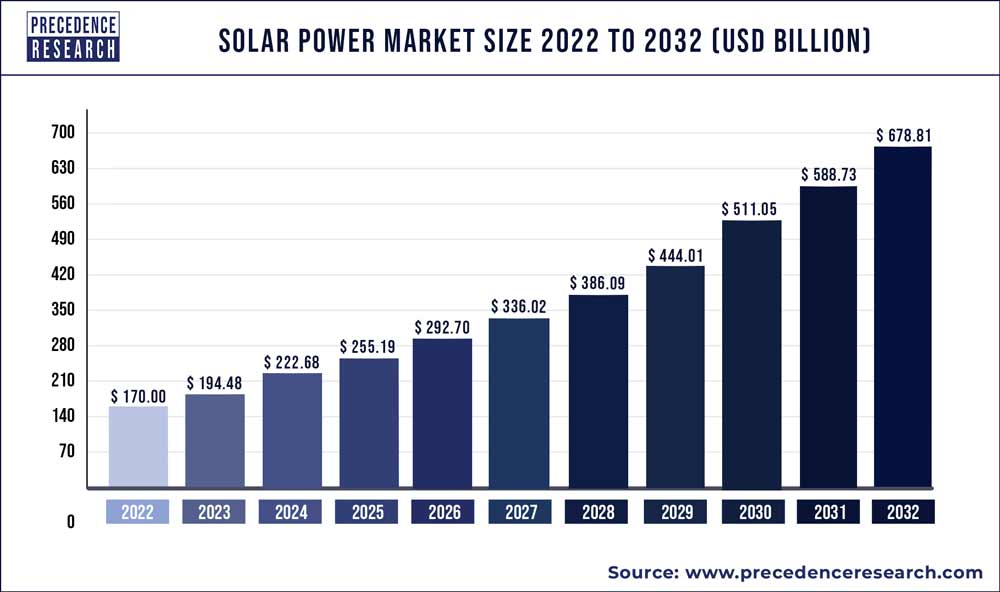

After a tough few last years for solar stocks, 2025 shows more promise as rising energy needs in developing countries and a mounting call for carbon reduction drive demand for solar power. While the market is still young and investments would likely take some time to deliver proper results, reducing dependency on fossil fuels is a trend that shows no signs of slowing down anytime soon.

The green revolution is here, and one solar stock lights the path for the rest to follow. Today, we’ll cover the story of First Solar (NASDAQ: FLSR) and why this solar stock might be what you should invest in right now.

Why are solar stocks down?

In 2023, certain solar stocks, such as Sunrun (RUN), SunPower (SPWR), and SolarEdge (SEDG), crashed, and more solar companies suffered similar fates.

The primary cause was higher interest rates, resulting in an unfavorable solar sector cost structure. As a consequence, installers ordered less, demand plunged, and solar companies took the hit.

Furthermore, in Q2 2023, California changed the rates at which users benefitted from supplying the grid, meddling with the maths of rooftop solar producers, and reducing sales for rooftop panels and related products.

However, rather than a hard stop on the whole sector, 2024 will likely prove that these were mere bumps in the growth of the renewable energy market. In the long run, the demand is increasing, and the industry is already adapting to the new circumstances.

Best solar stock to buy now: First Solar on top of the green wave

Due to the short-term obstacles the solar market faced, First Solar (NASDAQ: FLSR) stock price has been volatile over the past couple of years and further declined by 14.08% since the beginning of this year.

While the stock price has dropped, the company’s financial performance remained solid. Revenue increased 16% to $1.16 billion in Q4 2023 compared to the same period last year. Net income per diluted share beat estimates and reached $3.25 for Q4 and $7.74 for the whole year.

Furthermore, First Solar witnessed lower costs and higher average selling prices. Improved logistics and productivity due to higher economies of scale will have a lasting effect, evident in increased production and sales, especially in the United States, where it benefits from the U.S. Inflation Reduction Act.

First Solar has also continued expanding with new facilities in Ohio. The company has maintained a hefty backlog of bookings, over 80 GW, since the end of 2023.

The long-term macroeconomics also indicates a favorable climate for First Solar as inflation abates and the Federal Reserve considers reducing interest rates in 2024, which should make financing large projects easier for renewable energy companies.

However, there is still some risk to account for, including the results of the presidential elections in the U.S., which could dictate the terms of both fiscal policy and subsidies for solar companies.

First Solar stock price today

Due to the lower stock price and numerous estimates that First Solar stock is undervalued, investors may find that now is the right moment to invest.

About First Solar

First Solar, Inc. (NASDAQ: FLSR) is an American company and a leading provider of solar panels, utility-scale photovoltaic (PV) power plants, and support services. Known for its thin-film modules and CdTe semiconductor panels, the company promotes eco-efficiency and lower-carbon alternatives.

Founded in 1999 in Tempe, Arizona, the company went public in 2006. While its primary market is the United States, it has a significant presence in France, Chile, Japan, and globally.

First Solar’s stock is an S&P 500 component. It trades on the NASDAQ under the FSLR ticker.

What is the forecast for First Solar stock?

The solar market is recovering from its 2023 downturn and remains poised for continued growth in the near future. As the companies adapt to the shifted market, the lowered stock prices might prove to be enough incentive for investors to return to the power sources of the future.

Regarding First Solar, its solid financial performance, coupled with the expected growth of the solar market, implies that the conditions are ideal for its stock to perform better than before. With enough patience, the green revolution will likely come out of hiatus, with First Solar at the front of the green wave.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.