As witnessed by the travel restrictions not long ago, the hospitality real estate market remains highly dependent on various global factors, from market upturns and downturns to geopolitics and natural disasters. However, as worldwide travel and tourism is rebounding, the hospitality sector is on the uptake—with hotel real estate investment trusts (REITs) particularly performing well.

One hotel REIT player remains at the helm of the upward trend, benefiting from increased occupancy and room rates and, in turn, providing returns to shareholders. Let’s dive into the story of Apple Hospitality (NYSE: APLE).

Exploring the hospitality market and hotel REITs

The global COVID-19 pandemic has had disastrous effects on the hospitality industry. With countries under lockdown and international travel virtually entirely on halt, hotels were either held on a lifeline by subsidies or failed. Luckily, the post-pandemic boom in travel caused a resurgent market to grow once again, although it still has to reach the previous peak.

One of the most successful players to ride the industry’s growth wave is the Apple Hospitality REIT, and here we will give insight into its success.

Apple Hospitality REIT: Capitalizing on the return of travel

The company’s hotel portfolio includes 99 Marriotts, 119 Hiltons, and five Hyatt hotels. Apple Hospitality traces its roots back to 1999 and today aims at a broad consumer appeal coupled with high ESG standards. Furthermore, the company has provided steady growth and value to its shareholders throughout its history.

Apple Hospitality REIT stock price today

Key takes on Apple Hospitality REIT’s success

- Q4 2023 financial reports: At the end of 2023, the company reported a solid annual performance.

- Continuing expansion: Apple Hospitality has kept expanding, acquiring new assets at favorable prices;

- An optimistic outlook: Factors indicate that conditions for the company and the wider market will become increasingly favorable.

- Apple Hospitality REIT dividend: The REIT has a commendable dividend payment history, only pausing briefly during the pandemic.

Q4 2023 financial reports

In its latest financial report, the company managed a 2% increase in revenue per available room in Q4 and a 7% increase for the entirety of 2023 compared to the previous year. Furthermore, its total revenue for Q4 was $315 million and $1.4 billion for 2023, an increase of 3% and 7% from the previous year.

Continuing expansion

The company’s CEO, Justin Knight, reiterated the company’s intention to continue with expansion. In December, Apple Hospitality re-entered the Las Vegas market for the first time since the 2008 recession by acquiring the 299-room SpringHill Suites hotel.

The hotel was purchased for about $75 million in total or $251,000 per room. Justin Knight also pointed out that few hotel REITs are active in Las Vegas, implying less competition.

