Leveraging insider trade information can provide useful insights and a competitive edge to investing. When done legally, insider trading involves company executives or directors buying or selling stock based on their knowledge of the company’s performance and prospects. In this guide, we’ll explain how to leverage insider trade info to make better investment decisions.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

What is insider trading?

“Why are people who are appalled at insider trading so quick to trade on inside information when it comes their way?” — Jonathan Clements, personal finance writer and author

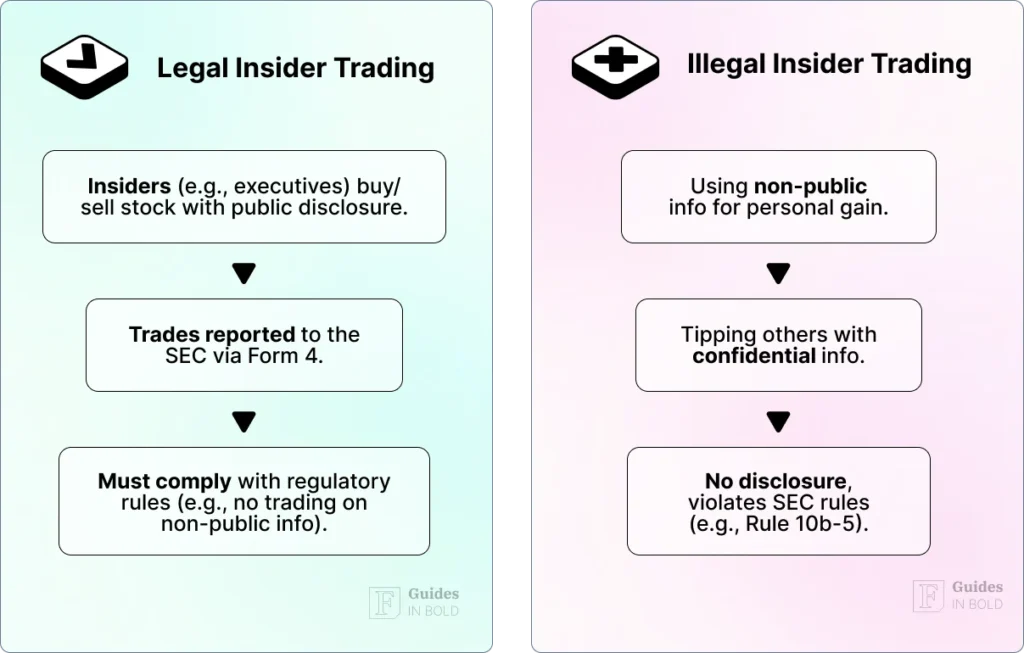

That said, it’s key to distinguish between illegal and legal insider trading:

- Illegal insider trading: When someone buys or sells stocks based on material, non-public information;

- Legal insider trading: When company insiders buy or sell shares based on publicly disclosed plans, following regulatory guidelines.

Who investigates insider trading?

