Inflationary pressures have once again come under the spotlight as the U.S. released its latest Producer Price Index (PPI) data on October 11, 2024, for the month of September.

According to the latest data from the Labor Department, the PPI remained flat on a month-over-month basis, defying expectations of a 0.1% increase. However, on a year-over-year basis, PPI rose by 1.8%, slightly exceeding the forecast of 1.6%.

Similarly, the U.S. Consumer Price Index (CPI) data showed that inflation remains sticky. On a monthly basis, CPI came in at 0.2%, the same as in August and July. Year-over-year inflation cooled slightly to 2.4%, down from 2.5% in August, but above the market expectation of 2.3%.

“The index for final demand less foods, energy, and trade services inched up 0.1 percent in

September after rising 0.2 percent in August. For the 12 months ended in September, prices for

final demand less foods, energy, and trade services increased 3.2 percent.”-U.S. Bureau of Labor Statistics

With both CPI and PPI data indicating a resurgence in inflation, speculation is building over how the Federal Reserve will respond and, crucially, how Bitcoin (BTC) will react to the growing inflationary threat.

Treasury yields and Dollar response

Following the release of the inflation data, U.S. Treasury yields fell, with the two-year yield sliding to 3.96% and the 10-year yield dropping to 4.09%. The U.S. Dollar Index also dipped, briefly falling below the 102.80 mark.

The rise in Core CPI for the first time in 18 months could mark a shift in the Federal Reserve’s strategy. The Kobeissi Letter echoed this sentiment in an October 11 post, highlighting that inflationary pressures are gaining traction, particularly with PPI rising for the first time since June.

Bitcoin’s reaction to rising inflation data

Bitcoin is currently trading around $62,000, but the latest inflation data could introduce significant volatility. Should the Federal Reserve tighten monetary policy in response to inflation, liquidity could be pulled from the market, potentially causing a short-term dip in Bitcoin’s price.

A drop below the key psychological support level of $60,000 could be imminent if the Fed signals a more hawkish stance at its next meeting.

Despite the potential for short-term dips, Bitcoin’s long-term outlook as a hedge against inflation remains strong. Rising inflation could push more investors to view Bitcoin as a store of value, protecting against the devaluation of traditional currencies.

Short-term dip: Inflation could trigger a sell-off

As inflation rises, the Federal Reserve may adopt a more hawkish tone, possibly slowing or pausing rate cuts to manage inflationary pressures. This could reduce liquidity in financial markets, leading to a sell-off in riskier assets, including Bitcoin.

Currently, Bitcoin is trading at approximately $62,216, with a 24-hour increase of 2.5%. While this suggests some stability, broader market sentiment remains cautious following the release of the latest inflation figures.

What’s next for Bitcoin?

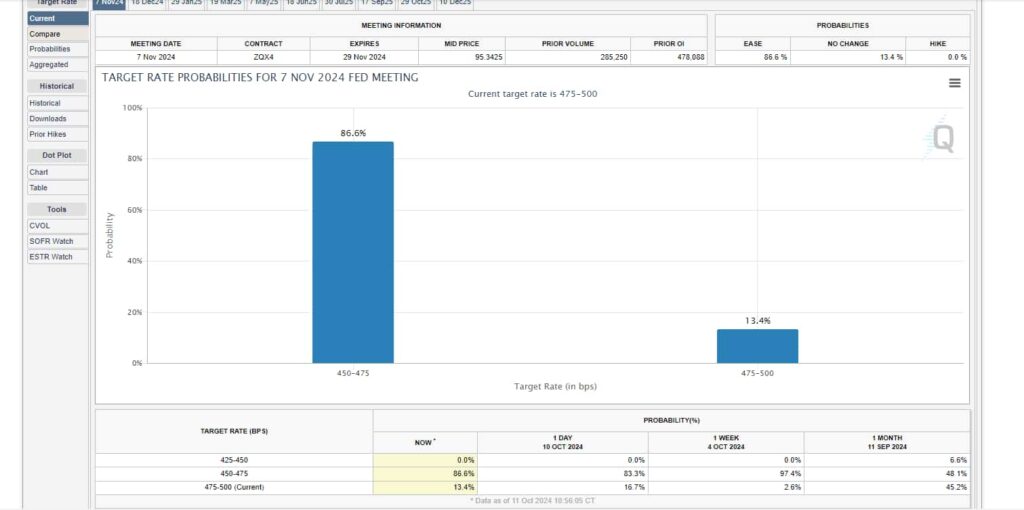

As inflation continues to rise, investors are wondering whether the Fed will pause or slow its rate cuts. The CME Group’s FedWatch Tool shows an 84% probability of a 0.25% rate cut in November, but as inflation remains elevated, the likelihood of rates staying unchanged is growing.

For now, Bitcoin’s price has held steady, but investors should remain alert to potential market shifts as the Federal Reserve’s response will likely dictate Bitcoin’s short-term trajectory. If the Fed adopts a more hawkish stance, Bitcoin could face downward pressure, potentially testing key support levels.

Finbold has offered a detailed technical analysis and AI-driven prediction for Bitcoin’s year-end price, incorporating insights from leading analysts.

The analysis highlights potential downside risks for Bitcoin, indicating that the cryptocurrency could face significant pressure in the coming months. This aligns with the broader analysis emphasizing the need for caution as inflation continues to affect the market and Bitcoin’s trajectory.

In conclusion, rising CPI and PPI inflation data are creating a precarious situation for Bitcoin. While the cryptocurrency could experience short-term volatility if the Federal Reserve tightens monetary policy, its long-term appeal as a hedge against inflation remains intact, attracting investors concerned about inflationary risks.