An optimistic outlook

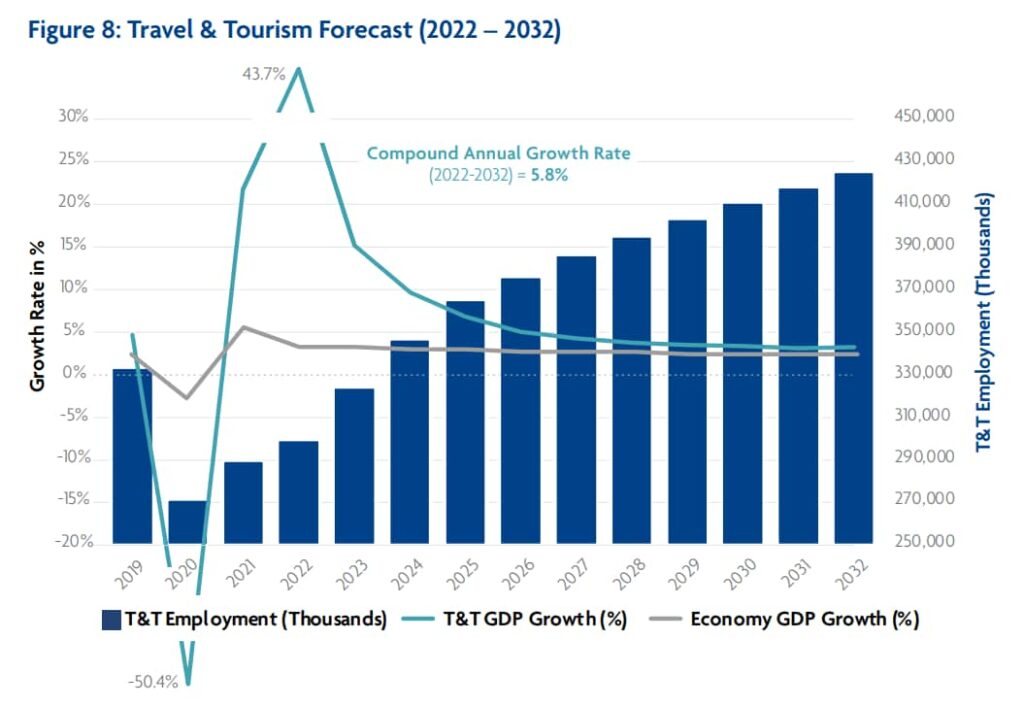

As indicated by the above chart, the hospitality sector is expected to grow, and the travel restrictions should represent a minor bump in its long-term growth.

Furthermore, the company estimates its revenue from rooms will increase by 2% to 4% in 2024, and its EBITDA margin will be between 34.6% and 35.6%. Apple Hospitality plans to keep its ongoing trend of opportunistic acquisitions, driven partly by favorable prices due to the lingering lack of available financing for many hotel operators.

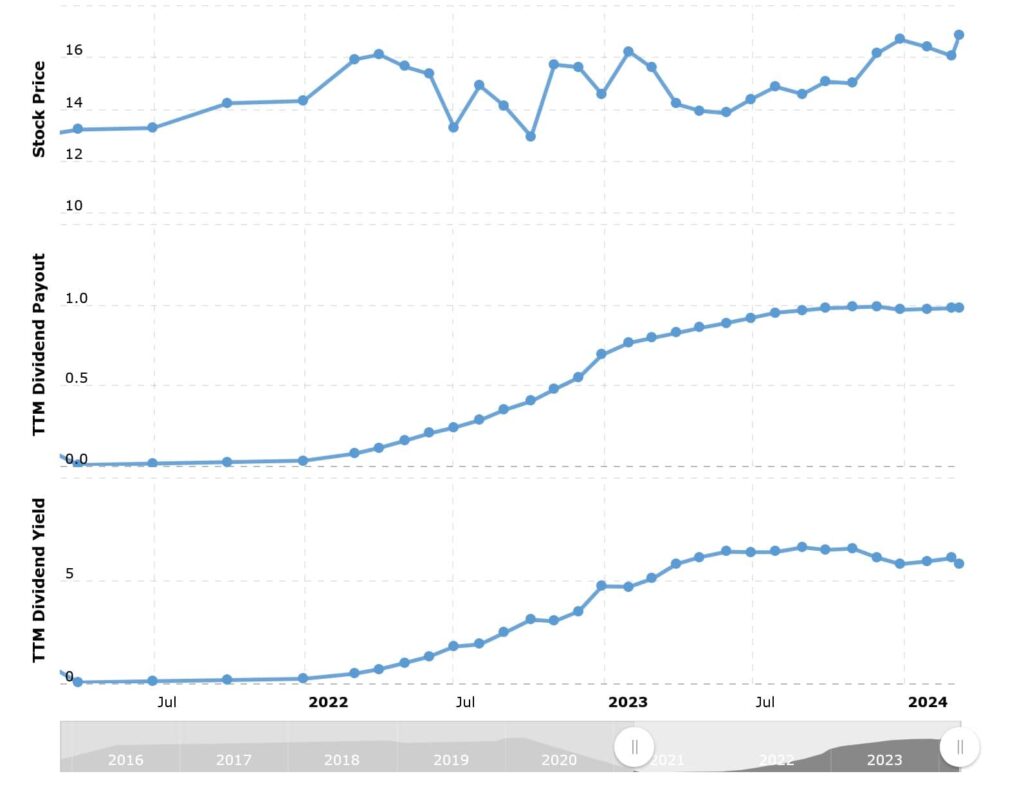

Apple Hospitality dividend yield

The REIT also has the potential to generate passive income with a regular monthly dividend payment. As of March 2024, Apple Hospitality REIT’s dividend yield is 5.69%.

Is Apple Hospitality REIT a good investment

Apple Hospitality REIT remains a pivotal point in the ongoing resurgence of travel and hospitality sectors, reaping the benefits of solid management, patience, and the opportunistic acquisition of assets.

From this point, this company’s capitalization trend sees few obstacles in the future, and it is poised for continuing prosperity. However, the answer to this question still depends on the evolving market conditions. If you decide to embark on this journey with Apple Hospitality REIT, bon voyage!

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.