Warren Buffett, the ‘Oracle of Omaha,’ has built a legacy as one of the most successful investors of all time, with Berkshire Hathaway (NYSE: BRK.A, BRK.B) consistently outperforming the market. His investment strategy, rooted in value investing, favors businesses with durable economic moats and long-term profitability.

Throughout 2024, Buffett and Berkshire Hathaway were net sellers, trimming key positions while amassing a record $334 billion cash reserve, even as they made some new bets.

Among the stocks in the legendary investor’s portfolio, three stand out as his clear favorites—Apple (NASDAQ: AAPL), Bank of America (NYSE: BAC), and American Express (NYSE: AXP).

Together, these companies account for 56.15% of Berkshire’s $272 billion portfolio, further validating Buffett’s long-term conviction in their value.

With the market showing mixed signals in early 2025, here’s how an investment in Buffett’s top picks at the start of the year would have performed so far.

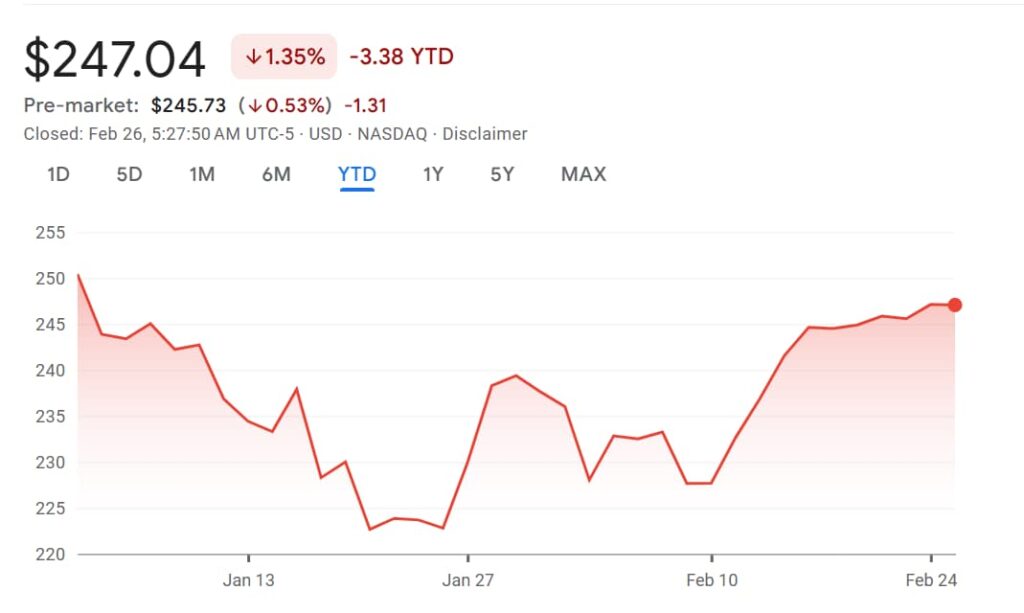

Apple (NASDAQ: AAPL)

Apple remains one of Warren Buffett’s most notable investments, both for its prominence in the global market and its weight in Berkshire Hathaway’s portfolio. After reducing its stake in previous quarters, Buffett held firm in Q4 2024, maintaining around 300 million shares valued at approximately $74.1 billion.

As of February 25, 2025, Apple stock trades at $247, reflecting a 1.35% decline year-to-date. Investors who put $1,000 into AAPL at the start of 2025 would now be sitting at $986.60.

