PayDo is a financial service platform that offers multicurrency and mass payment solutions for businesses and private entities. In this brief guide, we’ll go into more detail about its personal account features.

What is PayDo?

PayDo is a financial services platform that simplifies payment processes by enabling users to create personal, business, and merchant multicurrency accounts through a single digital contract.

As an authorized partner of Mastercard and soon Visa, PayDo provides each client with a dedicated European IBAN upon registration. It contains essential details such as their name or business name, ensuring smooth fund transfers.

PayDo offers users the flexibility to use different payment schemes:

- SWIFT

- SEPA

- Faster Payments

Additionally, the platform supports transactions in 12 different currencies, including EUR, USD, GBP, CAD, CHF, CZK, HUF, RON, PLN, SEK, NOK, and DKK. This multicurrency capability is one of PayDo’s unique advantages. As a client, you get global outreach and help your customers pay in the currencies they are used to.

Partnering with Mastercard, and soon Visa as well as American Express, PayDo complies with the PCI DSS security standard, ensuring the platform’s legality and sustainability by meeting all requirements for securing payment processes, including data transfer and payer information processing.

PayDo account types

There are three account types available with PayDo: business, merchant, and personal accounts.

With PayDo Business Account, corporate clients can receive dedicated European IBAN details with their company name designated for both sending and receiving payments, as well as open supplementary multicurrency IBAN accounts without providing any corporate data.

Clients with a business account can also establish a PayDo Merchant Account, which facilitates multiple payments and allows eligible UK companies to access direct merchant accounts with UK acquirers.

In this guide, we focus on PayDo Personal Account. So let’s explore it in more detail.

PayDo Personal Account

For individuals, PayDo offers dedicated European IBAN details specifically designed for EUR payments, where their names can be used as either the sender or recipient of funds. However, the platform also provides pooled multicurrency IBANs without any personal data.

With a PayDo Personal Account, users can send and receive cross-border transfers, manage multiple balances through one account, as well as make purchases on thousands of sites supported by PayDo.

Sending and receiving payments is available in around 150 countries and in over 12 currencies, including EUR, GBP, and AUD via SEPA, SWIFT, and Faster Payments. Storing funds in different currencies is also entirely free.

As an Electronic Money Institution (EMI), PayDo stores user funds in segregated client accounts held at leading European banks.

Cards

Soon, PayDo clients will be able to apply for VISA EUR cards for online and contactless payments via Apple Pay, Google Pay, and Samsung Pay. These cards will be linked to user accounts and give clients quick access to their funds.

Each card transaction will be protected by 3D Secure (3DS), a technology developed by Visa and Mastercard. When a cardholder makes a purchase online, they will receive a unique one-time password via SMS to confirm the transaction. This involves three parties: the acquirer (the online store’s bank), the issuer (the card issuer), and the compatibility domain (related to the payment system).

Additional services

Those holding PayDo personal accounts can make use of other services, too, including:

- Payments to/from other PayDo users: Transfers between PayDo users are facilitated through internal transfers;

- Real-time reporting: Users can get detailed reports for convenient payment management and download their payment history for a custom period in PDF or Excel formats;

- Money exchange: With the money exchange feature, clients can instantly convert money at favorable rates. Storing funds in different currencies is also completely free, and transparent exchange rates are updated several times a day;

- Easy shopping: PayDo allows for instant account creation from the checkout page. This makes topping up and paying from balances for purchases doable within seconds;

- Instant and free balance top-up: Instant top-ups during checkout are free of charge and don’t interrupt the payment process.

How to open a PayDo Personal Account?

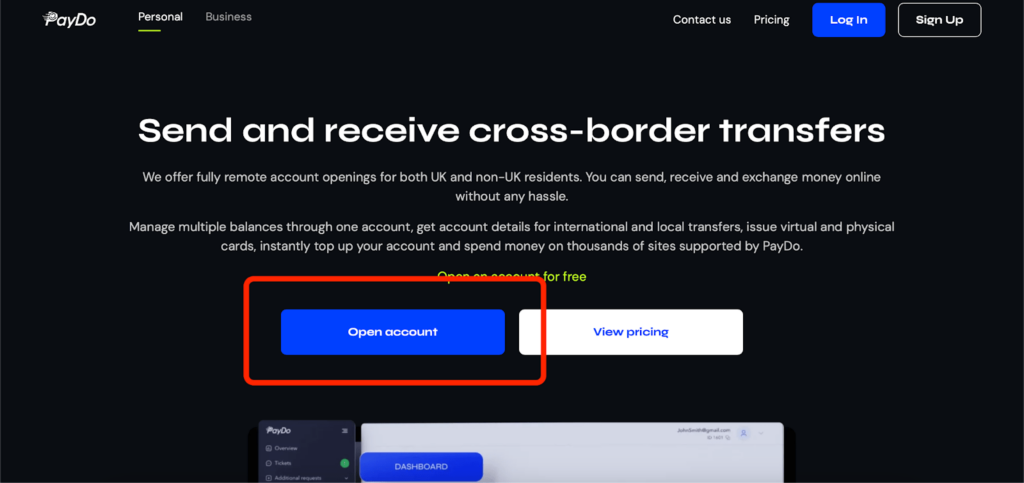

Opening a PayDo personal account is completely free and a matter of following a few easy steps. To open an account, go to the PayDo homepage and click on the Open account button (as shown below):

