Bitcoin (BTC) is once again showing a strong rebound, successfully establishing its price above the crucial $60,000 support zone.

Amid short-term bullish sentiments, a crypto analyst believes that the asset’s historical price trajectory could prepare Bitcoin to hit $300,000.

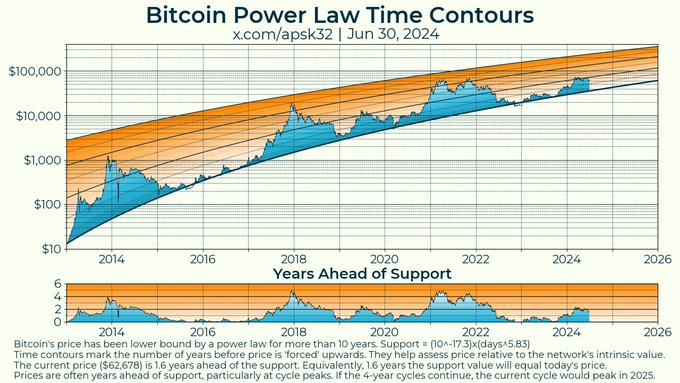

In line with this, pseudonymous analyst apsk32 noted in an X post on July 1 that a unique metric based on the power law could drive Bitcoin to a new all-time high.

The expert pointed out that Bitcoin’s price has adhered to a power law for over a decade. This adherence suggests a fundamental growth process in the Bitcoin network, something not typically seen in traditional financial markets.

According to apsk32, the power law support represents the network’s intrinsic value—the value when all hope and hype have dissipated. To assess the current price relative to this inherent value, apsk32 leveraged time as a metric.

Indeed, between 2014 and 2024, Bitcoin has exhibited a clear pattern of adherence to the power law. During the 2017 and 2021 bull cycles, Bitcoin’s price was five years ahead of the support line.

Apsk32 suggested that by the end of 2025, if the four-year cyclic pattern of bull markets continues, Bitcoin could be five years ahead of the support line, translating to a price of $300,000.

“The 4-year cyclic pattern of the bull markets point to a peak in late 2025. By the end of 2025, being 5-years ahead of the support line is equivalent to a bitcoin price of $300,000,” the analyst said.

Has Bitcoin bottomed?

If the prediction comes to fruition, Bitcoin’s short-term price movements remain crucial to watch. Attention is on whether BTC has bottomed. Notably, crypto trading expert Michaël van de Poppe suggested that Bitcoin could be in line for more gains after hitting a higher low and finding support at $60,000.

“It made a higher low, found support at $60,000, and continued the momentum upwards. I think we’ve bottomed out,” Poppe said.

In the meantime, with Bitcoin having opened the month on a positive note, investors will be hoping the asset emulates the historical trajectory for July.

In particular, data shared by crypto analysis platform Coinglass shows that Bitcoin has historically averaged a slump of 0.35% in June. However, the maiden crypto has recorded minimum monthly gains of 8% for seven last July 11 trading periods.

Bitcoin price analysis

In the near term, Bitcoin shows signs of resurgence after briefly claiming the $63,000 mark in the last 24 hours. By press time, BTC was trading at $62,770, having rallied over 2% in 24 hours. The value reflects a gain of almost 5.5% from the weekly low of $59,500.

Attention now shifts to Bitcoin reclaiming the $63,000 resistance, which will open the door to claiming $65,000.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk