This guide will examine in detail a derivative contract called total return swaps, how they work, who they benefit, as well as the pros and cons of using them.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in 70+ cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

Swap definition

Each cash flow forms one leg (one part) of the swap. While one cash flow is typically fixed, the other is in motion and based on a standard interest rate, floating currency exchange rate (determined by supply and demand), or index price.

Swap contracts are used as risk hedging instruments to minimize the uncertainty of specific operations. In contrast to futures and options, swaps are traded over-the-counter and not on exchanges.

Additionally, swap counterparties are generally businesses and financial organizations, not individuals, because there is always a high counterparty (default) risk (the possibility of not meeting their required payments on their debt obligations) in swap contracts.

The institution that acts as a broker between two counterparties is called a swap bank. They facilitate the transactions by matching two ends of the deal and usually earn a slight premium from both parties.

Finally, swaps were established in the late 1980s and are thus a relatively new type of derivative. However, their simplicity and extensive applications make them one of the most frequently traded financial contracts.

Total return swap definition

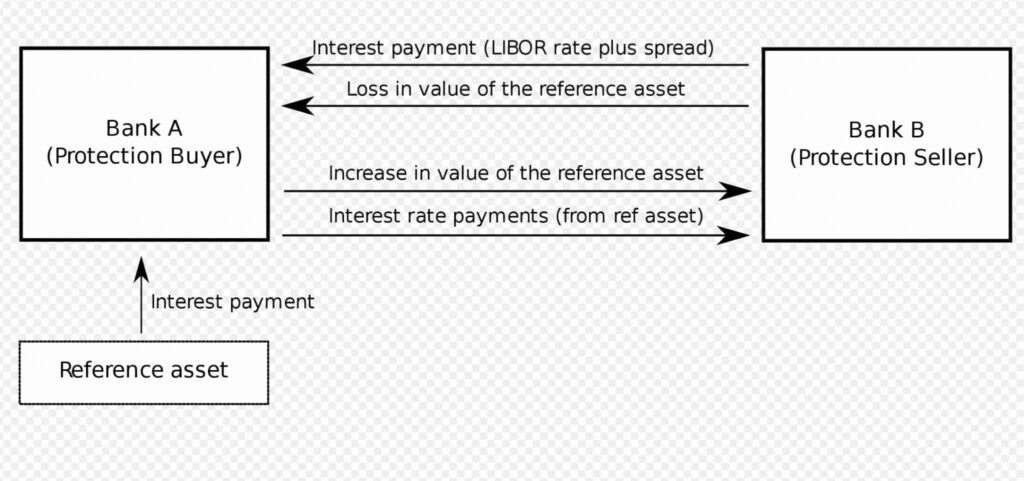

The underlying asset, referred to as the reference asset, is typically a bond, equity index, or a basket of loans and is owned by the party receiving the set rate payment.

Total return swaps permit the party receiving the total return to profit from the reference asset without purchasing it. The receiving party also collects any income generated by the security but, in exchange, must pay the asset owner a set rate over the lifetime of the contract. Conversely, the asset owner expects to generate extra income on these assets and mitigate against capital losses.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in 70+ cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

