Steady rental income from long-term leases and historical resilience against inflation and economic downturns make warehouse and storage REITs a potentially smart choice for investors. Coupled with a growing trend of e-commerce and online shopping, some REITs in the sector have what it takes to power through economic shifts and display industrial strength that can deliver substantial returns.

One of the best examples of a lucrative warehouse REIT is Public Storage (NYSE: PSA), one of the largest and most popular storage brands in the U.S.

Public Storage: a powerhouse REIT

Founded in 1972 and headquartered in Glendale, California, the company caters to both individuals and businesses looking for safe and reliable storage and warehouse solutions. Public Storage has managed to harness the growing demand for storage space to extend its network and maximize occupancy rates. Changing its structure to a REIT (real estate investment trust) in 1995, Public Storage has a tradition of reliable returns and significant dividend yields, benefiting shareholders even at times of economic downturns.

Public Storage is an S&P 500 component. It trades on the NYSE stock exchange under the PSA ticker symbol.

Public Storage stock price today

Currently, Public Storage stock price stands at $285.11, reflecting a slight decline of -6.52% year-to-date or $26.75.

Public Storage financial performance

In the 2023 financial report, Public Storage stated it achieved record revenues and net income, successfully concluded the integration of the Simply Self Storage portfolio, and owned over 3,000 properties at the end of the year. Furthermore, they claimed the industry’s highest margins, high growth potential, and the means to fund substantial external growth and create shareholder value.

Public Storage dividend performance

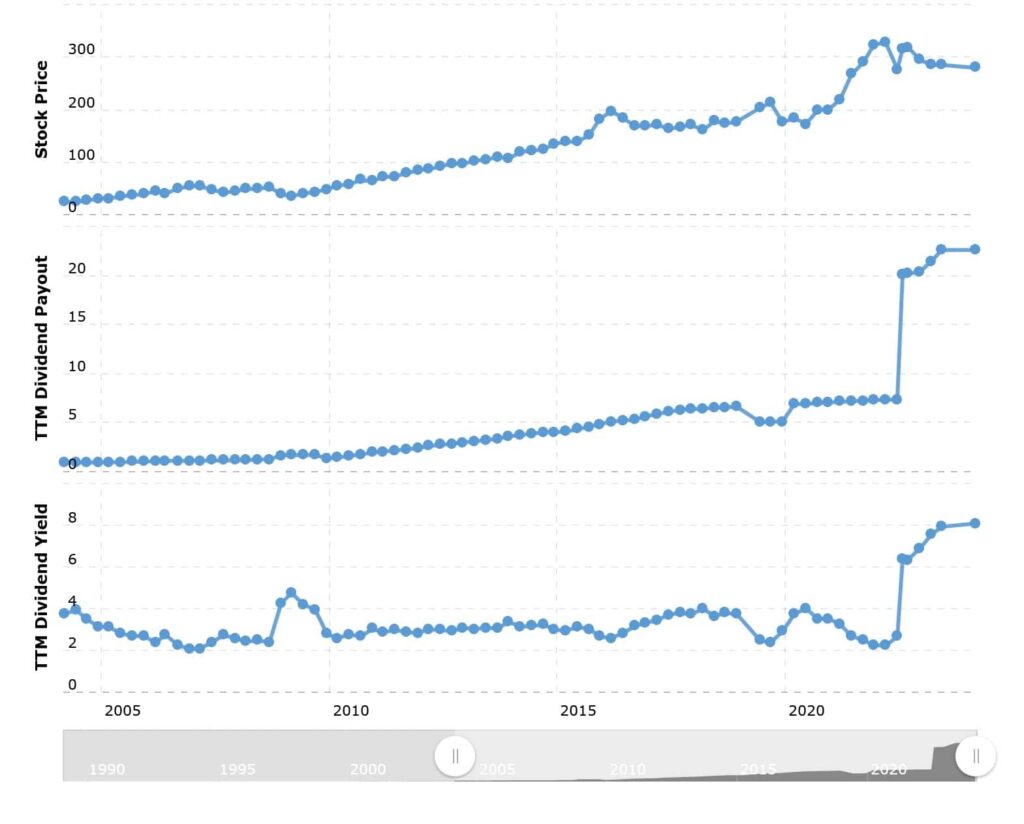

Public Storage maintains a decades-long tradition of regular dividend payments. At the moment, PSA maintains a dividend yield of approximately 4.24%, and the current TTM dividend payout is $12.00 per share.

The company has consistently and faultlessly increased dividend payment amounts over the previous 30 years, which can be seen in the following chart:

Persevering through downturns and recessions

In the decades Public Storage operated in the warehouse sector, consumer preferences evolved, and the market experienced radical shifts in demand, including the recent rise of e-commerce and the global pandemic outbreak and the subsequent lockdown.

Public Storage has managed to make its brand recognizable, foster client trust, and retain successful long-term leases with trustworthy clients. On top of that, the management has amassed significant experience in how to guide the company through tumultuous times, securing high potential for future growth, especially in the backdrop of surging online shopping.

The bottom line

Public Storage is the prime example of a REIT that utilizes the right market conditions but remains steadfast and powers through the bad ones. This is not the case with all REITs, as over the last 15 years, Public Storage had an average yearly return of 13.3% (with dividends reinvested), while the broader iShares Core U.S. REIT ETF (USRT) that tracks REITs globally returned less than half than that, with an annualized 5.9%.

Growth investors and those looking for passive income will likely find a worthy candidate in Public Storage REIT, as the company has a reputation for a solid, stellar performance of making the best out of the worst in a quickly evolving market.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.