The Federal Open Market Committee (FOMC) will meet on Wednesday, September 18, for what can be the first interest rate cut decision in years. This decision will potentially affect finance markets and leading assets like Bitcoin (BTC), requiring a trading plan for the week.

On that note, CrypNuevo shared his Bitcoin trading plan for this week and commented on what he expects to happen. In summary, the analyst believes BTC will trade in a range close to Bitcoin’s current price before the meeting.

“I’m leaning towards the idea of price forming a range here with a few deviations/traps until then. Let me explain why I think we could see a spike to $61.6k ish before dropping later on the week.”

– CrypNuevo

We can see the projected deviations and a run to $61,600 before what could be a major crash next.

Bitcoin (BTC) trading plan and price analysis

Overall, the trading expert believes this week will target two high-liquidity zones, liquidating both long and short-position BTC traders. However, Bitcoin spot orderbooks currently point to higher liquidity to the upside, which could be the first direction.

CrypNuevo forecasts a rally to as high as $61,600 that can increase downside potential liquidations for the following move. As of this writing, the bearish target is at $56,600, slightly below price support.

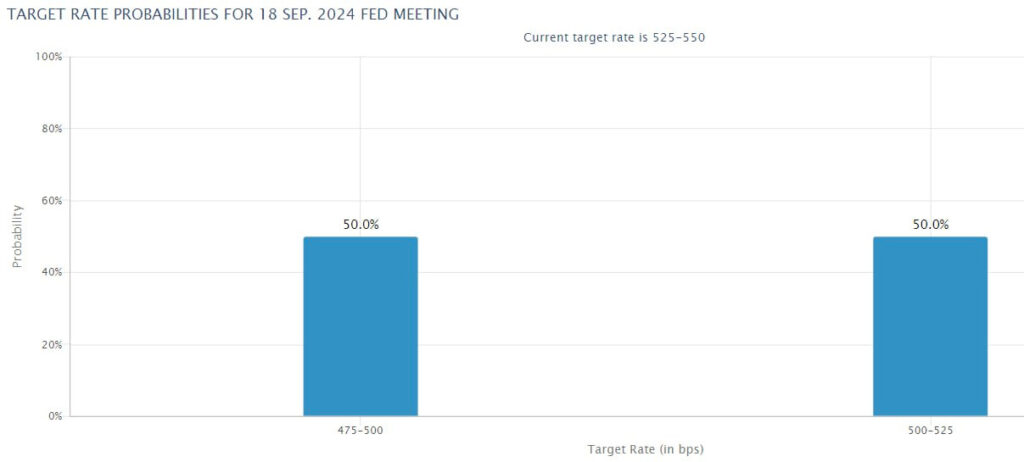

In short, the analyst forecasts a 25 basis point (bps) interest rate cut, fueling the price to the first target. Then, a cautious tone in Jerome Powell’s speech would make Bitcoin crash to the next level.

“So ideally, I’d like to see price ranging overall, with a push to that area between $61350-$61.6k before or during FOMC. Then after 25bps (most likely imo) are announced, Powell could be a bit hawkish and careful in his speech, and markets disappointed… triggering a reversal.”

– CrypNuevo

FOMC’s interest rate cut decision and Bitcoin

Interestingly, the expert pointed out a 50% chance of either a 25 bps or a 50 bps interest rate cut. In his opinion, the latter could be seen as bearish news by the market – potentially indicating a recession.

Nevertheless, an interest rate cut weakens the dollar and favors risk-on assets like Bitcoin.

Other technical analysts have also shown a bearish bias despite what retail primarily sees as a bullish week. Namely, Credible Crypto and Alan Santana predict that Bitcoin could drop further before bouncing back to an uptrend – Finbold reported.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.