It’s widely known that Microsoft (NASDAQ: MSFT) stock is a top choice for long-term investments, consistently delivering stable returns even during economic challenges.

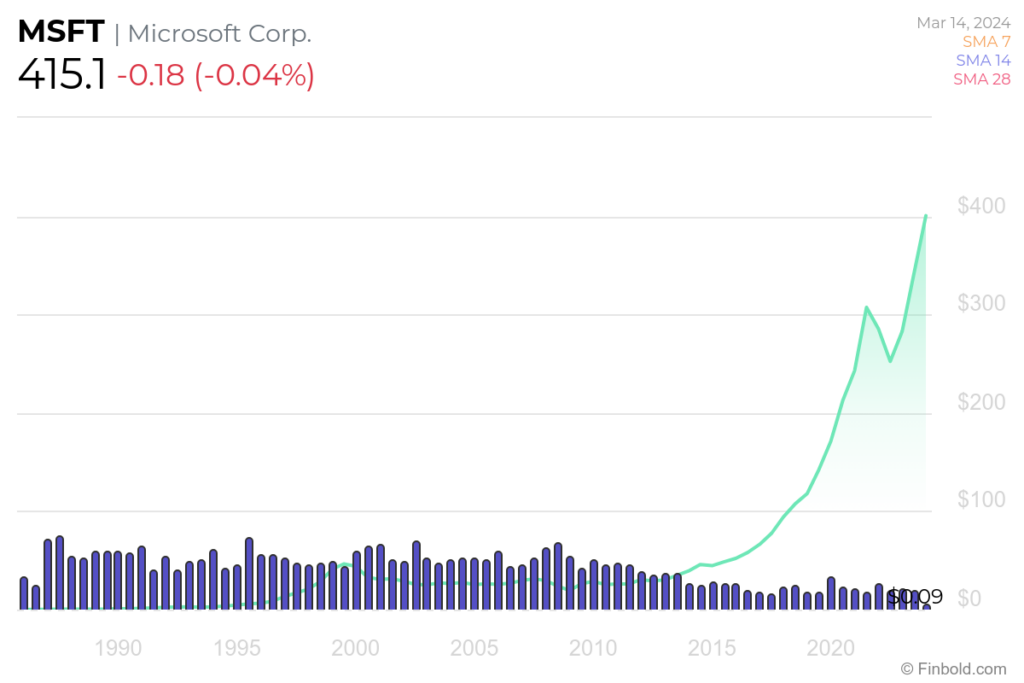

If you were among the early believers in this stock and invested $10,000 at Microsoft’s IPO, you’d be sitting on a substantial fortune today.

Specifically, if you had invested $10,000 in MSFT stock on March 14, 1986, it would have grown to $42.7 million by March 14, 2024. Over 38 years, this represents a remarkable growth of 415,000% by MSFT stock, turning you into a multimillionaire.

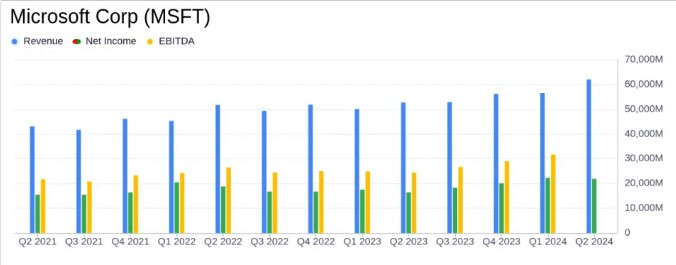

Microsoft financials between the earliest and latest report

Several factors have propelled the growth of MSFT stock, including industry revolutions like the advent of personal computers, the internet, and other technological advancements. These developments have translated into strong financial performance for the company. A comparison between the first quarterly results and the latest ones tells a compelling story of success.

When Microsoft first went public, its inaugural quarter showcased revenue totaling $50.5 million and a net income of $10.6 million.

Fast-forward to the latest quarter, Microsoft’s financial landscape has significantly expanded, with reported revenue soaring to $62 billion and net income reaching $21.87 billion.

March is a notable month for Microsoft

March holds significant milestones in Microsoft’s history beyond its IPO. Notably, in March 2020, Bill Gates stepped down from the board of directors, relinquishing his executive roles within the company. Gates, who had served as founder, CEO, and one of the largest shareholders, marked a significant transition in Microsoft’s leadership landscape.

Gates’ ownership stake in Microsoft has declined substantially from 45% during the company’s IPO in 1986 to just 1.34%, equivalent to 102.99 million shares, per the last ownership disclosure in October 2019. Following his resignation in 2020, Gates ceased publicly reporting his ownership of Microsoft stock.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.