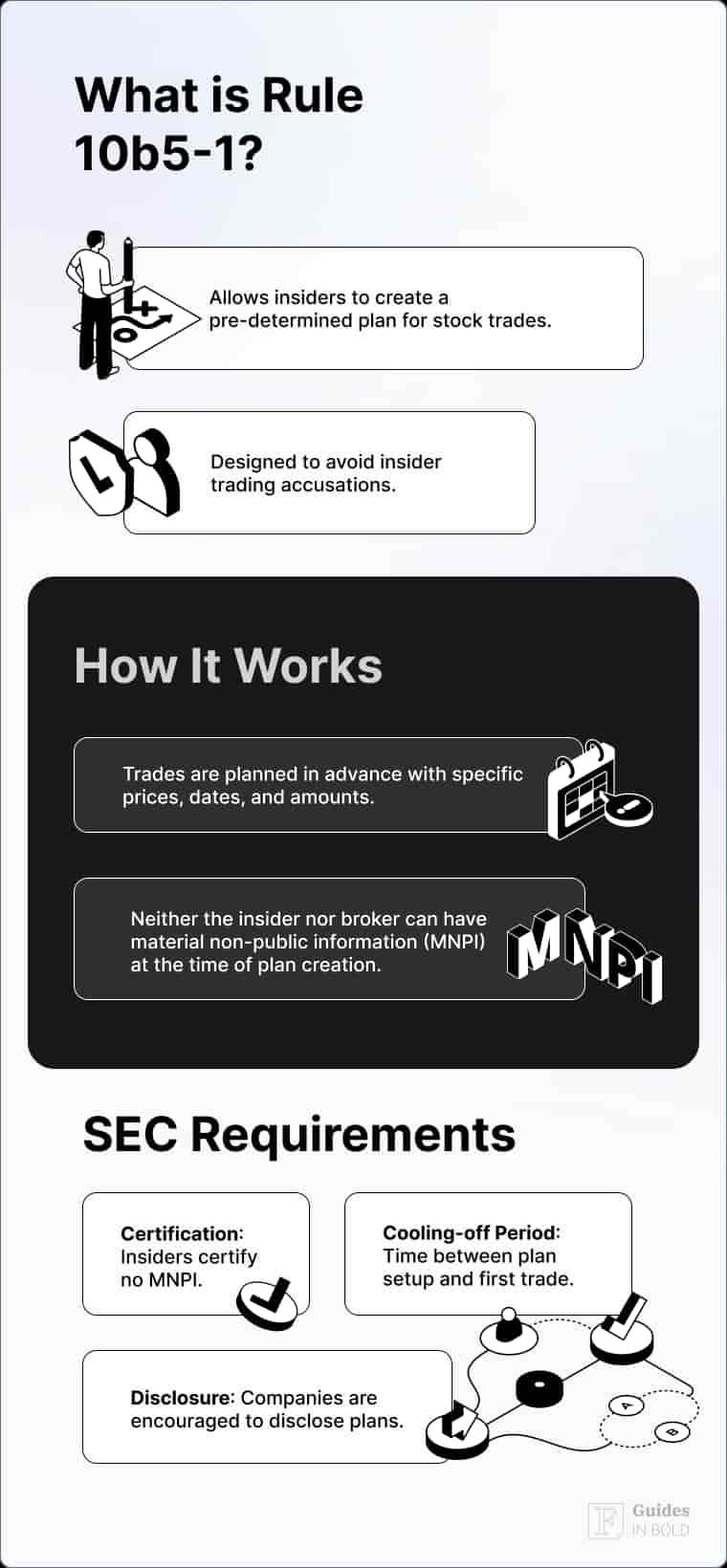

Rule 10b5-1 plans

Rule 10b5-1 plans are a regulatory framework established by the SEC that allow corporate insiders to set up a predetermined trading plan for selling or buying company stock. These plans enable insiders to systematically trade shares at specified times, helping them avoid accusations of insider trading by demonstrating that the trades were planned in advance and not based on material non-public information.

Why should you pay attention to insider trading?

Insiders have a unique understanding of their companies. When executives or board members buy large amounts of stock, it can signal that they believe the stock is undervalued or that the company is poised for growth. On the other hand, when they sell stock, it could indicate that they expect the price to drop or that the company faces challenges.

While insider trading activity is not the most reliable indicator, it can provide additional context for your investment decisions when combined with other research. With this in mind, here’s why insider trade information is useful:

- Confidence in the company: Insiders buying stock often shows they have faith in the company’s prospects;

- Unique insight: Executives have a better understanding of company challenges, opportunities, and future performance;

- Timing: Large and frequent insider trades can indicate key developments or upcoming growth prospects;

- Pattern recognition: Monitoring insider trading trends over time can help investors recognize patterns that may signal potential stock movements.

Recommended video: Insider Trading Explained in 2 Minutes

How to access insider trade data

The SEC requires insiders to report their trades through Forms 3, 4, and 5, each available to the public on the SEC’s website. However, for most investors, using third-party sources such as Finbold is much easier. These platforms provide insider trading analyses that are user-friendly and easy to interpret.

To help you get started, here’s a table showing key SEC forms related to insider trading:

| Form | Description | Purpose |

| Form 3 | Initial ownership report | Filed when an insider first owns company stock. |

| Form 4 | Report of changes in ownership | Filed when an insider buys or sells stock. |

| Form 5 | Annual statement of changes | Filed for any transactions not reported in Form 4. |

How to analyze and leverage insider trading activity

Once you have access to insider trade data, the next step is to interpret it. Not all insider trades carry the same weight, and knowing how to analyze them can help you make informed decisions.

