IMPORTANT NOTICE

Finbold may provide educational material to inform its users about crypto and digital assets. This content is for general information only and does not constitute professional advice or training certification. Content is provided "as is" without any warranties. Users must conduct their own independent research, seek professional advice before making investment decisions, and remain solely responsible for their actions and decisions.

RISK WARNING: Cryptocurrencies are high-risk investments and you should not expect to be protected if something goes wrong. Don’t invest unless you’re prepared to lose all the money you invest.

By accessing this Site, you acknowledge that you understand these risks and that Finbold bears no responsibility for any losses, damages, or consequences resulting from your use of the Site or reliance on its content. Click here to learn more.

In this guide, we’ll go over what a cryptocurrency trading bot is, how and why people choose to use one and how to avoid mistakes when selecting the right software. In addition, we will discuss the benefits and risks of trading bots, as well as tips on maximizing the automated trading tool and its strategies.

Introduction

Over the last few years, cryptocurrency trading has seen a significant increase in popularity, prompting many people to give it a try for themselves. Since crypto and the market’s volatility are much more complicated than they seem on the surface, the demand for trading bots has also increased.

Many individuals find the amount of information available to them overwhelming, and, thus, the prospect of learning everything on their own becomes intimidating. Between studying numerous projects and learning various trading signals, it is possible to quickly turn it into a full-time job.

For this reason, many traders are turning to the execution of automated algorithmic trading techniques (also known as crypto trading bots) to make faster and better trades in less time. However, although you may trade cryptocurrencies using automated software, there is still a significant amount of knowledge to learn before becoming a successful trader.

It is important to note that automated trading in cryptocurrency is not guaranteed to make huge gains. To avoid losing your hard-earned money, make sure you understand all there is to know about the strategies you decide to input.

Below, we’ve highlighted some suggestions and recommendations regarding choosing the best trading bots that are worth keeping in mind throughout your cryptocurrency trading journey in order to maximize your profits.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

What is a crypto trading bot

Cryptocurrency trading bots are a kind of automation that makes it simpler for you to execute trades based on certain criteria. Using an Application Programming Interface (API), a software intermediary that allows two applications to talk to each other, these software programs may connect to the exchanges you’re already using and execute certain trading methods on your behalf to generate profits consistently.

Depending on how it’s set up, the software may work with a wide range of algorithms and collect profits for you without any further input. Regrettably, many individuals buy a software application without doing any due diligence into how the program really operates, and as a result, they can encounter problems.

Numerous individuals have questions about the practicalities of trading bots, so let us clarify that this is not a passive investment. For instance, some people are often perplexed as to how these bots function, and it’s essential to realize that this is not a hands-off investment in the traditional sense.

The truth is if you want to make money in the market, you’ll need to grasp at least the fundamentals of cryptocurrency trading.

Why do people use a crypto trading bot

The fact that computers can start real-time simulation and computations over a thousand times quicker than a person without making mistakes demonstrates how successful trading bots can be when utilized as tools.

Furthermore, trading bots have a larger memory capacity and amazing calculation speeds, resulting in higher accuracy.

Human error

Many variables contribute to human error, including distractions, emotion, and the tendency to act on impulse rather than reason.

Contrarily, machines operate in response to the inputs they get; therefore, providing the machine with the appropriate inputs will guarantee that the relevant actions are taken.

Trading bots will obey your orders, strategies, and inputs, but they will only operate within a limited set of constraints. These devices are programmed to accept and carry out the instructions that are given to them.

Presently, the machines that are accessible to the general public do little more than execute a few lines of code to engage in certain behaviors such as scalping, arbitrage, and other forms of activity in the market.

It is important to remember that the current automated solutions for the cryptocurrency market will not offer the full extent of speculative potential. This implies that the software does not function completely on its own; you must still provide the trading bot software with data.

Trading bots multitask and operate simultaneously

Due to the fact that crypto trading bots do several jobs at the same time, these automated tools are beneficial. For example, it would be impossible for a human to concurrently act as a market maker and a scalper in two different markets at the same time while trading various cryptocurrencies across several exchanges.

Additionally, a trading bot would gain knowledge of the markets, participate in them, and continue to function as long as conditions were good for each of the strategies it had been given.

Overall speed

Many entities on the stock market use high-frequency computers to get an edge since machines are faster at doing calculations and executing trades than humans.