Understanding how total return swap works

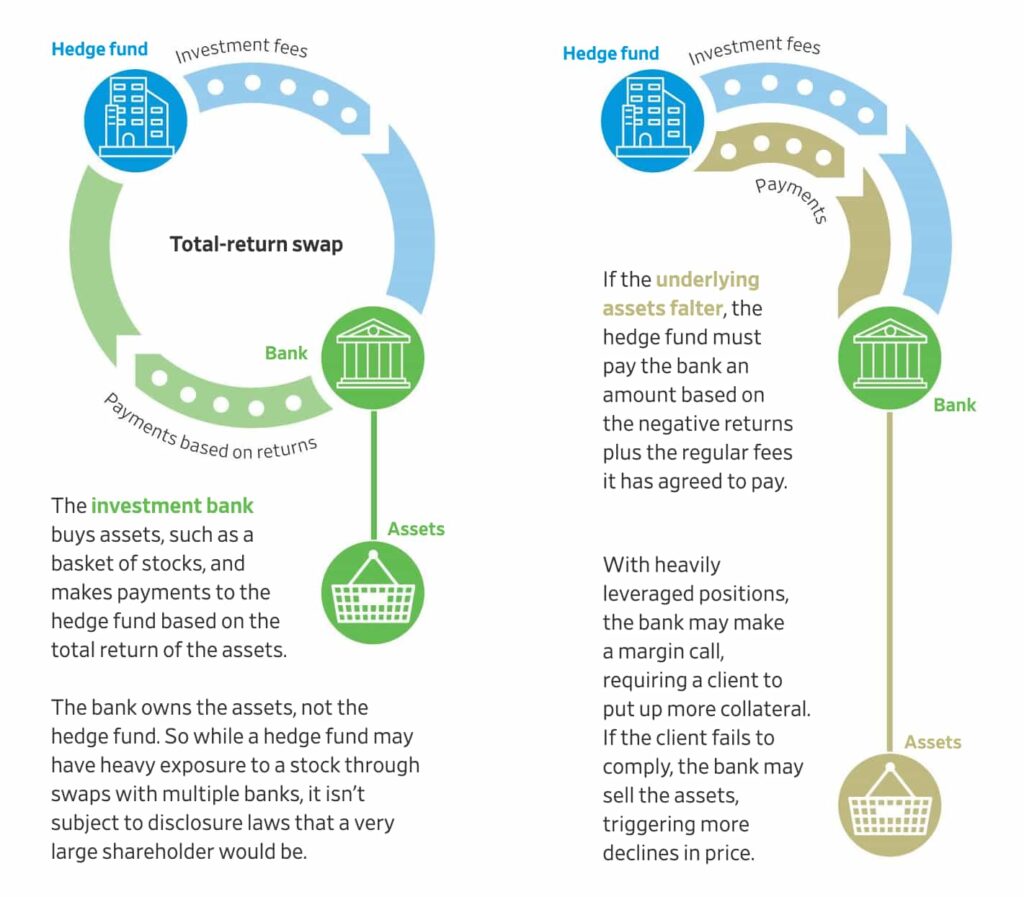

Total return swaps are agreements brokered by Wall Street banks that enable users to bear the profits or losses of a portfolio of stocks or other assets in exchange for a fee.

Swaps also allow investors to take huge positions while putting limited funds upfront, essentially borrowing from the bank, allowing them to invest in assets without owning them. The two parties involved in a total return swap are the total return payer and the total return receiver.

Characteristics of total return swaps

In a TRS, the total return receiver collects any income generated by the asset and benefits if the asset’s price appreciates over the contract’s lifetime. In exchange, they must pay the asset owner (total return payer) the set rate over the lifetime of the swap.

If the asset’s price falls over the swap’s life, the party receiving the total return will be required to pay the security owner the amount the asset has decreased.

The owner bears no performance risk but takes on the credit exposure risk the receiver may be subject to, whereas the receiver assumes systematic and credit risks. For instance, if the asset price drops during the agreement’s lifetime, the receiver will pay the asset owner a fee equal to the amount of the asset price decline.

Uses and participants of TRS

Total return swaps are generally used by investors who want to gain exposure to a specific security class without purchasing the underlying asset. In addition, these contracts can also be utilized to reduce the cost of holding an asset. Initially, it was created as a way for banks to hedge against default risk on a loan or group of loans.

The TRS market’s primary participants include large institutional investors such as investment banks, mutual funds, hedge funds, commercial banks, pension funds, funds of funds (a pooled fund that invests in other funds), private equity funds, and insurance companies, NGOs, and governments.

Moreover, special purpose vehicles (SPVs) such as Real estate investment trust (REITs) and bespoke collateralized debt obligation (finance product that is secured by a pool of loans and/or various assets) also participate in the market.

Typically, a hedge fund seeking exposure to particular securities pays for the exposure by leasing the assets from major institutional investors like investment banks and mutual funds. They hope to earn high returns from leasing the asset without purchasing it, thus leveraging their investment fully.

