Although Microsoft (NASDAQ: MSFT) stock continues to make progress this year, its advances are still modest and often interrupted by bearish price action. However, analysts remain optimistic it will pick up the pace and believe it could hit at least $450 in the next 12 months.

As it happens, during the last three months, prominent Wall Street experts have shared their MSFT stock price targets for the next one-year period, with the lowest target sitting at $450, which still suggests an increase from its price at press time, while some are even more bullish.

MSFT price targets

Specifically, one of these experts is Truist Financial’s Joel Fishbein, who has maintained the MSFT price target at a whopping $600, which would indicate a massive 44.72% increase to the price of Microsoft shares at press time, in addition to retaining his ‘buy’ rating.

As Fishbein explained, Microsoft’s focus on artificial intelligence (AI) and the expansion in this industry have driven the sustained momentum for the company in the third quarter last year, adding that:

“We expect this durable growth in the segment could continue to drive upside to current expectations.”

Indeed, thanks to the technology behemoth’s efforts in the field of AI, as well as its purchase of the gaming company Activision Blizzard, Microsoft’s shares have grown nearly 35% over the past year and have become the best investment right now.

Is $450 MSFT price target more realistic?

On the other hand, $450 might be more realistic for MSFT shares, at least according to RBC Capital’s Rishi Jaluria and Mizuho Securities’ Gregg Moskowitz, who have kept this price target after Microsoft posted an impressive quarterly earnings report in late April 2024.

In Jaluria’s view, Microsoft could overtake the market share from Amazon (NASDAQ: AMZN) in terms of cloud services provision, and cloud providers should broadly profit from signs of stabilization in technology spending. As he explained, “Azure is benefiting from a halo effect around Microsoft’s AI strategy.”

Elsewhere, Moskowitz boosted his MSFT price target from $420 to $450 back in December 2023, based on his optimistic views of Microsoft’s security Copilot launch, recently writing to Mizuho’s clients in a note that:

“We expect a warm reception from customers to Microsoft’s usage-based pricing, as it will provide businesses a low-cost opportunity (initially) to pursue interesting cybersecurity use cases.”

MSFT stock price analysis

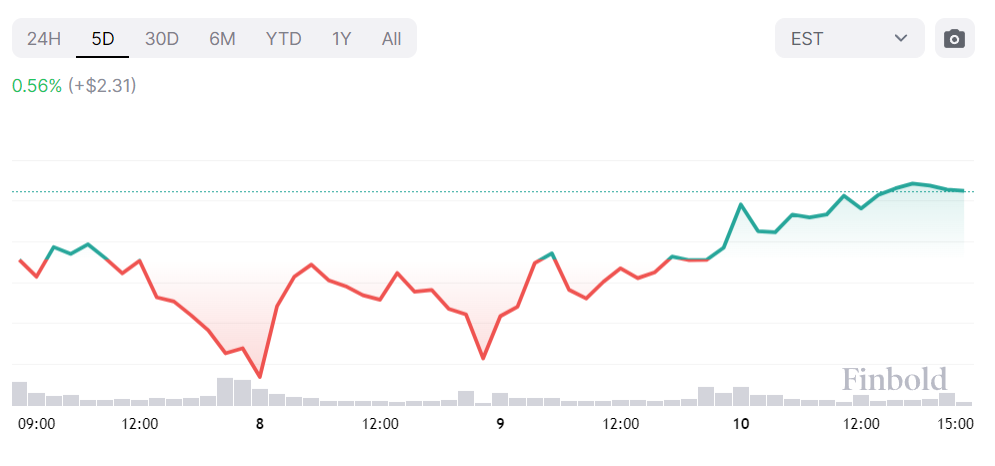

Meanwhile, MSFT stock is currently trading at the price of $414.60, suggesting a 0.08% increase on the day, gaining 0.56% across the past week, and accumulating an advance of 0.74% on its monthly chart, adding up to the 12.41% growth this year, as per data on May 13.

All things considered, Microsoft is certainly the top contender in today’s technology race, and $450 is a reasonable target to expect for the MSFT stock price. That said, the situation in the stock market can change unexpectedly, so doing one’s own research is critical when investing.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.