Insider trading can provide useful insights into how corporate insiders view their own companies. When insiders like executives, board members, or major shareholders buy or sell shares, it can signal confidence or caution about the company’s future. Using an insider stock trading tracker can help you stay on top of insider activities and make better investment decisions.

In this guide, we’ll walk you through how to use a trading tracker effectively, regardless of whether you’re a new investor or an experienced trader.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

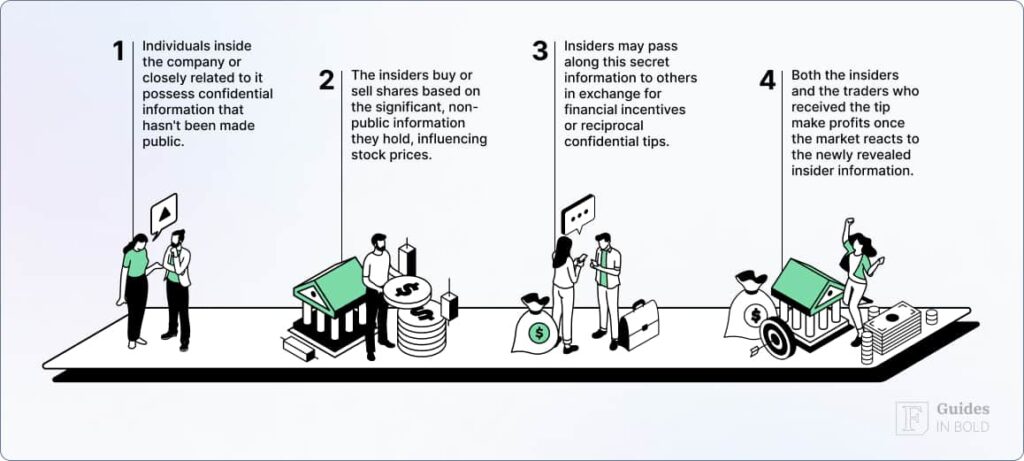

About insider trading

Insider trading refers to the buying or selling of a company’s stock by individuals who have access to material non public information (MNPI) about the company. These insiders typically include executives, board members, and other employees.

What is Insider Trading? Explained in 2 Minutes

What is a stock trading tracker?

