Most of us view financial contributions to elections as grassroots support reflecting people’s opinions. However, a trend is on the rise of anonymous agents using ‘dark money’ to influence electoral outcomes without leaving any trace of their identity. Today, we will explore dark money, how it steers American politics, and show you examples of its effect on previous electoral cycles.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

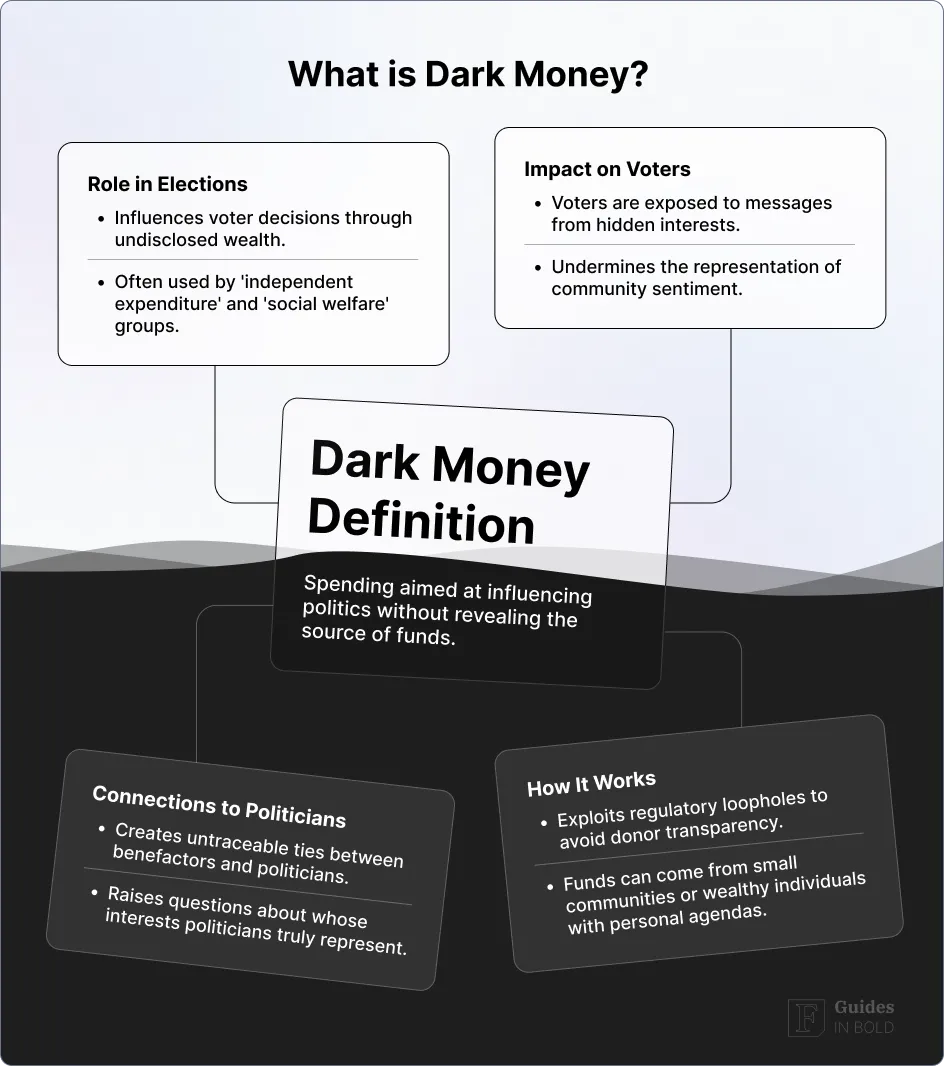

What is dark money?

Dark money definition

Dark money can have a substantial role in elections, primarily via ‘independent expenditure’ and ‘social welfare’ groups. It can make the typical voter susceptible to political messages from wealthy undisclosed groups or individuals rather than the broader sentiment of their respective community.

Furthermore, with dark money in play, the public is unaware of the potential connections between benefactors and politicians. If (or when) the time comes for the ‘favors’ to be paid back, voters won’t know whose interests their elected representatives will actually represent.

How does dark money work?

In the United States, as well as in other developed democracies, transparency has become the standard for governing public affairs, including financing elections. Both state and federal governments have implemented regulations to foster electoral honesty and transparency. These notably include disclosing the identities of donors and contributors to political parties and candidates.

