After subsequent sessions of sideways trading, Bitcoin (BTC) bears appear to be gaining momentum over the maiden cryptocurrency.

As of press time, Bitcoin had lost the $67,000 support zone in the last 24 hours, dropping as low as $65,000. Attention is now focused on the next price movement, with Bitcoin analyst CryptoCon noting in an X post on June 14 that investors should anticipate further corrections in the coming days.

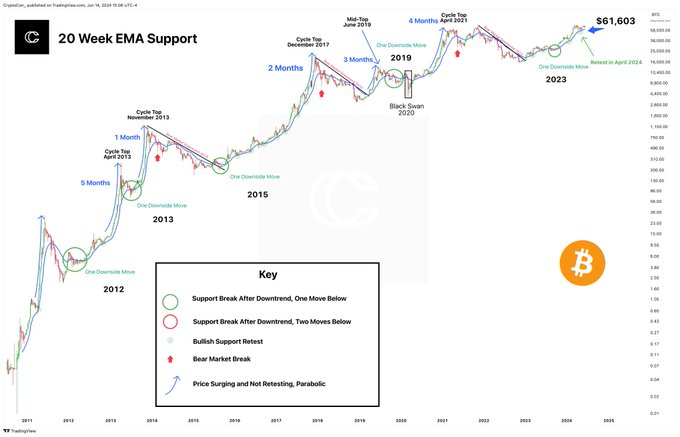

According to CryptoCon’s analysis, a critical support level that could heavily influence market direction has emerged at the 20-week exponential moving average (EMA), currently at $61,603. The analyst highlighted that the situation is now a ‘waiting game’ to observe Bitcoin’s next move.

“The number to watch: $61,603 according to the most reliable healthy support, the 20-week EMA. <…> It’s just a waiting game,” the expert said.

Historical impact of 20-week EMA

The 20-week EMA has historically been a reliable support level across various market cycles. For example, Bitcoin saw rapid growth during the early bull run of 2012-2013, using the 20-week EMA as a launching pad for higher prices. A notable retest of the EMA in April 2013 preceded another substantial price surge.

Conversely, bear market phases such as those in 2014-2015 and 2018-2019 witnessed Bitcoin breaking below the 20-week EMA, signaling prolonged downturns. For instance, in late 2018, Bitcoin’s decline below the EMA led to an extended bearish period until it regained support in early 2019.

In contrast, the sudden market crash triggered by the COVID-19 pandemic in 2020 briefly pushed Bitcoin below the EMA.

Breaking down Bitcoin’s sudden drop

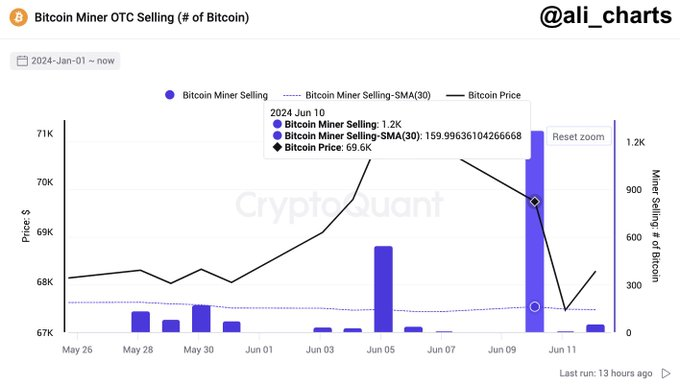

Elsewhere, several theories have been proposed to explain the sharp drop in Bitcoin, which plummeted to as low as $65,000. For instance, cryptocurrency analyst Ali Martinez suggested in a post on June 15 that recent activities by miners may have contributed to the decline. Martizenz noted that miners sold over 1,200 Bitcoins, valued at more than $79.20 million, which added to the downward pressure.

On the other hand, crypto trading expert Michaël van de Poppe pointed out that Bitcoin and the broader crypto market have been affected by a combination of hawkish signals from the Federal Reserve, a strong dollar, and regulatory uncertainties.

Despite current price consolidation, overall sentiment appears cautious yet optimistic. This is supported by data from Martinez indicating that investors are buying during the dip. Specifically, on the HTX crypto exchange, the Bitcoin Taker Buy Sell Ratio spiked to 545, signaling bullish sentiment toward the leading cryptocurrency.

Meanwhile, Bitcoin is striving to sustain its price above $66,000 and target $67,000. As of press time, Bitcoin was trading at $66,210, reflecting a 24-hour correction of over 1%. On the weekly chart, it remains in the red with a nearly 5% loss.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.