Investing in healthcare stocks can offer a solid foundation for your portfolio, especially considering the rapidly increasing demand for healthcare services, driven primarily by the aging population. Therefore, in this article, we’ll jump into the promising landscape of healthcare investments, highlighting a standout stock looking to revolutionize the industry.

The resilience of healthcare stocks

Amidst market turbulence, healthcare stocks have proven to be a beacon of stability. Year to date, the healthcare sector has surged by 4.7%, outpacing the broader market represented by the S&P 500, which has shown a growth of 3.84% in 2024.

Even on the most challenging market days, such as February 13th, when the S&P 500 plummeted by over 68 points, healthcare stocks demonstrated resilience, only dipping by 1.3%. This sector’s ability to weather storms can be attributed to the perpetual rise in healthcare expenditures globally.

The inexorable rise in healthcare costs

The trajectory of healthcare costs is on an upward climb globally, presenting a favorable landscape for healthcare investments.

According to the WTW Global Medical Trends Survey, the medical cost trend, indicating the rate at which healthcare service expenses escalate over time, escalated to a record high of 10.7% in 2023 from 7.4% in 2022.

Spotlight on UnitedHealth Group: A trailblazing investment

Among the numerous healthcare stocks, UnitedHealth Group (NYSE: UNH) emerges as a standout investment opportunity, particularly within the realm of healthcare insurance.

As one of the largest health insurers in the United States, UnitedHealth Group is strategically positioned to capitalize on the evolving landscape of healthcare expenditure.

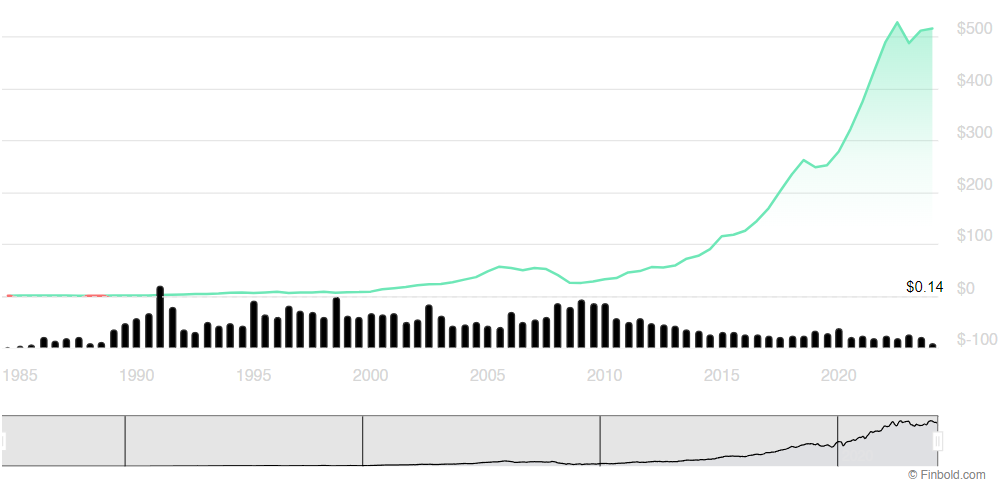

UnitedHealth Group stock price today

Driving forces behind UnitedHealth Group’s success

UnitedHealth Group’s success is underpinned by its innovative approach to healthcare delivery and insurance services. The company leverages its Optum business to steer insurance clients towards healthcare and specialty pharmacy offerings, fostering cost savings and enhancing customer satisfaction. Notably, the surge in healthcare spending propelled by the aging population in the U.S. serves as a catalyst for UnitedHealth Group’s sustained growth trajectory.

Financial performance and growth projections

| Metric | 2023 performance | Growth rate | 2024 projection |

| Revenue | $371.6 billion | 14.6% | $400 billion |

| Profit | $32.4 billion | 13.8% | – |

- Revenue growth: UnitedHealth Group witnessed substantial revenue growth in 2023, with Optum’s revenue soaring by an impressive 24%, complemented by a commendable 13% growth rate in the benefits business segment, UnitedHealthcare;

- Profit increase: The company’s overall revenue for the full year amounted to $371.6 billion, marking a robust 14.6% increase, with profits reaching $32.4 billion, reflecting a commendable 13.8% uptick;

- Projected revenue: Looking ahead, UnitedHealth Group anticipates further growth, with revenue projected to reach $400 billion, representing a solid 7.6% increase.

Commitment to shareholder value

UnitedHealth Group’s commitment to enhancing shareholder value is even greater due to its consistent dividend growth. Last year, the company raised its dividend by 13.9% to $1.88, marking the 13th consecutive year of dividend increases since its inception of quarterly dividends in 2010. This commitment underscores the company’s financial strength and management’s confidence in its long-term prospects.

The bottom line

In an industry marked by uncertainty, healthcare stocks offer investors a stable and promising avenue for portfolio diversification.

UnitedHealth Group, with its robust financial performance, innovative strategies, and unwavering commitment to shareholder value, stands out as a compelling investment opportunity within the healthcare sector.

As healthcare expenditures continue to rise due factors such as demographic shifts and evolving healthcare needs, UnitedHealth Group will revolutionize the industry, making it a stock worth considering for savvy investors looking to capitalize on the future of healthcare.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.