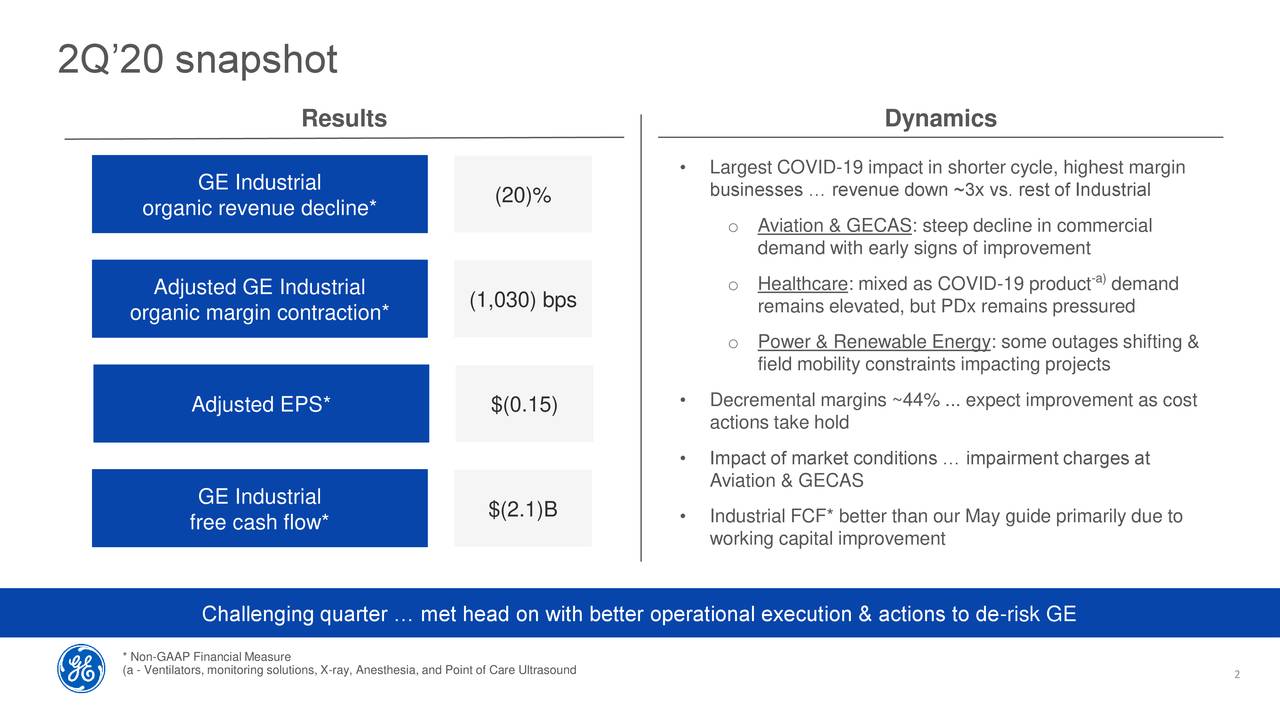

Its second-quarter adjusted loss came in at $0.15 per share, down 200% from the year-ago period.

“While it’s too early to predict the trajectory for the recovery of commercial aviation, we continue to plan for a prolonged return to prior levels of activity,” CEO Larry Culp declared. “We expect to return to positive Industrial free cash flow in 2021.”

Its second-quarter revenue of $17.75bn plummeted 38% year over year. The industrial organic revenue, which is the focus of CEO Larry Culp’s business strategy, dropped 20% year over year.

Its operating cash flows came in at a negative $1.6bn compared to $460M in the previous year. The industrial free cash flow stood around negative $2bn.

Despite the substantial cash generation decline, Larry Culp says they don’t need to look at external sources for cash. The company announced to fully monetize its Baker Hughes stake to increase its cash position and divest non-core assets.

General Electric stock price is currently trading around $6.40 per share. The shares are down 33% in the last twelve months, extending the five-year decline to 75%.