OpenAI’s artificial intelligence (AI) tool, ChatGPT, has identified three key areas where investors considering gold purchases should focus.

The outlook emerges as gold sustains a strong bullish run in 2025, with the precious metal up nearly 30% and trading at $3,395 as of press time.

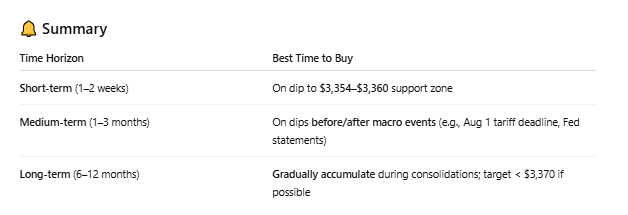

In the short term, ChatGPT noted that gold is trading within a narrow range between $3,354 and $3,387, a consolidation zone that could present a strategic entry point.

Best time to buy gold

It advised investors to watch for pullbacks toward the $3,354 and $3,360 range, especially when supported by bullish indicators, such as candlestick reversals or an RSI reading in the 40 to 45 zone. This area has consistently acted as a technical floor, and a rebound here could push prices toward $3,400 or even $3,450.

However, the AI tool warned against buying above $3,387 unless there’s a clear breakout supported by strong volume and a major catalyst such as a Fed rate cut or rising geopolitical tensions.

Over the medium term, spanning the next one to three months, ChatGPT maintained a bullish outlook for gold. A weakening U.S. dollar, continued central bank purchases, and expected interest rate cuts are likely to drive further gains, particularly as the fourth quarter of 2025 approaches.

The AI tool noted that dips following major events, such as profit-taking after Federal Reserve announcements, could offer attractive buying opportunities. Key dates to watch include the U.S. tariff deadline on August 1 and potential monetary policy signals from the Jackson Hole symposium in late August.

ChatGPT advised gradually building positions during pullbacks to the $3,340 and $3,360 range, particularly ahead of events that typically boost demand for safe-haven assets.

Gold entry for long-term investors

Looking further into late 2025 and 2026, long-term forecasts from institutions like Goldman Sachs and the World Gold Council project gold reaching between $3,700 and $4,000 by mid-2026. ChatGPT recommended using consolidation phases or modest corrections, typically 5% to 8% pullbacks from recent highs, as opportunities to enter or expand long-term positions.

Notably, gold often experiences brief retracements following strong rallies, making these periods favorable for investors with a longer-term outlook.

In summary, ChatGPT’s analysis emphasized disciplined buying, favoring technical or event-driven dips over chasing price surges.

Featured image via Shutterstock