Using insider trade information evokes images of Wall Street scandals and illegal activity. However, there are two types of insider trading—legal and illegal.

Legal insider trading happens when corporate insiders like executives, directors, and employees buy or sell stock in their own company while following the rules set by the Securities and Exchange Commission (SEC). On the other hand, illegal insider trading involves using non-public, material information to make a profit or avoid a loss.

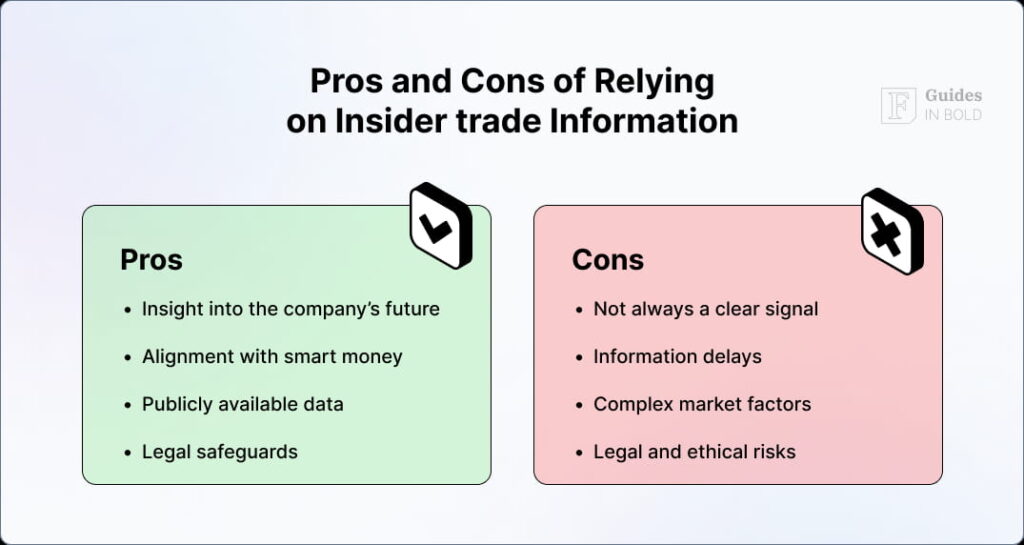

While using insider information may seem like a promising way to profit from the stock market, it comes with its own pros and cons.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

What Is insider trading?

“If companies tell us more, insider trading will be worth less.” — James Surowiecki, business and finance journalist and author

Insiders must disclose their transactions to the SEC within two days, and this information becomes public, enabling regular investors to track their moves. By following insider trades, you can match yourself with those who arguably know the company best.

Relying on insider trading information as an investment strategy isn’t perfect, and it has its own share of pros and cons.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

Pros and cons of relying on insider trade information

Pros

- Potential insight into the company’s future: Insiders have access to information that the public doesn’t. This can include knowledge about upcoming product launches, mergers, or even internal issues that could impact the company’s stock price. When insiders buy large amounts of stock, it can signal that they believe the company is on the verge of growth;

- Alignment with smart money: Following insider trades allows investors to align with the so-called smart money in the market. When company insiders are making significant trades, it can be a sign of confidence in the company’s future. If insiders are buying, it could suggest that they expect the company’s stock price to go up;

- Publicly available data: Thanks to SEC regulations, insider trading data is available for free. Investors can easily follow insider activity through insider trading tracker tools, or the SEC’s own database, Electronic Data Gathering, Analysis, and Retrieval (EDGAR). This offers an extra layer of confidence that you’re making informed decisions;

- Legal safeguards: Legal insider trading happens under strict regulations, which protect both insiders and the public. By relying on disclosed trades, you are not engaging in illegal activity and still benefit from useful market insights. The SEC closely monitors these transactions, making them a safer bet for everyday investors compared to other unregulated methods of gathering market information.