Whatsmore, competent crypto traders will also employ a range of computer and system settings to increase their overall speed. Digital asset automation, whether via the use of a DCA bot or another method.

Ultimately a trading bot runs through strategies and data you have input. Therefore things such as:

- Human emotions;

- Human mistakes;

- Bad timing;

- Hesitancy;

All of the above are taken out of the equation, not to mention the trader does not need to be sat at the computer screen 24/7.

Market patterns and acting on inputs

Important to note is that these tools are effective because they are able to properly read the markets, understand the strategies that will be necessary in the market, execute the actions, and adjust the position as needed.

You should have this in mind whether you are investing for the long term or trying to implement techniques that are just meant to be used for a short period of time. Moreover, the trading bots will adjust their behavior according to your risk tolerance levels and the approach you have selected.

More importantly, if you connect them to market feeds, they will get more information and will be able to take better action. However, the human brain is still needed to understand information related to speculation and other aspects of life affecting the market, even if the software is given data directly.

Strategies

Scalping is a trading technique often used by cryptocurrency trading bots that focuses on generating gains on small price fluctuations. It is a common trading strategy among human traders, although it may be time-consuming due to the large number of tiny transactions required to make a profit.

Hence trading bots are handy for this particular strategy since they automate the process, allowing the bot to trade for you continuously whenever the right circumstances occur without you having to be there. Using this method, you may make money without having to spend all of your time in front of your computer.

How to choose a crypto trading bot

Cryptocurrency traders have an increasing number of efficient, automated trading platforms to select from, all of which attempt to streamline the whole process and enable anybody to make the most of their trading prospects.

In this environment, more professional traders and investors are exploring methods to automate their activities, streamline them, and make their life easier in a variety of ways, including financial.

Credibility

The importance of doing extensive research on the software you want to use cannot be overstated, and you should avoid purchasing the first trading bot you come across.

By the same token, these tools may theoretically be created by anybody, and for them to function, they will need access to your exchange account. Therefore, reputation is paramount when selecting a solid crypto trading bot.

Analyze the reputation among the industry and the crypto trading community to gauge their satisfaction in order to determine whether it is dependable, effective, and trustworthy.

Traders should also consider the developer’s participation and measure how long they have been in business. Purchasing trading software is not always a cheap endeavor, and you should be certain that the company that created it will continue to provide updates and support to its clients.

Exchanges

You should also be aware that not every trading bot is compatible with every cryptocurrency exchange, so you should double-check that the bot you choose will work with your preferred platform before purchasing it. What makes a solid trading bot is one that operates the way you want it to and in the locations you specify.

Settings

You’ll also want to look at the many options and features that are accessible. A cryptocurrency trading bot is not a miracle solution that instantly starts making money. It’s a tool that will need modifications in order to stay profitable, and good software will have many options that one can customize.

Risks of using a trading bot

Of course, using a trading bot is not entirely risk-free; therefore, users should exercise caution and do their due diligence. Before implementing a trading bot, users should make sure they understand the fundamentals of trading before applying strategies and utilize the virtual trading bot on the platform they select to practice and test out certain strategies in the market.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

Our top 3 trading bot picks

We have, however, listed below three of the most efficient cryptocurrency trading bots currently available on the market, saving you the time and effort of searching for and installing ineffective or perhaps hazardous software.