That said, there are exceptional cases, regulatory ‘loopholes,’ and deliberately deceptive tactics that provide evasive individuals with means to withhold their identities, paving the way for discrete influence in politics, or dark money.

This way, the millions of dollars worth of contributions may come from communities of passionate supporters or a single billionaire intent on furthering their individual interests.

Crossroads GPS: A case study of dark money influence

A frequently cited controversial case of dark money influencing politics occurred in 2010, when the practice first gained traction in U.S. politics.

In the 2010 elections, Crossroads Grassroots Policy Strategies (Crossroads GPS), a nonprofit 501(c)(4) organization founded by two Republican strategists, spent tens of millions of dollars on ads attacking Democratic candidates and became the top spender in political advertising in Senate races.

As a ‘social welfare’ organization, Crossroads GPS was not obliged to disclose its donors. According to the Sunlight Foundation, donor anonymity was vital to the fundraising strategy.

Crossroads GPS heavily influenced the 2010 elections, helping Republicans win disproportionately more seats in Congress.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

Campaign finance in the U.S.

Not every political spending is dark money. The most straightforward or traditional political spending comes with full donor disclosure and contribution limits. Furthermore, it allows organizations to coordinate their actions to help a candidate. The most common groups include political parties, candidate committees, and traditional Political Action Committees (PACs).

Independent or non-coordinated spending refers to spending made by groups other than candidate campaigns (‘outside’ spending). These groups can accept unlimited contributions from individuals or organizations and are allowed to engage in a number of political activities, like buying ads or running phone banks. However, they are not allowed to coordinate their actions with political parties or candidates.

This ‘outside’ spending provides the framework for dark money activities, as some outside groups are not required to disclose the identity of their donors or do not need to disclose it in a meaningful timeframe.

In fact, the gap in legislation is getting wider each electoral cycle: according to OpenSecrets, there’s more dark money and less disclosure than ever before.