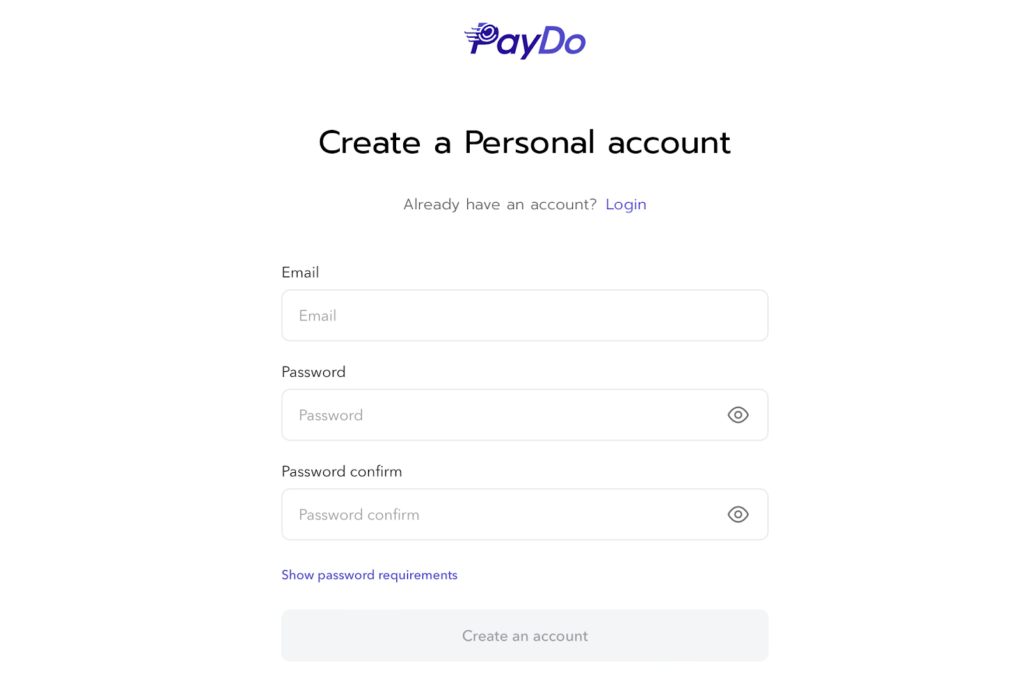

Then, you will be redirected to a new page where you’ll have to provide your email and come up with a password.

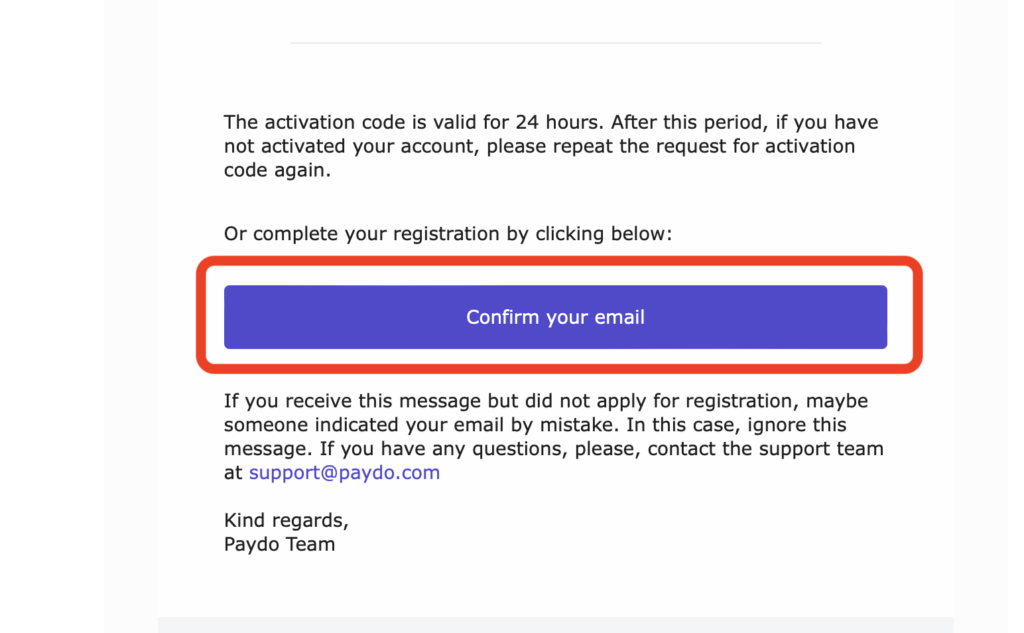

After entering your email and choosing a password, click the Create an account button. Then, head to your email inbox and open the account confirmation email from PayDo. You’ll see a link in the email that you can click to verify your email address (as depicted below):

