Amid a bullish period for some participants in the stock market, like Nvidia (NASDAQ: NVDA) and Walmart (NYSE: WMT), the prices of which have recently crushed their previous all-time highs (ATHs), indications have appeared that the summer of 2024 might be even more positive.

As it happens, analysts at Goldman Sachs (NYSE: GS) have argued that the stock market might receive a substantial amount of money from passive equity allocations in early July, which would set the stage for a bullish rally throughout the early summer, per a report on June 5.

‘Wall of money’

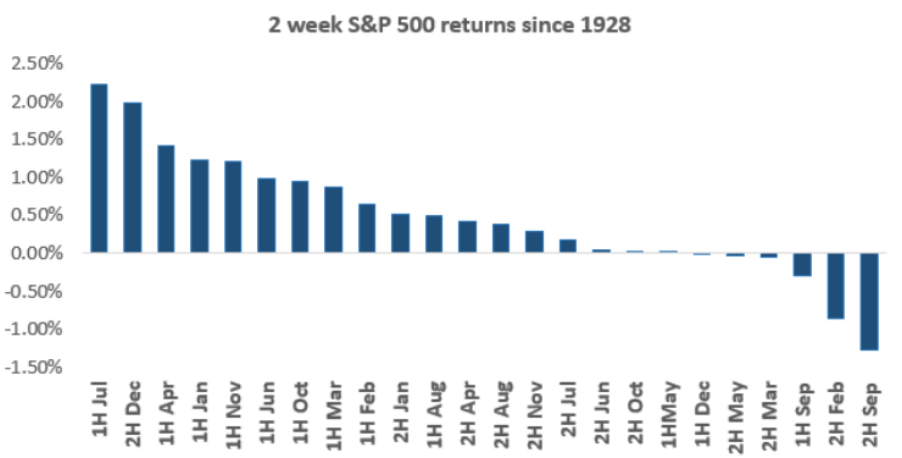

Specifically, according to Goldman Sachs’ global markets division managing director and tactical specialist, Scott Rubner, a ‘wall of money’ will fuel stock market gains this summer, alongside seasonality, as the first half of July has been the strongest two-week period for the S&P 500 since 1928:

Picks for you

“New quarter (Q3), new half year (2H), this is when a wall of money comes into the equity market quickly. (…) I am seeing a re-emergence in retail traders during the summer, they tend to come around in July.”

Indeed, as Rubner noted, for nearly a century, the first two weeks of July have been the best two-week trading period of the year for stocks, with a tendency to falter after July 17, with roughly nine basis points of new capital entering the market every July, expecting $26 billion this year.

As he specified, for nine years in a row, the S&P 500 Index has been positive in the first half of July, posting an average return of 3.7%, while the Nasdaq 100 Index has been posting even more bullish results – an average return of 4.6% for the past 16 consecutive Julys.

Post-election stock rally

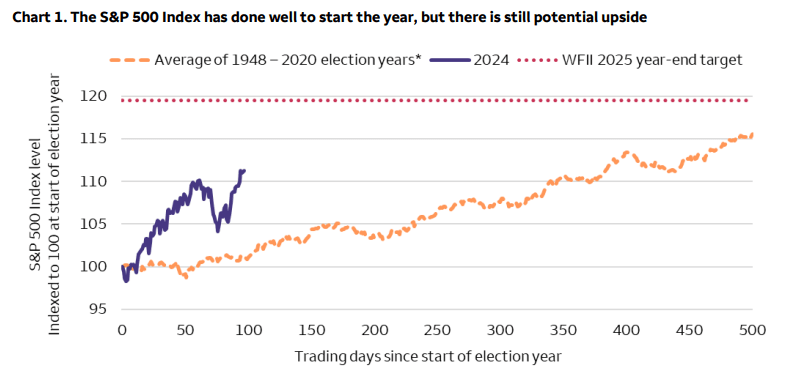

It is also worth noting that, earlier, Wells Fargo (NYSE: WFC) told equity investors that they should consider abstaining from cashing out following the strong performance of the S&P 500 this year, arguing that large-cap stocks could keep riding higher after the November presidential election.

According to Jeremy Folsom, investment strategy analyst at Wells Fargo Investment Institute, the index could reach about 5,700 in the post-election rally next year, offering significant returns for investors from current levels, on top of the dividend yield:

“We encourage investors to maintain their overall exposure to U.S. Large Cap Equities and avoid siphoning off cash to time a cheaper entry point later. Trying to time markets to reinvest later is difficult, with significant drawbacks from missing out on periods – sometimes even days – of strong performance.”

That said, Folsom has advised investors to trim from sectors that have outperformed, such as communication services and IT, as well as those that his firm has rated unfavorably, such as consumer discretionary, financials, and real estate, while the market is at the upper end of its 2024 year-end target range.

At press time, the S&P 500 stood at 5,354.03 points, recording an advance of 3.34% this month and gaining 12.89% since the year’s turn, whereas the Nasdaq has reached 17,187.89, reflecting an increase of 5.13% across the month and a 16.40% growth year-to-date (YTD), per data on June 6.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.