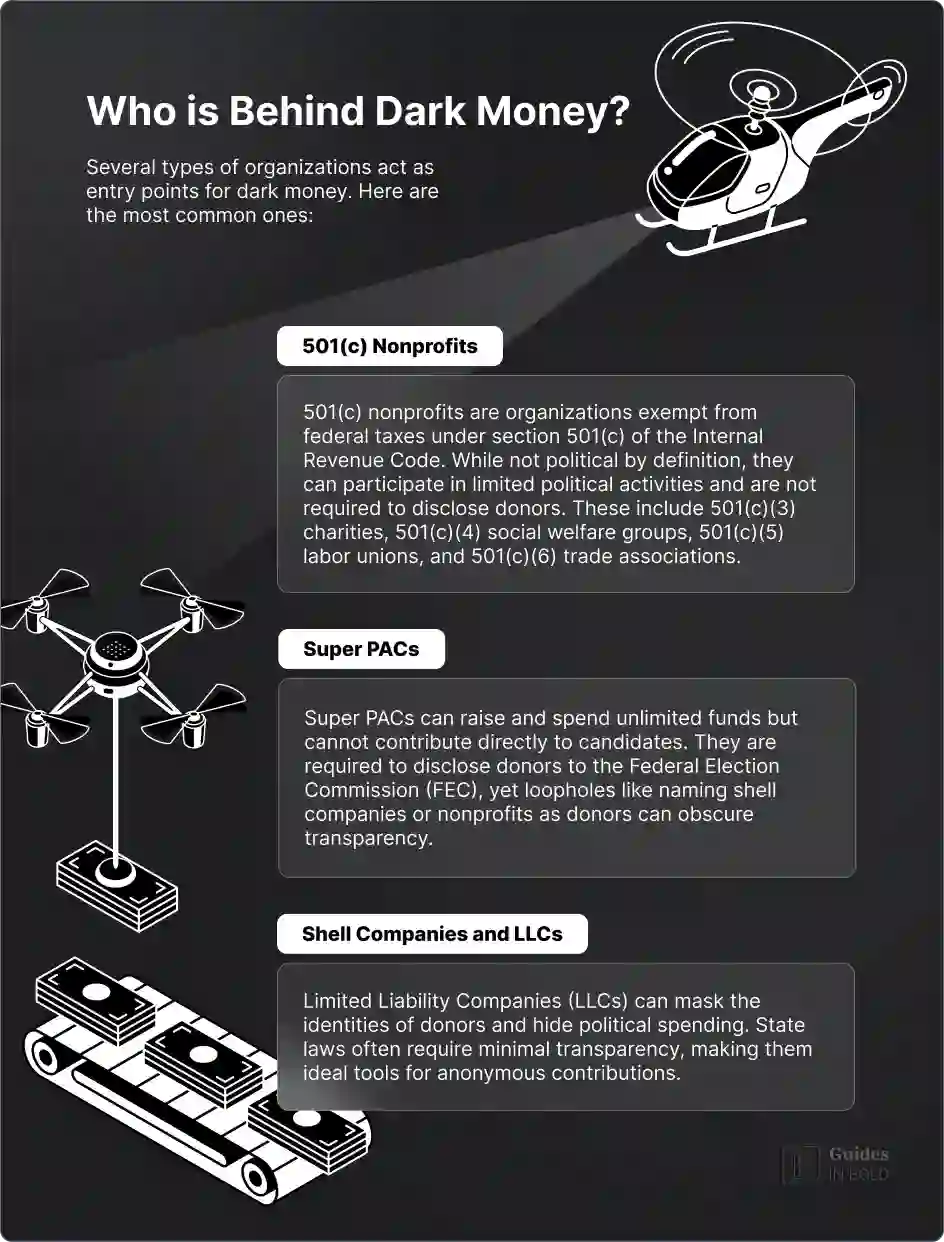

Who is behind dark money?

Any money spent in an election to influence voters’ decisions without disclosing the actual source of the money is dark money. Several types of organizations represent entry points to dark money, the most common of which we’ll discuss in this article.

501(c) nonprofits

What are 501(c) nonprofits?

When they engage in political activities, they are bound to the rules of ‘outside’ spending: while they can receive unlimited funds, they are prohibited from coordinated spending with political parties or candidates.

As nonprofits are nominally non-political organizations, they are not required to disclose their donors to the public.

Types of 501(c) nonprofits

- 501(c)(3). These nonprofits are organized for religious, charitable, educational, or scientific purposes. Commonly known groups include the American Red Cross and NAACP. They are not supposed to engage in political activities, but they are allowed limited registration activities. Donations are tax-deductible;

- 501(c)(4). These nonprofits are commonly known as ‘social welfare’ organizations. They are permitted to do political activities as long as they are ‘not their primary purpose.’ As the IRS did not define ‘primary’ in this context, this limitation is easily bypassed, and 501(c)(4) groups are the most frequent gateway for dark money. Commonly known groups of this type include the National Rifle Association and Planned Parenthood;

- 501(c)(5). These nonprofit organizations are defined as labor and agricultural groups and are mainly funded by union employee membership dues. They have the same limitations as the 501(c)(4) groups. Some commonly known organizations of this type include the American Federation of Labor and Congress of Industrial Organizations (AFL-CIO) and the National Farmers Union (NFU);

- 501(c)(6). Business and trade associations, chambers of commerce, and real estate boards represent types of these organizations. The most common example is the U.S. Chamber of Commerce. The same limitations as in the previous two types are applied to these nonprofits.

Super PACs

Independent expenditure committees, commonly called super PACs, can also collect and spend unlimited funds. However, the outside spending limitations are applied: they cannot directly contribute to candidate campaigns.

Another way for super PACs to dodge this requirement is to form just before the elections, which allows them to disclose their donors only after voters go to the polls (so-called ‘pop-up super PACs’).

While super PACs are prohibited from coordinating with political candidate’s campaigns, they are frequently operated by the candidate’s associate or a former campaign assistant.

Shell companies and LLCs

While limited liability companies (LLCs) mainly exist for business, their structure can be abused to disguise donors and cover the tracks of political spending.

State laws govern LLC transparency, which is generally minimal. For example, states like Delaware and New Mexico do not require the disclosure of even the names of owners and managers.

| 501(c) nonprofits | Super PACs | |

| Regulatory body | IRS | FEC |

| Disclosure of contributors | Not required | Required |

| Disclosure of expenditures | Yes, only via IRS tax filings through Form 990s(typically delayed by over a year) | Yes, via FEC fillings and sometimes IRS tax filings(typically delayed by over a year) |

| Limits on contributions | None | None |

| Political purpose | Must be ‘primarily’ non-political | Fully political |

| Coordination with candidate campaigns | Prohibited | Prohibited |

Controversy and call for transparency

Disclosure of donors, campaign expenditures, and contributions is meant to prevent corruption. Clear ties between politicians and their benefactors allow the public to check whether their elected officials align their actions with their words according to the needs of their respective constituents.