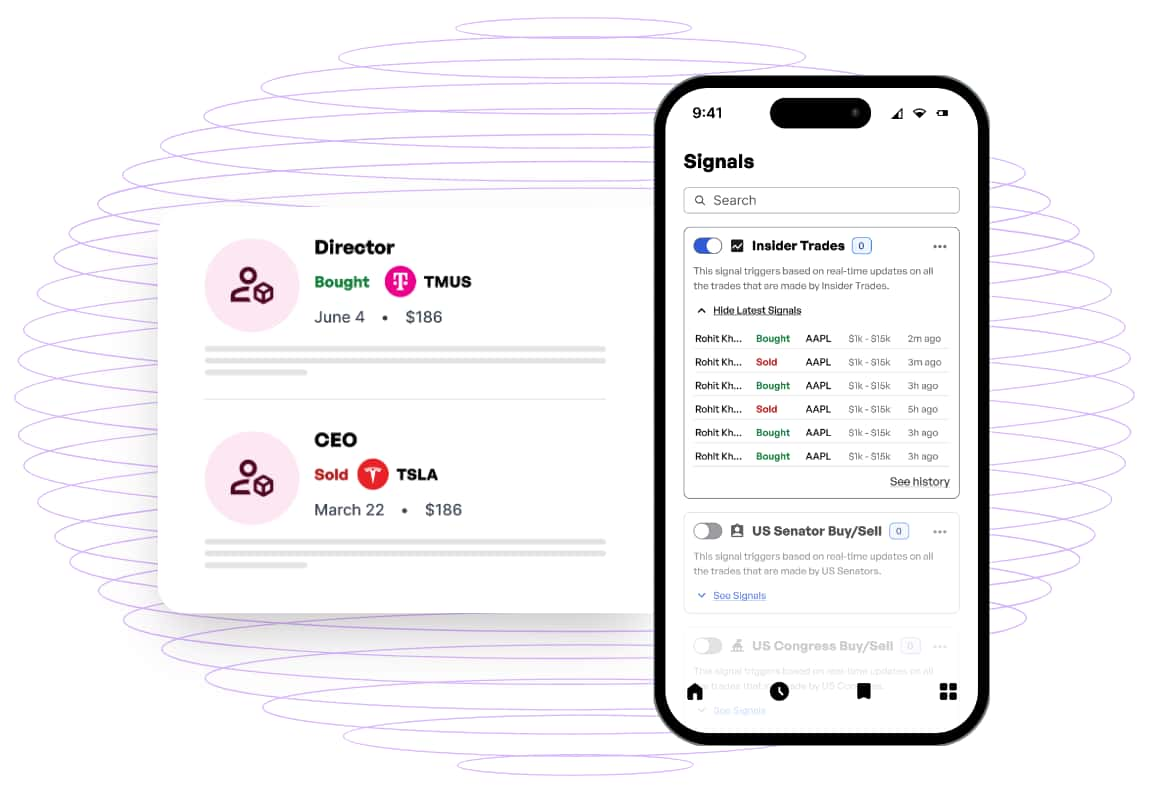

A stock trading tracker is a specialized tool that monitors insider trading activities and, in turn, provides real-time updates.

In essence, stock trading trackers compile publicly available data on insider trades, making it easy for investors to identify patterns and trends. An individual can use this information to then spot potential opportunities or avoid bad investments.

Why is insider trading knowledge so useful?

Insiders often have a solid understanding of their company’s operations and growth potential. As such, their trading activities can reveal their confidence or concerns.

Here’s why it can be useful to pay attention to their moves:

- Insider buying: When insiders buy shares, it suggests they believe the stock will perform well;

- Insider selling: When insiders sell shares, it doesn’t always mean trouble, but large or consistent sales might indicate concern.