With this in mind, let’s take a look at four key points to consider when evaluating insider trades:

#1: Look for large purchases

One of the most straightforward indicators is when an insider makes a significant purchase of company stock. These large purchases signal confidence in the company’s future performance. Executives and directors wouldn’t risk their own money if they didn’t believe in the company’s long-term prospects.

For example, if a CEO purchases a substantial amount of shares shortly before the release of a major product, this could indicate that they expect the product to be successful and positively impact the company’s stock price.

#2: Pay attention to cluster buys

A cluster buy is when multiple insiders buy stock around the same time. When more than one insider buys stock, it’s often a stronger signal of confidence. Clusters suggest that insiders across different areas of the company share a positive outlook on the company’s future.

#3: Beware of sales

While insider sales can sometimes signal a lack of confidence, they don’t always indicate bad news. Insiders may sell shares for various reasons, including portfolio diversification, personal expenses, or taxes. It is, therefore, essential to examine the context of the sale rather than automatically assume it’s a negative signal.

#4: Monitor frequent buying patterns

Insiders who frequently buy stock, especially in companies with stable growth prospects, can provide consistent indicators of confidence. Keep an eye on insiders who regularly add to their positions, as this demonstrates long-term belief in the company’s potential.

What does science say?

Example of insider trade at Intel

In September 2024, Intel (NASDAQ: INTC) experienced a significant increase in insider stock purchases which coincided with its $3.5 billion US government contract. In Q3 2024, insiders bought approximately 12,500 shares, a 43% increase compared to 2023.

This surge came with Intel’s award of a Pentagon deal to produce advanced chips for military and intelligence applications. Despite Intel’s stock struggling in 2024, this news led to a positive market reaction, with the stock rallying 6.7% in pre-market trading.

Steps to use insider trading information in your investment strategy

Here’s how you can effectively incorporate insider trading data into your investment strategy:

- Track insider trading reports: Use insider trading tracker tools, like Finbold Signals, or SEC filings to stay updated on insider transactions;

- Identify patterns: Look for consistent buying or selling patterns by insiders over time;

- Combine with other research: Insider trades are just one piece of the puzzle. Use financial reports, market trends, and company news to get a well-rounded view;

- Be cautious with insider sales: Remember that insider selling doesn’t always mean trouble. Investigate the reasons behind the sale before making decisions;

- Stay updated: Insider trading activity changes frequently, so set up Finbold insider trading activity Signals to stay in the loop.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

What to avoid when leveraging insider trading?

When using insider trading data for your investment strategy, you should keep in mind the following pitfalls:

- Relying solely on insider trading data: Avoid making decisions based solely on insider trades. Instead, use them as part of a broader research strategy;

- Ignoring market conditions: Sometimes broader market trends, not company-specific issues, lead to insider sales;

- Focusing on small trades: Not all insider trades are meaningful. That said, you should focus on large transactions or cluster buys.

The bottom line

Leveraging insider trade information can give an edge in making informed investment decisions. Insiders often have access to insights that the general public doesn’t, and following their trades—large or clustered purchases—can provide valuable leads.

However, it’s key to combine this information with other research and to stay aware of the broader market context. Doing so lets you make smarter, more informed investment decisions that align with your financial goals.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs on how to leverage insider trading

What is insider trading definition?

Insider trading refers to the buying or selling of a company’s stock by individuals who have access to non-public, confidential information about the company. It can be legal or illegal, depending on the timing and disclosure of the trade.

Is insider trading always illegal?

No, insider trading is legal when company insiders, such as executives or directors, buy or sell shares in their own company and report these transactions to regulatory bodies like the SEC. Illegal insider trading is when non-public information is used to make trades unfairly.

Where can I find insider trade data?

Insider trade data can be accessed on the SEC’s website through Forms 3, 4, and 5. However, it’s easier to use third-party financial platform tools, such as Finbold Signals, which deliver real-time updates through your preferred platform.

How should I analyze insider trades?

When analyzing insider trades, you should look for significant purchases, cluster buys, and consistent buying patterns. However, it’s necessary to be cautious with insider sales, as they may not always signal bad news.