Apart from insider trading, lobbying by major firms in the US industry remains one of the most persistent issues in US politics. Companies lobby to influence politicians and legislation that could benefit their stocks.

The latest quarterly results revealed that companies invested millions to sway US politicians toward more favorable positions.

Quiver Quantitative compiled a list of the industry’s top spenders, and Finbold decided to find out how the top lobbying stock performed over the same period.

The list reveals some well-known firms whose stocks performed impressively over the previous quarters, with some reaching all-time highs.

META stock is the highest spender

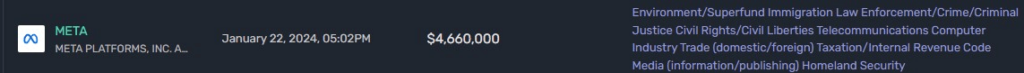

With almost $5 million spent over the latest quarter, Meta (NASDAQ: META) takes first place, and rightfully so. It seems that money spent on lobbying reflected positively on META shares.

Namely, Meta spent significant resources influencing legislators’ opinions on labor, antitrust, and journalism issues over the last quarter.

However, the most significant amount, $4.6 million, went towards issues regarding internet privacy, digital service taxes, and data flows.

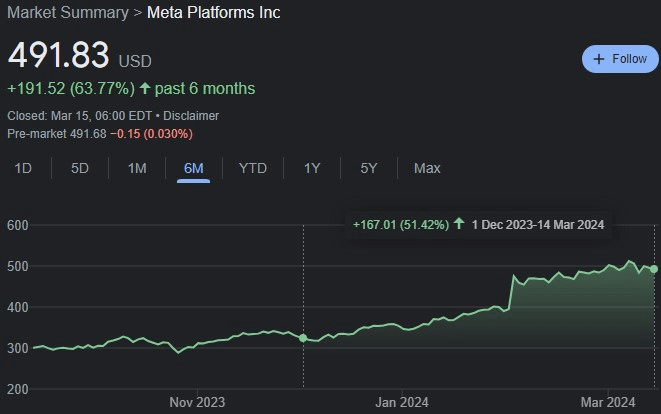

META stock performance over the last quarter

It appears that the lobbying efforts paid off handsomely for META stock, as it recorded remarkable gains over the last quarter, with a valuation increase of over 50%.

During this period, META stock also reached several all-time highs, with the peak occurring on March 7, when META shares reached an unprecedented high of $512.19.

With the news of the House moving to ban TikTok in the US, Meta will continue to dominate the internet social service sector, potentially leading to further gains.

While it’s difficult to confirm, some lobbying resources may also have contributed to this decision.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.