The shares of Hims & Hers Health (NYSE: HIMS), a direct-to-consumer telehealth company, have surged by more than 40% since the release of its Q4 earnings report and more than 50% since the start of the year.

Despite being relatively unknown with a $2 billion valuation, the company has caught the interest of investors due to its impressive growth and improving financial performance.

It might feel like a missed opportunity when news emerges of a stock already gaining momentum. However, there’s always potential for new opportunities, as HIMS still offers a reasonable valuation and entry point.

Strong performance since the IPO

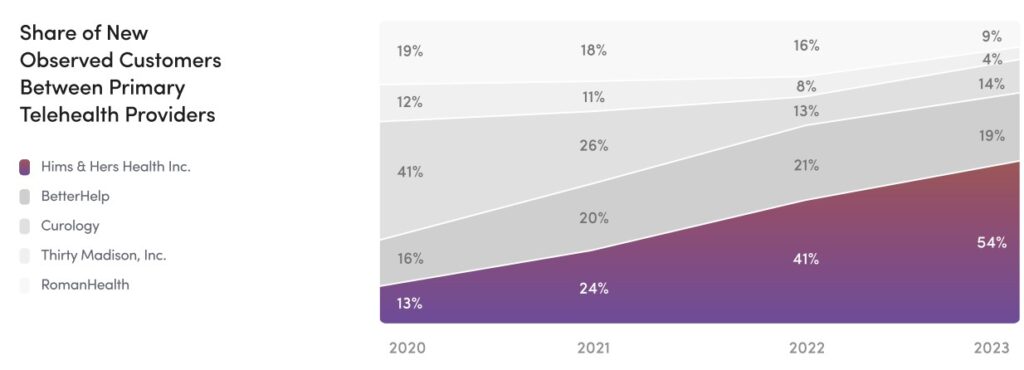

Since its IPO in 2021, Hims & Hers has consistently demonstrated robust growth. Over the past three years, the company has nearly tripled its subscriber base to over 1.5 million, accompanied by impressive revenue growth. While Hims & Hers needs to maintain its execution, substantial evidence suggests that HIMS is on the right track, which could drive significant long-term expansion.

Considering healthcare’s broad appeal, every adult represents a potential customer, and Hims & Hers’ current 1.5 million patient base is just a fraction of the US population alone. Management estimates that each specialty focus represents a market of between 80 million to 100 million US adults.

There is still room for growth of HIMS

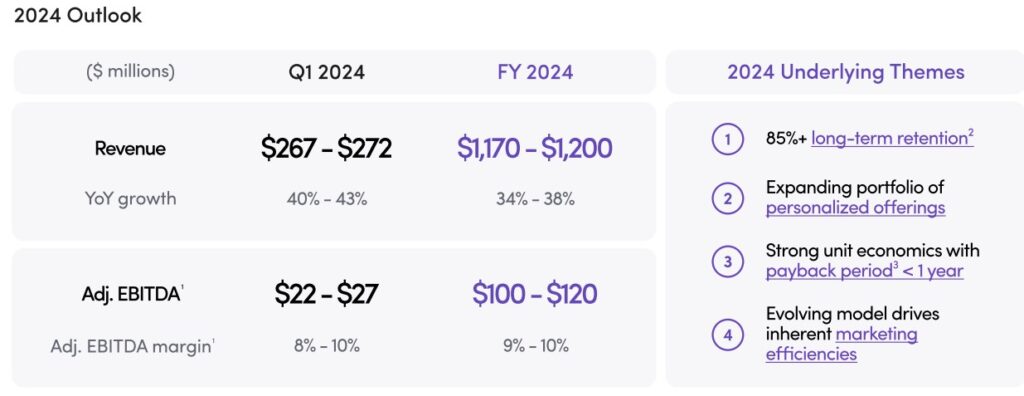

Despite its recent surge, the stock trades at about 35 times its projected 2024 earnings. With management expecting a 38% revenue increase this year and the company’s strong performance in 2023 surpassing initial forecasts, there’s a possibility of conservative estimates.

Additionally, next year’s earnings per share estimate of $0.50, reflecting a 31% increase, may undervalue Hims & Hers’ operational efficiency.

Given the current earnings growth rate and P/E ratio, the stock appears undervalued, with the potential for further outperformance, potentially offering a great option for long-term investment.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.