Cons

- Not always a clear signal: While insiders may have privileged knowledge, their reasons for buying or selling are not always obvious to the public. Insiders might sell shares for various reasons, such as personal financial needs or tax planning. Likewise, insider purchases don’t always guarantee future growth; sometimes, insiders misjudge the company’s future prospects;

- Information delays: Insider trades are disclosed within two days after they occur, meaning you’re never working with real-time information. By the time you make a move based on insider trading data, market conditions might have changed, and the stock price may have already adjusted to reflect the insider activity;

- Complex market factors: Insider trading is just one piece of the puzzle. The stock market is influenced by a wide array of factors, such as economic conditions, interest rates, and various global events. Relying solely on insider trading data can leave you vulnerable to these other factors;

- Legal and ethical risks: Though relying on publicly available insider trade data is legal, attempting to access or use non-public information could lead to insider trading penalties, including fines and jail time. Even if you don’t intend to break the law, misunderstanding or misusing insider trade data can get you into hot water with regulatory authorities.

Research shows that insider trading can provide useful insights, but it’s not always a clear indicator of future stock performance. For instance, a study by Seyhun from 1986 found that insider purchases often outperform the market, indicating that insiders may have valuable information about a company’s future prospects.

However, a contrasting study by Jenter from 2005 revealed that insiders sometimes misjudge the market, particularly during times of overvaluation, showing that insider trades are not always a foolproof signal of future growth.

Recommended video: Insider Trading Explained in 2 Minutes

Insider trading example

A recent example that highlights both the pros and cons of insider trading involves Elon Musk and Tesla (NASDAQ: TSLA). In November 2021, Musk sold a significant portion of his Tesla shares, worth around $5 billion. The sale was part of a pre-arranged trading plan under Rule 10b5-1, which allows insiders to sell shares at predetermined times to avoid any appearance of trading on non-public information.

| Pros | Cons |

| Market efficiency: Musk’s sale provided valuable insights into his views on Tesla’s stock valuation, helping the market adjust accordingly. | Market reaction: The sale caused a temporary dip in Tesla’s stock price, raising concerns among investors about the impact of large insider sales. |

| Transparency: The sale was conducted under a Rule 10b5-1 plan, ensuring transparency and legal compliance, which helps maintain investor confidence. | Perception of fairness: Despite the legal framework, such a significant insider sale lead to a perception of unfairness among everyday investors, who felt disadvantaged compared to insiders with more information. |

Insider trading data: What to consider

If you decide to rely on insider trading information, you should consider these important factors:

- Position of the insider: CEOs and CFOs tend to have the most meaningful trades;

- Frequency of trades: Consistent buying over time could be more indicative than one large purchase;

- Size of the trade: A small trade may not mean much, but significant trades could signal more confidence in the company’s future;

- Sector trends: If several companies in the same sector show insider buying, this could indicate a broader industry trend.

Summary

Although relying on insider trade information can provide valuable insights into the stock market, it shouldn’t be your only tool when determining potential investments. While insider trading can signal confidence from within a company, it comes with its own risks, such as potential data misinterpretation and delays.

The stock market is influenced by many factors, so it’s best to combine insider trading data with other forms of analysis for a better investment strategy.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about the pros and cons of relying on insider trade information

What is insider trading?

Insider trading occurs when corporate insiders like executives, directors, or employees buy or sell shares of their own company. This can be legal or illegal depending on whether the trades are based on non-public, material information.

How is legal insider trading different from illegal insider trading?

Legal insider trading follows SEC rules, which require insiders to disclose their trades to the public within two days. Illegal insider trading involves using confidential, non-public information to make a profit, which is against the law.

Where can I find insider trading data?

You can find insider trading data on various financial websites or directly from the SEC’s EDGAR database. Alternatively, you can use tools like Finbold Signals, which offer timely notifications on insider trades, making it easier to track key market moves without navigating multiple sources.

How can I tell if an insider trade is a good signal?

Look at the insider’s position (e.g., CEO or CFO trades are typically more significant), the frequency of their trades, and the size of the transaction. Large, consistent insider buying can be a more reliable signal than small, occasional trades.