Late on Wednesday, December 10, Elon Musk seemingly confirmed in a social media post that a SpaceX stock IPO would be coming soon. Responding to Ars Technica editor Eric Berger, who shared his thoughts about the aerospace giant going public on X, the world’s richest man simply stated:

“As usual, Eric is accurate.”

As usual, Eric is accurate

— Elon Musk (@elonmusk) December 10, 2025

Unsurprisingly, the laconic remark sent waves of enthusiasm across the market, as a SpaceX IPO would most certainly be among the most, if not the most, consequential market events in 2026. After all, Musk had already floated the idea of a $1.5 trillion SpaceX valuation, which would double his fortune.

Considering the quickly evolving market dynamics and Musk’s generally dismissive tone when it comes to rumors regarding potential insider prices and external valuation estimates, it is virtually impossible to determine the exact figure at which SpaceX shares would change hands day one.

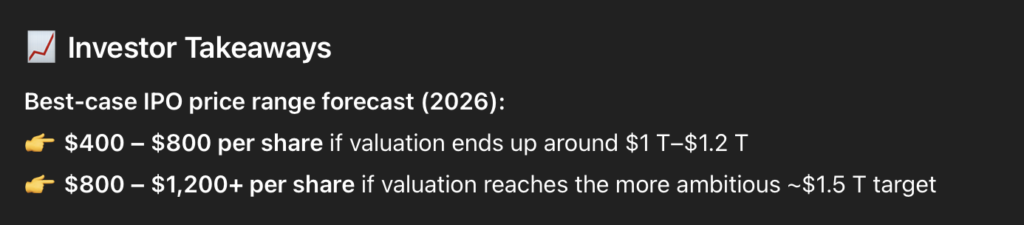

Nonetheless, Finbold took to OpenAI’s leading chatbot, ChatGPT-5, with inquiries regarding a potential SpaceX stock price during an initial public offering next year based on some of the statistics available at this point. In response, the artificial intelligence (AI) algorithm suggested a wide price range between $400 and $1200 or more, depending on the final number of shares outstanding and, more importantly, valuation.

SpaceX stock price prediction

Calculating potential SpaceX share prices on their first day of trading, the AI first noted that a public-offering valuation in the range of $1 trillion to $1.5 trillion would be one of the biggest tech debuts of the past decade.

That target is well above the roughly $800 billion private valuation implied by recent insider share sales, which priced SpaceX stock at approximately $420, a figure Musk has since dismissed as inaccurate.

“There has been a lot of press claiming SpaceX is raising money at $800B, which is not accurate.”

There has been a lot of press claiming @SpaceX is raising money at $800B, which is not accurate.

— Elon Musk (@elonmusk) December 6, 2025

SpaceX has been cash flow positive for many years and does periodic stock buybacks twice a year to provide liquidity for employees and investors.

Valuation increments are a…

SpaceX is expected to generate about $15 billion in revenue in 2025 and potentially $22–24 billion in 2026, driven largely by the rapid global expansion of its Starlink satellite-internet service. This, the chatbot argued, could justify a premium valuation if the company successfully files for an S-1 next year.

Should the space company meet these expectations, a $1 trillion–$1.2 trillion offering could be likely, implying a price of $400–$8000 per SpaceX share. On the other hand, an even more favorable, $1.5 trillion debut could push the pricing well above the $800 mark, potentially above $1,200.

Still, ChatGPT cautioned that the ultimate price will hinge on market sentiment at the time of listing, as well as capital-intensity concerns and appetite for high-cap tech offerings. The latter could very well become a point of contention, now that the tech stock valuation fears are reaching new heights.

Even so, the algorithm appeared quite optimistic, with forecasted prices and market cap being genuinely impressive. With confirmation from the company still pending, though, Wall Street can only wait for what could be the biggest IPO of 2026.

Featured image via Shutterstock