There are several advantages to futures trading, including higher leverage and lower trading costs. A corporate entity can hedge prices of their raw material supply needs to lock in current prices, whereas individual investors can profit from price movements of underlying assets.

However, futures trading does come with higher risks and isn’t well-suited for beginner investors. Due to leverage, which means using debt or borrowed money for trading, investors risk losing more money – profits are amplified, but so are losses. This guide will explain the basics, including what futures are, how they work, and its benefits and risks.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

What are futures?

Finally, futures trading is facilitated by futures contracts, commonly used by individual traders to make a profit or by corporations to lock in the prices of commodities they need for production and manufacturing.

What is futures trading?

The brokers only ask for part of the initial investment, a fraction of the contract’s total value, usually 3% – 10%, called the initial margin. The trading provider or broker would loan the rest to complete the total contract value.

Whereas the futures exchange is the one setting the initial margin, your broker will require you to have additional funds in your account, called maintenance margin. The minimum amount should be on your account at any given time, usually between 50% to 75% of the initial margin.

If the amount drops below the maintenance margin, e.g., if the price goes against the trade, the broker will send a margin call to the trader, requiring them to deposit more money to reach the initial margin level again. Futures contracts oblige both parties who have entered the agreement to buy or sell the underlying asset.

Lastly, futures contracts are commonly used by two types of investors: hedgers and speculators. Hedgers are institutional investors who want to lock in current prices of raw materials they need in production via commodity futures. Speculators are individual traders who aren’t interested in the actual physical product but want to profit from the price swings.

Futures vs. options contracts

Unlike options contracts, where holders have the right to buy or sell the underlying asset at any time before the contracts’ expiry date, futures contracts oblige buyers to take the underlying asset at the time of expiration and not before.

Futures contracts require the buyer or seller to buy or sell the asset on a specific agreed future date and price detailed in the agreement. Holders can, however, close their position before the expiry date.

The critical difference is that options contracts, as the term suggests, give traders the option, but not the obligation, to exercise the right to buy or sell shares at a set price, at any time, and not just at the contract’s expiry date. It’s a form of equity compensation, a popular form of employee compensation as employee stock options (ESOs).

The similarities are that futures contracts can exercise the right to sell their position at any time before the expiration to be free of the obligation to buy the asset. Buyers of both options and futures contracts can, in this way, close their position and benefit from a leverage holders’ position closing.

