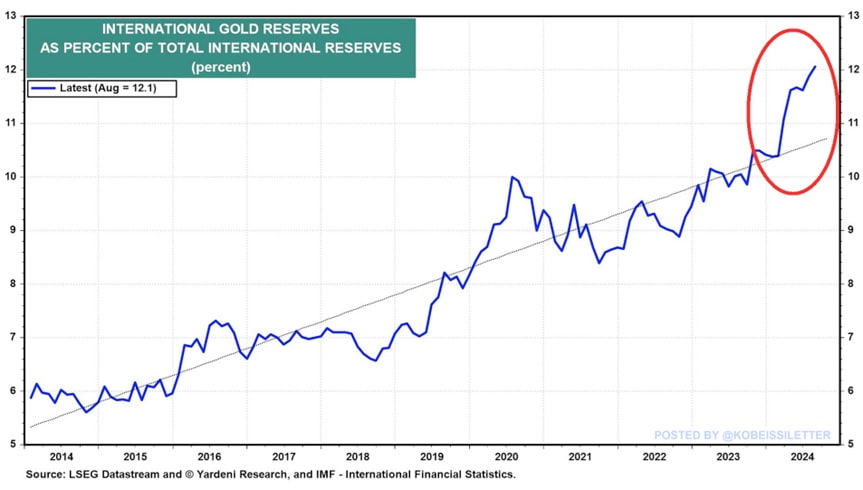

In another gold rush, central banks worldwide have been accumulating and now hold 12.1% of the precious metal’s global reserves. This accumulation has intensified in recent years, reaching a record-high level since 1990, which has doubled over the last decade.

According to The Kobeissi Letter‘s post, China, India, Turkey, and Poland are the largest contributors to this gold rush. Interestingly, the first three are members of the BRICS, also leading in other commodities and human resources, growing their relevancy.

China, in particular, has massively accumulated the yellow metal that now accounts for 5.4% of its foreign exchange reserves. The country’s central bank currently holds 2,264 tonnes of gold, a behavior mirrored even by young Chinese people.

Notably, the international gold reserves chart illustrates the new “gold rush” with a significant rally above the 10-year average. Central banks are rushing to accumulate as much of the leading commodity as possible, and other institutions may follow soon.

International gold reserves as percent of total international reserves. Source: LSEG Datastream and Yardeni Research, and IMF – International Financial Statistics.

Gold price analysis

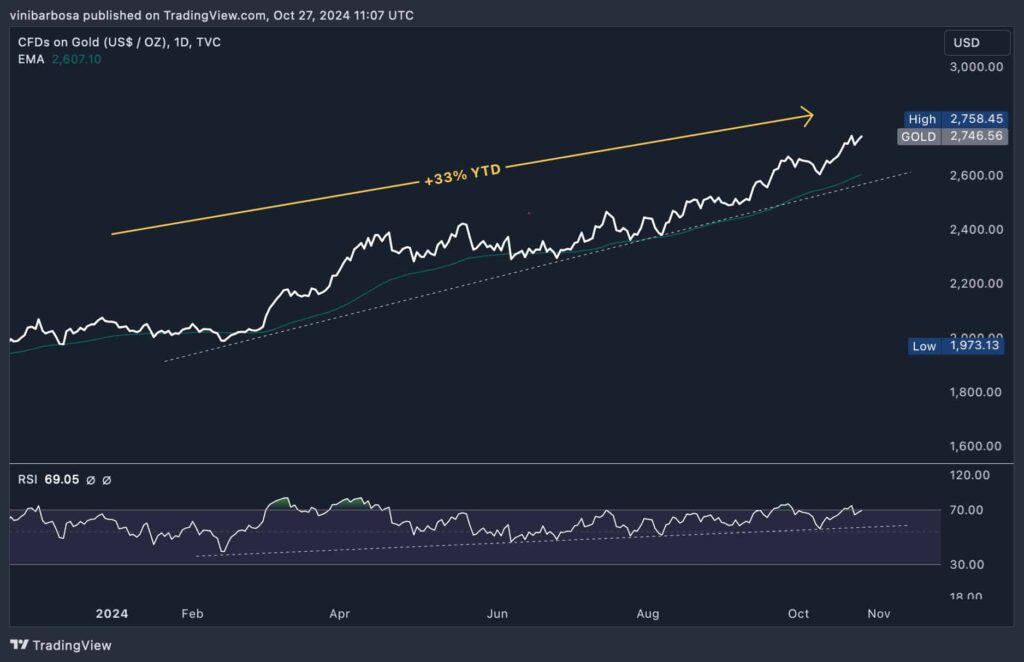

Meanwhile, gold is trading near its recently reached all-time high of $2,758.45 per ounce. Precisely, TradingView‘s price index of CFDs on gold (US$/OZ) registers a last exchange rate of $2,746.56.

This price marks 33% gains for the precious metal’s investors year-to-date (YTD), displaying strong indicators for bullish long-term continuation. Indeed, gold is rushing above the 50-day exponential moving average (50EMA) of $2,607.10. Moreover, its daily relative strength index (RSI) continues to show strong momentum with an uptrend convergence YTD.

On that note, some analysts believe gold could reach $3,000, while others are far more optimistic, forecasting even higher prices.

CFDs on Gold (US$/OZ) daily chart. Source: TradingView / Finbold / Vinicius Barbosa

Worldwide gold rush

It is not only central banks that are accumulating the commodity in a new gold rush. Companies and worldwide institutions from the most varied sectors are also adding gold to their reserves.

For example, Tether CEO Paolo Ardoino disclosed his company holds 48.3 tons of gold in its reserves. This amount sides with 82,454 BTC (Bitcoin), which composes the required reserve to back the $120 billion stablecoin USDT.

Furthermore, The Economist recently reported a literal gold rush in African countries as the precious metal’s price keeps increasing. This, however, is raising concerns among global authorities, especially due to its environmental and social impacts. As reported, part of this illegally mined gold is also flooding Dubai’s gold market.

“It keeps getting worse and worse. If you look at Google maps, Ghana has turned from green to brown.”

– Camry Tagoe, activist

Either way, both Africa’s illegal gold rush and central banks’ increased accumulation are a direct result of gold’s impressive price performance over the years, making it a solid financial asset for corporate and individual allocation.

This rise happens as economic data keeps sounding alarms, like the US credit card unpaid debt rally, despite some recession fear cooling off, as Finbold reported in two situations. Therefore, gold’s demand is expected to continue surging, which may keep fueling gold rushes worldwide to profit from that.