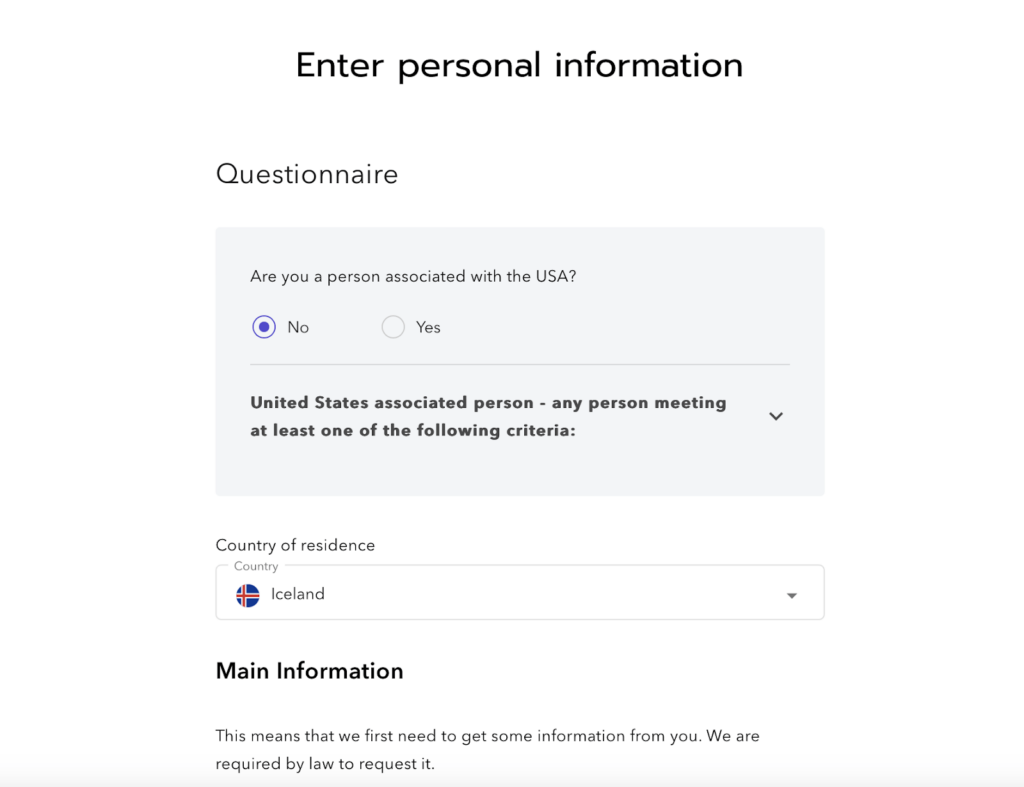

After clicking the link in the email, your account will become active. You can then return to the PayDo website, sign in using your email and chosen password, and complete a brief questionnaire before diving into the platform.

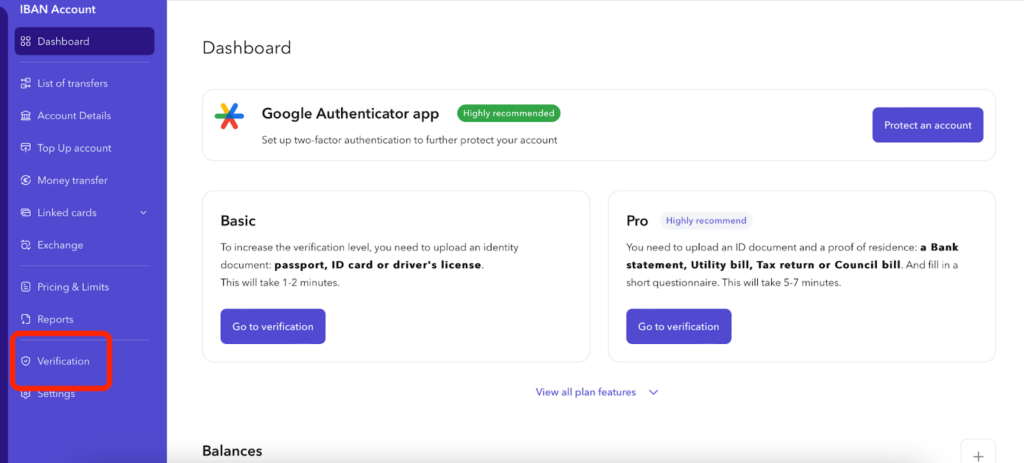

Once you finish the questionnaire, you’ll be directed to the main PayDo dashboard. First, verify your account. To do this, navigate to the main PayDo interface and click on the Verification option located on the left-hand side (as illustrated below):