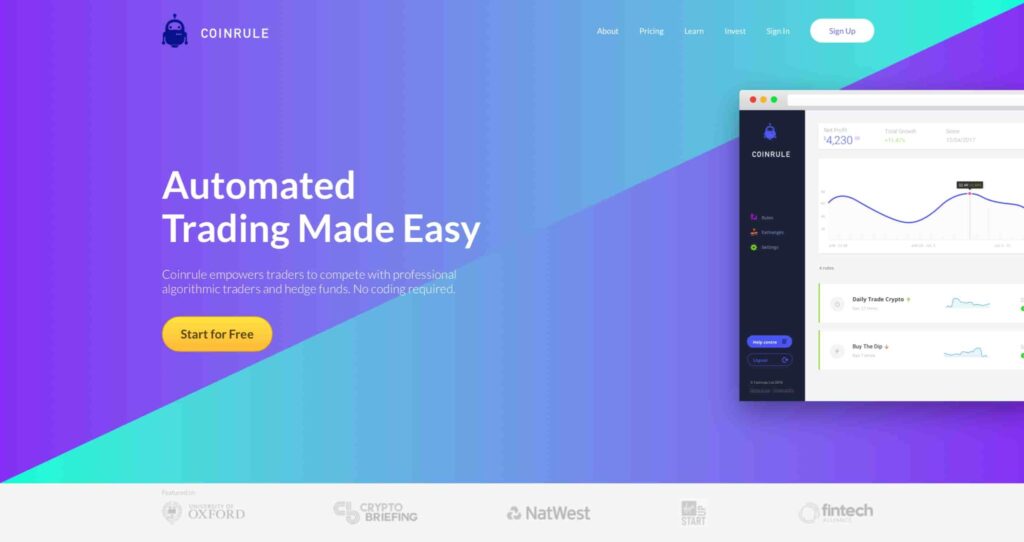

Coinrule

For both technical and non-technical traders, Coinrule is an innovative, simple-to-use automated crypto trading bot system. The platform offers a whole new range of trading options for traders accustomed to dealing with more restricted trading interfaces.

In addition, Coinrule also enables anybody to select from various predefined trading methods with no coding required. As a result, traders of all skill levels can actively engage in the perpetually open cryptocurrency market and trade around the clock.

Coinrule supports major exchanges like Binance, BitMEX, Coinbase Pro, and Kraken, and traders can access it for free by opening a Starter account.

Free starter package: including two live and demo rules, seven template strategies, and one connected exchange.

Pionex

By automating the cryptocurrency trading process, Pionex frees up its clients from having to keep track of market trends and fluctuations themselves. Instead, trading may be delegated to one of the free 16 built-in automated trading bots available on the crypto exchange, which will keep track of everything and place orders on their behalf.

Pionex’s competitive trading fees fixed at 0.05% employing a maker-taker cost model will appeal to investors who trade in large volumes. Additionally, the platform has a proprietary mobile application, making it an excellent solution for investors who trade on the move.

The all-in-one software also has an intuitive user interface (UI) that is simple to navigate, with instructions and important functions readily accessible both on the desktop and mobile versions.

Furthermore, the cryptocurrency exchange uses a cloud-based interface thus eliminating the need to leave your computer or mobile device on around the clock. Alternatively, users have the option to perform manual buy and sell trades if they choose to do so.

Hummingbot

Free and open-source software, Hummingbot stands out from the crowd. While taking advantage of the platform’s arbitrage, market-making, and other capabilities, users may employ bots on both centralized and decentralized exchanges in the market.

In its current state, this project has over 20 links to controlled and decentralized exchanges, including well-known companies like Coinbase, Binance, and Kraken, to name a few examples.

This open-source software client, which traders can download for free, allows users to create and operate high-frequency market-forming bots in order to automate trading transactions. Additionally, new features such as CLI access, customization possibilities, and overall smooth performance keep Hummingbot up to date with the latest technology.

Pros & Cons of crypto trading bots

Pros

- The bot trades for you automatically, saving you time;

- Trading on several exchanges simultaneously allows you to vary your strategies;

- Software expedites the execution of orders;

- Removes the influence of emotions on your trading decisions;

- Consistency in your tactics is facilitated.

Cons

- Trading bots use account APIs and require you to put your confidence in a third party.

- Some are complicated to set up;

- Outside of their code, they have no way to quantify for sudden changes in pricing;

- No hands-off investment here, you have to keep an eye on it all;

- You must still implement the strategies and data which requires a fundamental; knowledge of how the market operates.

Conclusion

Finally, it’s essential to realize that cryptocurrency trading bots are just a tool, and even the most sophisticated of them are not impervious to the whims of the cryptocurrency market and its fluctuations.

It’s critical to understand that they are not a divine technique for producing money without putting in any effort or doing your own research to put particular tactics to use to generate income. However, they may be very profitable if you are willing to put in the time and effort to learn how they work and set them up correctly.

Naturally, cryptocurrency investors should take steps to keep their money safe, but those who use automated systems should make extra efforts to ensure that their funds are protected.

We understand that there are many various types of software programs accessible. Not all trading bots are developed by people who have your best interests at heart when developing their software. As a result, we have provided you with three of our best suggestions to help you in making your decision.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.