Underlying asset classes of futures contracts

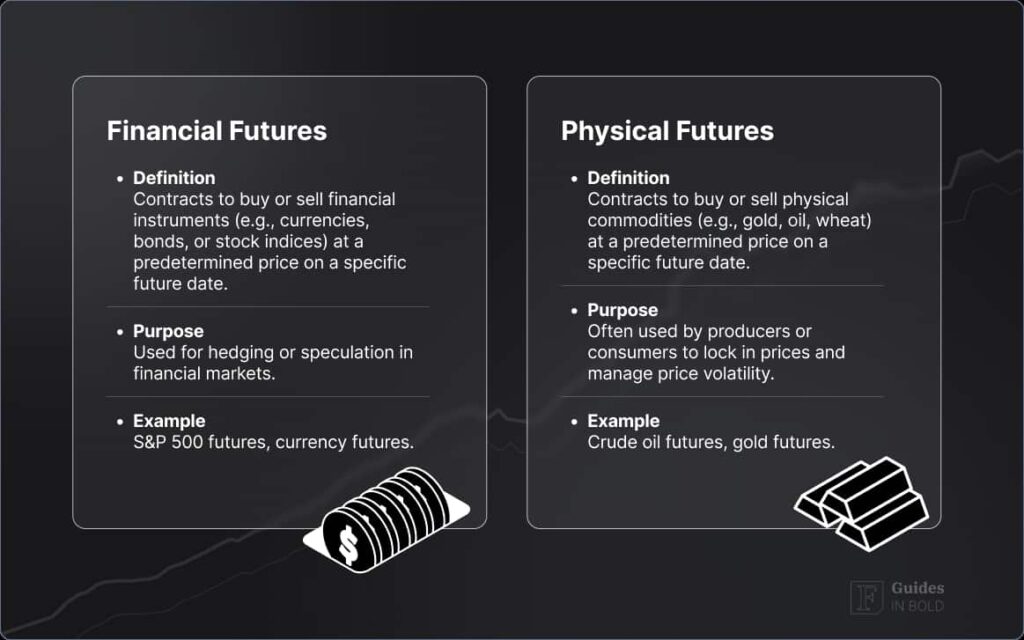

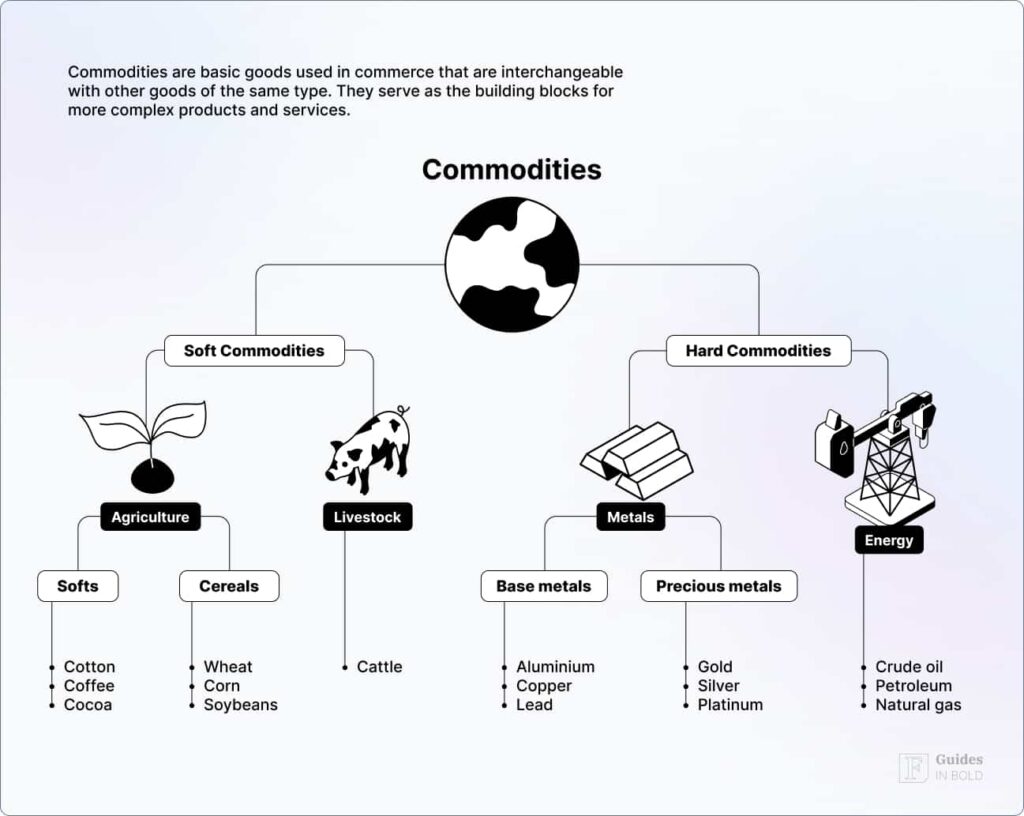

Investors often use the term futures to reference the overall asset class. However, futures contracts derive value from several other asset classes that are then available for trading via a futures contract. There are a few standard asset classes: commodities, financial futures, and currencies.

The underlying asset classes commonly include to following:

Commodity Futures

Energy futures can lock in prices of commonly used energy commodities for large companies, used in several industries, including manufacturing and production or transportation. For example:

- Crude Oil;

- Natural Gas;

- Heating Oil;

- Gasoline.

Metal futures offer exposure to various metal commodities used for manufacturing and other large industries, including gold manufacturers or retailers. For example:

Agriculture and grain futures can fix prices via futures contracts for agricultural commodities, processing and making other products, and raw materials used for commercial processing. For example:

Livestock futures are commodities that include live animals used in food processing and meat product distribution. Livestock futures contracts offer exposure to price fluctuations. For example:

- Cattle;

- Feeder Cattle;

- Lean Hogs.