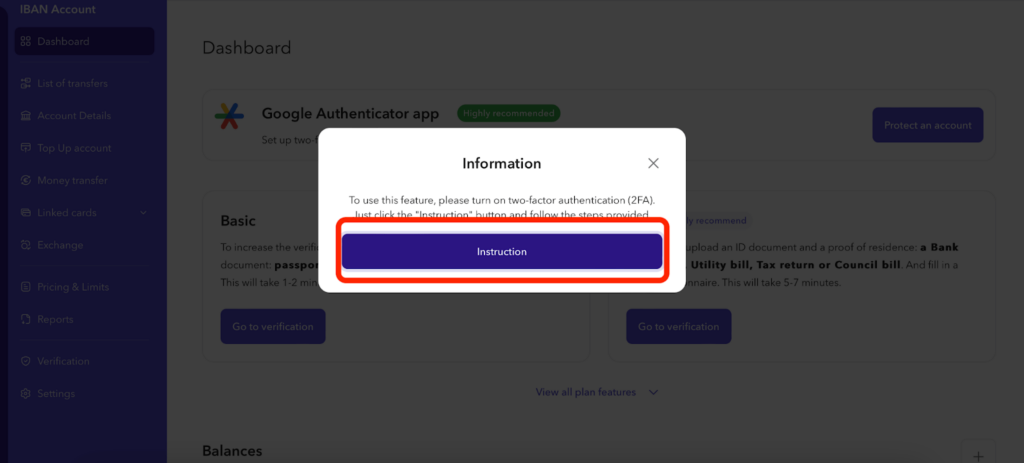

When you click on Verification, a new window will pop up, so just click on the Instructions button (as depicted below) and follow the further instructions provided by the platform:

Once your account is verified, you can freely explore all of PayDo’s features.

Are PayDo personal accounts safe?

PayDo is a legit payment service regulated by the UK’s Financial Conduct Authority (FCA), which ensures careful management of the client’s money. The platform implements strict user verification and complies with Payment Card Industry Data Security Standard (PCI DSS) Level 1 for merchant services, and user funds are securely held in separate accounts in banks, with real-time fraud detection, biometric authentication, and 3D-Secure (3DS) technology for card payments to enhance security.

PCI DSS also ensures secure processing, transferring, and storing of payment data, which is essential for building trust and protecting sensitive information. 3D-Secure, developed by Visa and MasterCard, adds an extra layer of security to online payments, reducing fraud risk.

Unlike traditional banks, PayDo employs specialized techniques to protect funds, including real-time monitoring and keeping funds in accounts at reputable institutions. While not covered by the Financial Services Compensation Scheme (FSCS), PayDo’s stringent safeguarding measures ensure that even in the event of insolvency, user funds remain unaffected, with clear communication strategies and prompt return of funds by correspondent credit institutions.

Conclusion

In conclusion, PayDo’s personal account offers a comprehensive solution for individuals seeking efficient and secure financial management. With the provision of European IBAN details, users can seamlessly send and receive payments in multiple currencies, including EUR, GBP, and AUD, across 150 countries. The platform’s adherence to PCI DSS security standards also ensures the safety of transactions and user data, and upcoming features such as the issuance of cards for online and contactless payments via Apple Pay, Google Pay, and Samsung Pay will enhance user convenience.

Whether it’s internal transfers, real-time reporting, currency exchange, or easy shopping, PayDo’s personal account caters to diverse financial needs with simplicity and reliability. Opening a personal account is straightforward and free, making it accessible to anyone looking for a modern and versatile financial solution.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

PayDo Personal Account FAQs

Can you open a PayDo personal account for free?

Yes, opening and maintaing a PayDo account is free.

What kind of accounts can you open at PayDo?

At PayDo, you can open personal, business, and merchant accounts.

What do clients say about PayDo?

In general, PayDo boasts decent reviews. While there is always room for improvement, the bigger chunk of PayDo reviews are positive.

What services does a PayDo personal account offer?

Some of the services offered by PayDo personal accounts include payments to and from other PayDo users, real-time reporting, money exchange, full secure solutions, online shopping, multicurrency balances and payments, instant and free balance top-ups, and one-click payments.