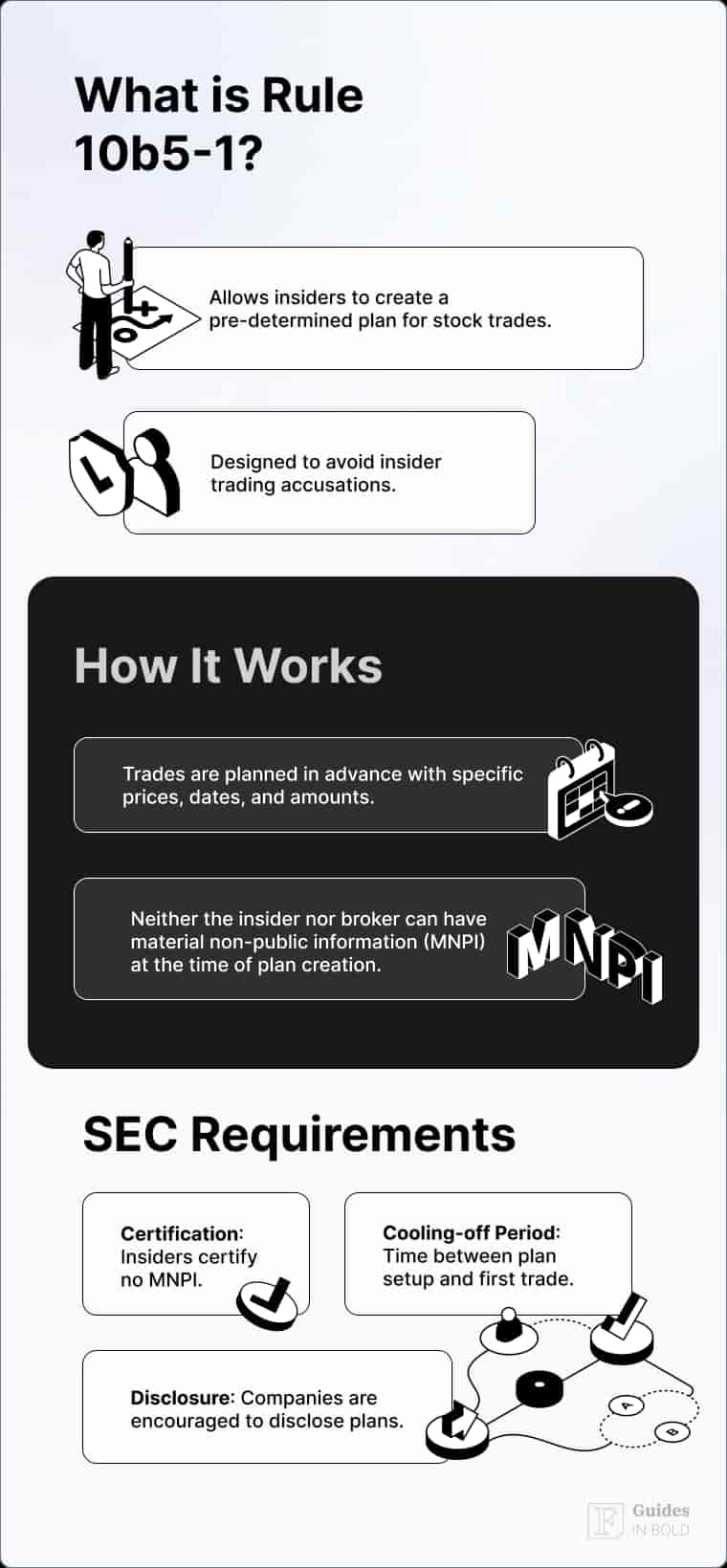

Still, it’s key to note that not all insider sales indicate a negative outlook. Many executives use 10b5-1 plans, pre-arranged trading plans that allow them to buy or sell shares at scheduled times, regardless of non-public information. These plans help insiders avoid accusations of illegal trading while maintaining financial flexibility.

How to use a stock trading tracker: Step-by-step process

Here’s a step-by-step guide on how to use a stock trading tracker in general.

Step 1: Choose a reliable stock trading tracker

First things first. You should pick a tool that provides real-time updates, easy-to-read dashboards, and detailed trade reports.

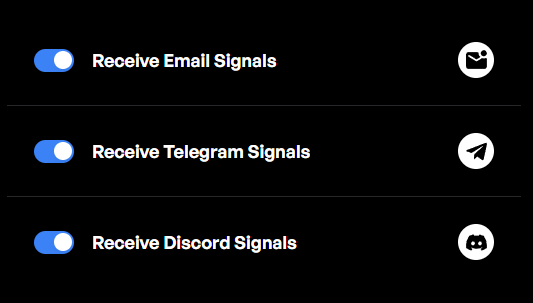

Once you do so, continue by setting up your account. Also, be sure to customize your preferences and set alerts for specific companies or industries that you follow.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

Step 2: Analyze the data

With a set-up account, the next step is to understand how to interpret the information your tracker provides. Be sure to pay attention to these points:

- Insider type: Keep track of key people, such as CEOs, CFOs, and board members;

- Trade type: Pay attention to whether they are buying or selling;

- Transaction size: Consider the number of shares and trade value.

Step 3: Identify trends

After you grasp what to look for in data, you can start identifying distinct patterns.

For example, if several insiders are buying shares simultaneously, it could indicate optimism about the company’s performance. On the other hand, if they are selling in numbers, it can point to the opposite, though nothing is a guarantee.

Step 5: Integrate with your investment strategy

Lastly, we should point out that you mustn’t rely solely on insider data. Instead of doing so, it’s best to combine this data with other types of analysis, such as earnings reports and industry trends, and you’ll make more solid decisions.

What to look for in a stock trading tracker

When choosing a tracker, we suggest focusing on the features in the table below:

| Feature | Description |

| Real-time updates | Ensure the tracker provides timely information. |

| Custom alerts | Look for tools that allow you to set alerts for specific stocks or insiders. |

| Historical data | A solid tracker lets you analyze trades to identify long-term patterns. |

| User-friendly interface | Pick a tool that’s easy to navigate and understand. |