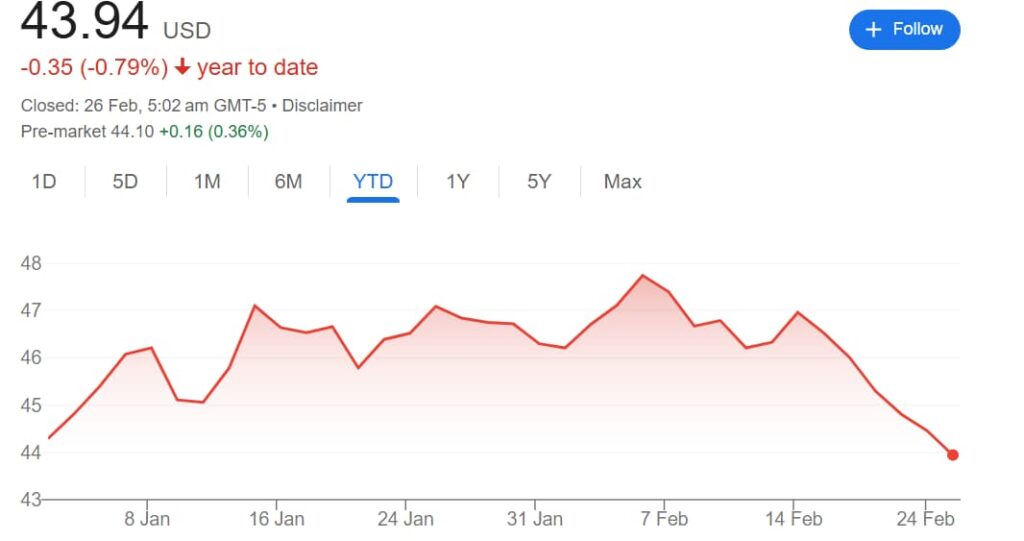

Bank of America (NYSE: BAC)

Buffett’s stance on Bank of America has shifted, with Berkshire steadily reducing its stake over the past year.

In Q4 2024, Berkshire trimmed another 14% of its BAC holdings, extending its two-quarter selloff to 23.7%. This selling spree, which began in mid-July 2024, lowered Buffett’s ownership below the 10% threshold. Still, Bank of America remains Berkshire’s third-largest equity holding, accounting for 11% of its portfolio.

As of the market close on February 25, BAC stock trades at $43.94, down 0.79% year-to-date. A $1,000 investment at the start of the year would now be worth approximately $992.10.

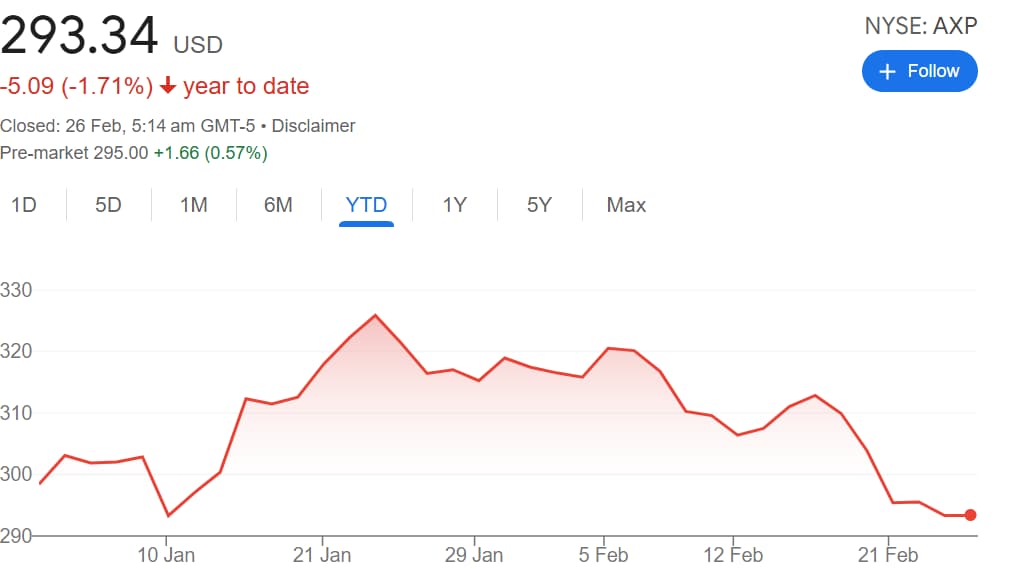

American Express (NYSE: AXP)

Warren Buffett’s longstanding relationship with American Express dates back to the 1960s when he first acquired shares during a corporate crisis.

In 1991, Berkshire Hathaway invested $300 million in preferred securities from American Express, which were later convertible to common stock. This set the stage for decades of additional purchases.

Today, Berkshire’s stake in American Express is valued at over $44.5 billion, representing 16.84% of its overall portfolio.

American Express closed the latest trading session at $293.34, with a year-to-date decline of 1.71%. A $1,000 investment at the start of 2025 would now be worth approximately $982.90.

For traders and investors assessing Buffett’s core holdings, a hypothetical $1,000 investment evenly split across Apple, Bank of America, and American Express at the start of 2025 would currently be valued at $987, reflecting a 1.28% loss year-to-date.

While these declines may appear bearish, they reflect broader market headwinds rather than fundamental weaknesses in these companies.

Featured image via Shutterstock