Conversely, the asset owner hopes to generate additional income in the form of LIBOR-based (the average interest rate at which global banks lend to one another) fees and agreed-upon spread to mitigate capital losses.

Total return swap example

Let’s imagine two parties that enter into a one-year total return swap in which the first party receives a fixed margin of 2% in addition to the LIBOR (London Interbank Offered Rate). The second party receives the S&P 500 (Standard & Poor’s 500 Index) total return on a principal amount of $1 million.

After one year, LIBOR is at 2.5%, and the S&P 500 has appreciated by 18%. The owner pays the receiver 18% and acquires 4.5%, making the total for the receiver $135,000 ($1 million x (18% – 4.5%)).

In contrast, consider that the S&P 500 falls by 18% rather than appreciating. The first party would receive 18% in addition to the LIBOR rate plus the fixed margin, making the total for the owner $225,000 ($1 million x (18% + 4.5%)).

Bond index TRS

Bonds have become one of the most widespread underlying assets for total return swaps. A bond index total return swap is an agreement in which the total return swap is indexed to a series of bonds. This is an excellent structure compared to something like an equity and issues guaranteed income payments based on the underlying bonds’ coupon payments.

Moreover, the risk of the capital loss is limited in a bond. For bonds with good credit ratings, the absolute risk is mainly systemic and based on demand in the market for bonds in general. However, investors shouldn’t mistake this for the absence of risk. For example, if the sale price of bonds falls over the span of the contract, a bond indexed TRS can still lose money.

Finally, it allows the investor to access a bond market without buying and selling bonds, which are capital-demanding, long-term instruments.

Bill Hwang’s stock manipulation scheme using swaps

In one of the most infamous cases using swaps, trader Bill Hwang, founder of Archegos Capital Management, rattled markets in March of 2021 when investors worldwide learned that his company had defaulted on loans used to create a $100 billion portfolio.

According to Bloomberg, this was one of the most spectacular failures in modern financial history, and no single individual has ever lost so much cash so quickly.

Archegos is estimated to have managed about $20 billion of its own money. However, its total positions that were wiped out approached $30 billion thanks to leveraging Archegos obtained from banks, all lost in the space of a week.

Because Hwang was using borrowed money and levering up his bets fivefold, his collapse left a trail of devastation. As banks dumped his holdings, stock prices plummeted. Credit Suisse Group AG, for example, one of Hwang’s lenders, lost $4.7 billion, and Nomura Holdings Inc. faced a loss of about $2 billion.

Using total return swaps instead of simply purchasing company shares provided two main benefits for Archegos. These derivatives enabled the company to boost its leverage, essentially owning more of an asset than its funds would have otherwise allowed. In addition, these swaps entitle investors like Hwang to maintain their anonymity.

Hwang also kept his lenders in the dark by trading via swap agreements. In a typical swap, a bank exposes its client to an underlying asset, such as a stock. While the client gains or loses from any price changes, the bank shows up in filings as the registered owner of the stock. That’s how Hwang was able to compile significant positions so quietly. And since the banks had details only of their dealings with him, they couldn’t know he was piling on leverage in the same assets via swaps with other banks.

One problem with stock picking at this scale is hedging, and Hwang never had an effective hedge. Many sophisticated stockpickers attempt to mitigate risk by balancing long positions with shorts on similar names and, as a result, making up some losses with profits if the market tanks.

Interestingly, if the stocks in his swap accounts rebounded, everyone would stay afloat. However, as soon as even one bank flinched and started selling, they’d all be exposed to plunging prices.

Recommended video: How to lose $20 billion in two days

Where is Bill Hwang now?

Pros and cons of total return swaps

Total return swaps are a form of derivative contract which takes their value from the value of an underlying asset. As a result, it lets one party receive all the benefits of owning a security without locking up funds in that asset. However, any fortune borrowed money stands on shaky grounds and comes with the risk of losing it all.

