Berkshire Hathaway (NYSE: BRKA, BRKB) announced to the Security and Exchange Commission (SEC) its Q3 report on Tuesday, November 14, which tells an interesting story of new acquisitions, reductions, and exits from holdings.

During this period, BRKA acquired a position in Liberty Live Group (NASDAQ: LLYVA) with 5,051,918 shares, adding up to 0.05% of the portfolio and a total value of $161.26 million.

Another notable new investment is Sirius XM Holdings Inc (NASDAQ: SIRI), with the acquisition of 9,683,224 shares, amounting to 0.01% of the portfolio with a total value of $43.77 million. Atlanta Braves Holdings Inc (NASDAQ: BATRK) represents the final addition with 223,645 shares, valued at $7.99 million.

Exists and reductions in holdings

During the third quarter, Warren Buffett finalized the exit from Activision Blizzard (NASDAQ: ATVI) with the sale of all 14,658,121 shares, impacting the portfolio by -0.35%. Furthermore, General Motors Co (NASDAQ: GM) stock can no longer boast a place in its portfolio, as all of its 22,000,000 shares were sold, resulting in a -0.24% decrease.

Additionally, Procter & Gamble (NYSE: PG), which had $848 million in shares, and Johnson & Johnson (NYSE: JNJ), with a reported $48 million in June, lost their place in this portfolio, as their shares were completely sold as well.

Chevron Corp (NYSE: CVX) represents a notable reduction in holding, as its shares were reduced by 12,871,831, adding a -10.45% decrease in shares and a -0.58% effect on the portfolio.

HP Inc (NYSE: HPQ) also experienced a deduction of 18,433,783 shares, leading to a -15.24% decrease and a -0.16% portfolio impact.

Moreover, the holding of Amazon, Inc. (NASDAQ: AMZN) decreased from 10.55 million at the conclusion of the second quarter to 10 million by the end of the third quarter, with the present investment valued at $1.38 billion.

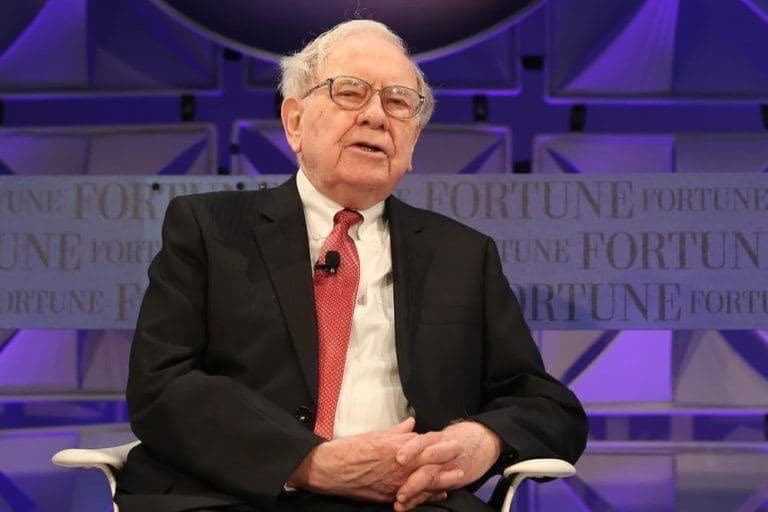

Buffett’s portfolio overview

The primary holdings consist of 50.04% in Apple Inc (NASDAQ: AAPL), 9.03% in Bank of America Corp (NYSE: BAC), 7.22% in American Express Co (NYSE: AXP), 7.15% in Coca-Cola Co (NYSE: KO), and 5.93% in Chevron Corp.

As the third quarter concluded, 78% of Berkshire’s stock portfolio was centered around these five key companies: Apple, Bank of America, American Express, Coca-Cola, and Chevron.

According to Berkshire’s latest quarterly report, the company divested nearly $7 billion in stocks during the period, offset by purchases totaling $1.7 billion.

As of the end of September, Berkshire concluded with a historic $157.2 billion in cash and equivalents, marking an increase of nearly $10 billion from the second-quarter closing. Additionally, Berkshire repurchased $1.1 billion of its shares during the third quarter.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.