Recent developments in Nvidia‘s (NASDAQ: NVDA) stock performance have prompted questions about whether the company has reached its peak.

Despite a remarkable 76% surge year-to-date, concerns loom regarding the sustainability of this growth trajectory.

Analysts at KeyBanc maintained an overweight (buy) rating on the shares but raised the price target from $1,100 to $1,200. The new price target represents a potential upside of nearly 38% over the next 12 months, compared to the current price

These uncertainties have led to discussions about whether Nvidia has topped out, signaling a potential shift in its stock dynamics.

Nvidia price analysis

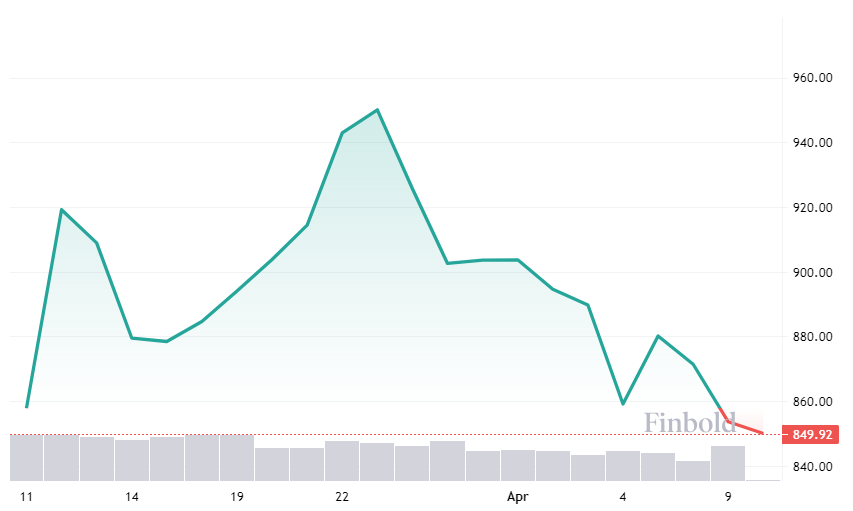

Nvidia’s stock price has been on a notable downward trajectory since reaching its peak value of $950.02 on March 25.

Currently, the stock is experiencing a significant decrease of -10.15% from its highest point. As of press time, Nvidia’s shares are priced at $853.54, reflecting a daily loss of -1.35%.

However, perhaps more concerning is the recent trend, with a decrease of -5.02% over the past five days.

Although the past month has seen a more modest decline of -0.97%, the recent performance suggests a potential shift in investor sentiment or market dynamics.

NVDA’s challenges

Nvidia faces several challenges that could potentially lead to a decline in its stock price. One major concern is the looming threat of diminishing dominance in the artificial intelligence (AI) hardware market.

Historically, Nvidia has held a dominant position in supplying hardware and software for high-powered computing needs driven by the proliferation of AI applications.

However, D.A. Davidson analyst Gil Luria said to BNN Bloomberg:

“A lot of its big customers … are stocking up on its GPU products,” Luria stated, pointing to Nvidia’s biggest AI chip buyers, like Microsoft (NASDAQ: MSFT) and Amazon (NASDAQ: AMZN). “But as they get to the capacity that they need to have, they’re not going to keep buying this for years to come, which is what current Nvidia estimates imply.”

This potential shift could result in reduced demand for Nvidia’s products and lead to a significant cyclical downturn by 2026, according to Luria’s analysis.

As a result, D.A. Davidson expects Nvidia shares to potentially drop to $620 per share, representing a decline of nearly 30% from recent closing prices.

While Nvidia is not solely reliant on its AI chip business and has revenue streams from segments like autonomous driving technologies, the prospect of increased competition and reduced demand in its core market poses a significant challenge to the company’s future growth prospects.

Buying opportunity or looming decline?

Has Nvidia’s stock price peaked? It’s difficult to say. The recent downward trend and analyst predictions of a potential cyclical downturn raise concerns.

However, Nvidia’s strong overall technical rating, dominance in data centers, and robust pipeline of new technologies suggest long-term potential.

For short-term investors, waiting for a period of consolidation might be prudent. Long-term investors, however, may find the current price point an attractive entry opportunity despite the headwinds.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.