Financial futures

There are mainly two types of financial futures: index contracts and interest rate (debt) contracts. Index futures contracts derive the prices from specific market indexes, while dept contracts from the interest rate of debt securities. For example:

- E-Mini S&P 500;

- E-Mini Nasdaq;

- E-Mini Russell 2000;

- Mini Dow Jones;

- E-mini Mid-Cap 400;

- Micro E-minis (multiple indices);

- Bloomberg Commodity Index;

- Nikkei 225 (CME);

- Volatility Index;

- U.S. Treasury Bonds;

- U.S. 10-Year Notes.

Currency futures

Futures contracts can also derive their underlying value from currencies, and currency futures offer exposure to the exchange rates of both fiat currencies and cryptocurrencies. For example:

- Dollar;

- Euro;

- Yen;

- Pound;

- Bitcoin.

Types of futures traders

Individual traders or speculators commonly use futures contracts to earn a profit, or corporations or hedgers use them to hedge against inflation. Whereas individual traders don’t want to own the physical commodity, institutional investors aim to avoid price increases of raw materials they need for production.

These two types of contracts are either for physical delivery for hedgers or cash settlement for speculators when contracts are closed out or netted.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

Hedgers – institutional investors

Large corporations can use futures as a hedge against the underlying asset’s price movements, where the aim is to prevent losses from rising prices. In most cases, these companies need large amounts of specific commodities in their production or manufacturing process to make their products or to operate.

For example, if a buyer, a hedger working for an airline, knows they need to use large amounts of oil to operate, an oil futures contract guarantees them a fixed price until the contract expires, protecting them against price hikes.

While sellers benefit, they can guarantee profits via futures contracts if they drop prices. A farmer grows and sells corn for $5 per bushel. He assumes prices will fall in six months. To lock in the current higher price, he enters a futures contract that guarantees the same price for that period.

Note

Speculators – individual traders

Speculators are individual investors who want to benefit from the underlying asset’s price movements and don’t want to receive the physical assets. Their only interest is to earn a profit from trying to predict the price changes, which is why they close their positions before the futures contracts expire.

For example, the initial margin of one wheat futures contract is $2,500, which is a required minimum to open a trade on a futures exchange.

The maintenance margin for that same contract is $1,400, which is set by the broker and is a required minimum on your account at all times. If the money on the account drops below $1,400, the trader must make an extra payment to return it to the initial margin.

If one wheat futures contract includes 5,000 bushels, and it sells at $12,50 per bushel, it is worth $62,000 of wheat, meaning that you would need less than 5% to trade it. As brokers set them, they can also adjust them, and the maintenance margin is primarily based on volatility.

Moreover, futures contracts enable traders to speculate in which direction the prices of the underlying assets go and open either a short or long position.

If a trader takes a short position, they think the price will fall. If the prices go up, they incur a loss. If the prices fall, the trader can offset the transaction, which means closing a transaction to realize the profits before the contract expires.

Similarly, a trader can take a long position, which means speculating the prices of underlying assets will go up and will trade above the original price at the contract expiry. If that happens, they will profit, and the futures contract will be sold at the current price and closed before expiration.

Note

Futures trading strategies

In terms of the trading strategies of speculators, it is normal for them to choose one to two main sectors they specialize in and have a thorough understanding of those markets.

For example, it isn’t easy to know whether commodities’ prices, such as corn, go up or down without in-depth market knowledge. It takes an edge and understanding of markets’ fundamentals and economic trends, sentiment, and approach via technical analysis.

All strategies have ups and downs, but you should decide which one you want to go with and define it for your futures trading.

- The most common strategy is directional strategy, which means that a trader speculates on the direction of a specific commodity or other underlying assets. It means opening either a short position if they think the price will decline or a long position if they think prices will rise.

- Liquid contracts are agreements close to their expiration date, also called front-month contracts, favored by short-term traders.

- A slightly more complicated strategy is spread trading, which involves simultaneously opening short and long positions for the same underlying asset. Despite the name spreading, it isn’t any less risky than a directional strategy as trade can still go against you in the same way.

Example

Moreover, a trader can opt to use spread trading between two correlated markets, as different needs tend to move in the same direction. For example, a trader could go long S&P futures and short NASDAQ futures if they think the S&P is undervalued next to the NASDAQ.

Chicago SRW Wheat futures example

Here is an example of information from the Chicago SRW Wheat CME group, the world’s largest derivatives exchange that trades assets including agricultural products, metals, energy, stocks indexes, currencies, and cryptocurrency futures.