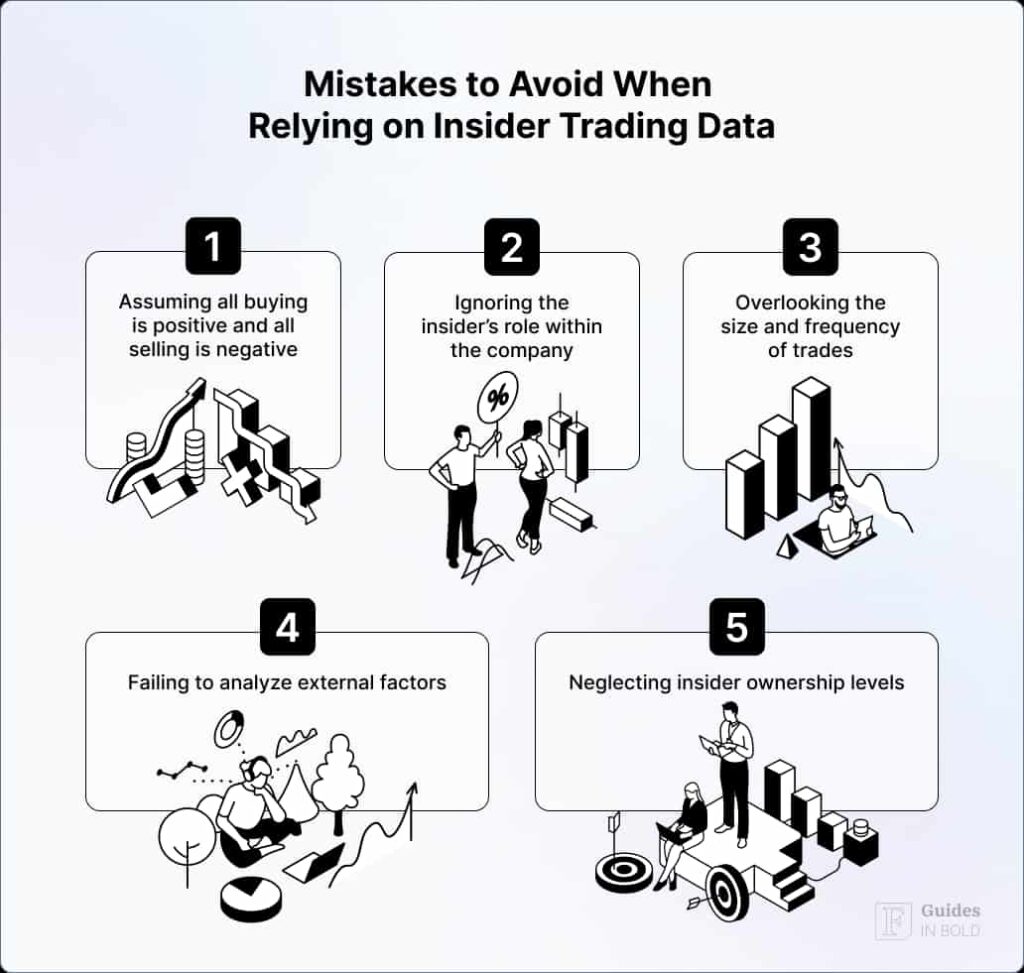

Common mistakes to avoid

Even with the best tracker, it’s possible to make poor decisions. Therefore, be sure to avoid making the following mistakes:

- Assuming all buying is positive, and all selling is negative: Insider buying often signals confidence in the company’s future, but it’s not a guaranteed indicator of success. Similarly, insider selling doesn’t always mean trouble, as executives and insiders may sell shares for personal reasons, such as financial planning or diversification;

- Ignoring the insider’s role within the company: Not all insider trades carry the same weight. For example, trades made by a CEO or CFO might provide more significant signals about the company’s future than those made by junior executives or board members;

- Overlooking the size and frequency of trades: A single trade may not be as impactful as consistent patterns of buying or selling over time. Large-volume trades often reveal greater confidence or concern compared to smaller, routine transactions;

- Failing to analyze external factors: Insider trades don’t happen in a vacuum. Broader market trends, industry performance, and economic conditions can influence insider activity. For instance, a company might experience insider buying due to a general uptick in its industry, not necessarily due to internal developments;

- Neglecting insider ownership levels: Understanding an insider’s overall stake in the company can provide critical context. If an insider already owns a significant percentage of shares, additional purchases may not carry as much weight.

The bottom line

To summarize, using a stock trading tracker can give you an edge in the market. By monitoring insider trades, you can potentially gain valuable insights into the confidence levels of those closest to the company. Furthermore, specialized tools like our go-to option, Finbold Signals, make all this more simple and effective.

Take advantage of this resource today and start making better-informed trading decisions.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs on how to use an insider stock trading tracker

What is an insider stock trading tracker?

A stock trading tracker is a tool that monitors insider trades, such as buying or selling of shares by executives or major shareholders, and provides real-time data for investors.

Why should I use a stock trading tracker?

A tracker can help you stay informed about insider trading activities, identify trends, and make more data-driven investment decisions.

Are insider trades a reliable trading signal?

No, not always. While insider buying often signals confidence, selling could be due to personal reasons, such as financial planning or diversification. Tools like a tracker help you analyze trends over time.

What is a 10b5-1 plan?

A 10b5-1 plan is a pre-arranged schedule for insiders to buy or sell shares, ensuring trades occur regardless of insider knowledge to avoid accusations of illegal trading.

Are all insider trades legal?

Legal insider trades must be reported to regulatory authorities like the SEC. Illegal insider trading involves using confidential information for personal gain and is prohibited.