That said, the FEC has proven unable to control dark money, especially after the U.S. Supreme Court’s ruling in Citizens United v. Federal Election Commission in 2010 struck down financial contribution limitations. Furthermore, the IRS, responsible for the 501(c) groups, also failed to curtail nonprofit spending, especially after the 2013 controversy in which it was accused of illegal targeting.

Many have turned to the SEC because the FEC and IRS failed to control non-public political contributions. In August 2011, academics from various universities petitioned the SEC to require public companies to disclose to shareholders the use of company resources for political activities. Although the proposal enjoyed widespread congressional support, pressure from the Republican Party ensured that no bill prevented the occurrence of dark money.

As of today, no legislation prevents donor anonymity, which is crucial for fostering the influence of dark money.

U.S. election outside spending 2024

Outside spending clears the path for dark money spending. Although companies and organizations are not required to disclose the identities of their donors, they still have to report outside political expenditures to the FEC. According to OpenSecrets, the total dollar value of outside political spending in the 2024 elections amounted to $4,478,930,584, which is almost $4.48 billion.

| Type of organization | Total Spent | Number of registered | Number of spending |

| Super PACs | $2,728,202,953 | 2,459 | 598 |

| Other (corporations, individual people, other groups, etc.) | $1,493,751,495 | 1,223 | 301 |

| Parties | $191,276,080 | 165 | 26 |

| Social Welfare 501(c)(4) | $47,033,588 | – | 118 |

| Unions 501(c)(5) | $15,965,069 | – | 12 |

| Trade Assns 501(c)(6) | $2,701,399 | – | 8 |

| Grand Total | $4,478,930,584 | 4,029 | 1063 |

Additionally, this nonprofit aiming for open government also tracks the amount of outside funding from electoral cycle to electoral cycle. Here are the results:

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

The bottom line

To sum up, dark money in politics represents all funds that have undisclosed or non-public sources. Their influence on elections since 2010 is significant and growing, with the risk of politicians owing ‘favors’ to benefactors the public cannot identify going greater by the cycle.

While proponents of dark money argue that the First Amendment protects the right to donor privacy, critics say it is a backdoor to corruption and a stain on the transparency of the public exercise of democracy.

As of writing, no legislation prevents super PACs and 501(c) nonprofit organizations from withholding the names of financial contributors for their political activity.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about dark money in politics

What is dark money?

Dark money is financial spending with the goal of influencing political outcomes, such as elections and public policy, without disclosing the source of the money to the public.

What is dark money in politics?

Any money spent in an election to influence voters’ decisions without disclosing the actual source of the money is dark money. Two common types of organizations harbor dark money activity: super PACs and 501(c) nonprofits.

Are political donations public record?

Hard money political donations (or traditional political donations) are publicly disclosed. Outside political donations, the primary source of dark money can withhold certain parts of information, notably including the names of donors.

Who are the top 3 dark money donors?

Dark money donors have their identities withheld, so we do not know who they are. The top three outside spending donors in the 2024 elections, which may serve as access points for dark money, are the Senate Leadership Fund, Congressional Leadership Fund, and Senate Majority PAC.

Is dark money illegal?

Although controversial, dark money is not illegal.

How does dark money influence elections?

As dark money, millions of dollars worth of contributions may come from a single billionaire intent on furthering their individual interests rather than from communities of passionate supporters. During elections, dark money can steer the outcome toward the goals of rich anonymous individuals rather than the broad group of workers.

How much can an individual donate to a PAC?

Individuals are limited to a total of $5,000 per year in donations to traditional PACs. Super PACs allow unlimited fund-raising but prohibit direct donations to candidates or parties.

How much money can a private citizen donate to a political campaign?

Private citizens donating to a candidate committee are limited to $3,300 per election as of 2024.

How much money is spent on political campaigns each year?

Billions of dollars are spent on political campaigns each year. In the 2024 elections, a total of $15,901,068,285 was spent.

How did dark money affect the 2024 elections?

In the 2024 elections, up to $4.48 billion of spending came from organizations that could have withheld the names of donors, either via shell companies or by not being required by law to do so. It is not publicly known whose interests will be represented when the time comes for the elected officials to ‘return the favor.’