- Exchange: Chicago Mercantile Exchange (CME);

- Contracts available: 15 monthly contracts of Mar, May, Jul, Sep, and Dec listed annually following the termination of trading in the July contract of the current year;

- Expiration dates: terminates on the business day prior to the 15th day of the contract month;

- Maintenance margin: $2,500 (10%);

- Trading hours: Sunday – Friday: 7:00 p.m. – 7:45 a.m. CT and Monday – Friday: 8:30 a.m. – 1:20 p.m. CT;

- Contract unit: 5,000 bushels (~ 136 metric tons);

- Minimum price fluctuation: 1/4 of one cent (0,0025) per bushel = $12,50.

Main benefits of futures trading

One of the main benefits of futures contracts for investors is that investors can trade significant sums of money compared to relatively small amounts invested.

Even though futures trading comes with higher risks due to leverage and more complicated investing and trading processes, it has several upsides. Below you can find some of the main benefits.

- Leverage

Usually, the futures exchanges’ initial margin amount is around 3% – 10% of the underlying contract value. It is much lower than an equity position where the margin account required is 50% or more of its total value.

This higher leverage allows investors to gain higher profits by having less equity. However, it can equally put you at risk of losing more money than initially invested.

- Diversification

For speculators, futures offer more ways to diversify than investing in stocks. They give uninterrupted exposure to the prices of the underlying assets to commodities like gold or oil, unlike stocks, where many other market factors are in play and affect the share prices.

Futures contracts offer the possibility to manage risk by anticipating upcoming events that can change market prices.

- Short Selling

Whereas with other investing strategies, margin requirements for long and short positions differ, with futures contracts, the margin is the same for both without additional requirements.

- Tax Benefits

One more benefit to futures trading is tax compared to stocks, where the total of 100% of profits are taxed as ordinary income, and futures provide a potential tax benefit.

Profitable futures are taxed on a 60/40 basis, meaning that only 40% of profits are taxed with the standard income tax rate, and the rest, 60%, is taxed as long-term capital gains.

- Lock in current prices

For hedgers, futures contracts offer the possibility to lock in current prices of commodities they know they need in large amounts for future production or manufacturing of their products.

- Lower transaction costs

Due to the highly liquid nature of futures markets, traders can quickly move in and out of their open positions. Selling a futures contract can also be relatively easier than short-selling stocks.

Main risks of futures trading

- Futures trading can present excellent investment opportunities but also carries high risks. One downside of futures trading is that the process isn’t as easy as other strategies, and it is easy to make common investing mistakes.

- Speculators risk losing more money than the initial margin due to leverage because even though profits are multiplied, so are the losses.

- Hedgers might lose out on price decreases by locking in current prices through futures contracts.

- Beginner investors should educate themselves first before trading futures.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

In conclusion

When considering futures trading, you must first familiarize yourself with all its processes, including transaction fees, leverage, and obligations. It is also essential to go with a trusted broker and get acquainted with various underlying assets of futures contracts.

An online broker usually provides all the necessary information on their website, but it is still a worthwhile idea to speak to your broker first to verify it.

All in all, when speculating underlying asset prices of futures, technical analysis is recommended. As a beginner, start small, choose a reputable broker, and opt for an asset class you are most familiar with.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about futures trading

What are futures contracts?

Futures contracts can lock in current prices of assets at a fixed price at a set date in the future. Futures contracts derive their value from underlying assets, either commodities such as gold, gains, what, or oil, or financial securities like stocks or bonds.

What is futures trading?

Futures trading is facilitated by futures exchanges, like the Chicago Mercantile Exchange (CME), and requires investors to have an approved brokerage account. When traders or companies enter a futures contract, it obliges them to sell or buy the underlying assets at a set price and date in the future.

Corporations commonly use this tactic to lock in current prices of commodities they need in production to avoid price hikes or by individual investors to profit from price swings.

What are the main benefits of futures trading?

Futures trading is leveraged, allowing investors to trade more significant amounts of money than their original investment, which means they need less equity to enter the trade. Other benefits include exposure to actual prices, tax benefits, and lower transaction costs.

Is futures trading risky?

As futures are leveraged, investors don’t have to put in the entire equity amount to enter the trade. It also makes futures trading riskier, as even though the initial margin is low if the trade goes against you, investors risk losing more money than they invested.