Pros

- Operational efficiency: in a TRS contract, the receiver does not have to deal with interest collection, settlements, payment calculations, and reports that are typically required in a transfer of ownership transaction;

- The asset owner maintains ownership of the asset, and the receiver does not need to deal with the asset transfer process;

- The payer forfeits the risk associated with this particular asset and receives a set payment;

- Enables the TRS receiver to make maximum use of its investment capital as it allows for a leveraged investment;

- If the asset gains value, they receive any potential yield and return generated by this asset;

- Allow investors exposure to a particular asset without purchasing the underlying security;

- Allow traders to get exposure to diverse investments;

- Reduce the cost of holding an asset and are often more cost-efficient than owning the underlying security directly;

- It can be tax advantageous for institutions that invest in specific securities;

- Effective hedging tool: Can act as credit risk insurance for companies seeking to mitigate default risk on a loan.

Cons

- The TRS receiver accepts any systematic and unsystematic risk of the underlying asset. Were the security to lose value, the receiver will make payments based on those losses;

- Counterparty risk: if a hedge fund joins multiple TRS contracts on similar underlying assets, all and any decline in the value of these securities will result in lower returns as the fund continues to pay regular fees TRS owner;

- Suppose the decline in the value of assets continues over an extended period and the hedge fund is not adequately capitalized. In that case, the payer will be at risk of the fund’s default. Moreover, the risk may be intensified by the high secrecy of hedge funds and the treatment of such assets as off-balance sheet items;

- Both parties are affected by interest rate risk. The payments made by the receiver are equal to LIBOR plus or minus the fixed fee. An increase in LIBOR during the agreement boosts revenues for the payer and vice versa. However, interest rate risk is even higher on the receiver’s side.

Final thoughts on TRS

To sum up, swaps can be a helpful tool that allows investors exposure to global markets, specific stocks, sectors, and products they would otherwise struggle to participate in. In addition, it lets them bet on moves in an asset without devouring up as much capital as buying actual shares.

However, what is probably questionable is that too much leverage has been extended to one counterparty by the banks. In addition, there is a lack of transparency about the reporting requirements for investors who hold significant positions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about total return swaps

What is a total return swap?

A total return swap (TRS) is an agreement contract between two parties in which one party makes payments based on a set rate in exchange for exposure to the total return generated by a particular asset or assets. The parties involved in a total return swap are the total return payer and the total return receiver.

What are the advantages to the total return receiver?

TRS enables the receiver to derive the economic benefit and exposure of owning an asset without incurring the burden of ownership and the processes that come with it, as well as requiring a minimal cash outlay. In addition, it gives access to specific markets they might otherwise be restricted from accessing. Moreover, the TRS contract is an off-balance sheet transaction, allowing the investor to stay anonymous.

What are the disadvantages to the receiver?

A decline in the value of the reference asset results in massive losses amplified by the fact your capital is leveraged, in addition to the regular fixed-rate payment. Also, receivers are exposed to the reference assets’ market risk (e.g., interest rate risk) and credit risk (e.g., risk of default).

What are the advantages to the total return payer?

A TRS contract enables the payer to purchase protection against a potential decline in the value of the reference asset, as well as hedge against default risk on a loan or group of loans. In addition, the owner receives streams of fees based on a reference rate (LIBOR-based payment plus the fixed spread).

What are the disadvantages to the payer?

The payer is bound to pay the receiver any appreciation in the reference asset’s value. Moreover, the payer takes on credit risk exposure to the receiver if they cannot meet the fixed rate payment obligations. If the reference asset’s value plunges over an extended time, the receiver may default on the swap, leading to the payer taking on exposure to the underlying assets.

What are the differences between total return swap vs CFD?

A Total Return Swap is a derivative for exchanging an asset’s total return for a fixed or floating payment, enabling return exposure without ownership. A Contract for Difference (CFD) is also a derivative, where parties exchange the value difference of an instrument between the opening and closing of the contract, allowing price speculation on the underlying asset, often with leverage. Both instruments serve for hedging or speculation but differ in their structures and risk profiles.

What is the difference between a total return swap vs equity swap?

An equity swap specifically involves swapping the returns of an equity asset (like stock returns) for a fixed or floating rate. While both allow for indirect investment in the underlying assets, a TRS can cover a broader range of assets, whereas equity swaps are focused solely on equities.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in 70+ cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.