The price action that XRP (XRP) has experienced over the course of 2024 has been quite erratic and volatile.

At press time, the token is trading at $0.52607, having shed 14.26% in value since the beginning of the year.

There are several major factors that have dominated XRP’s price action since January.

On the bearish side, the token’s escrow schedule, which sees hundreds of millions, if not billions of tokens released in short timeframes, as well as the continued action against Ripple Labs by the SEC.

On the bullish side, Ripple has branched out into DeFi, crypto custodianship, and the stablecoin market. It seems like Ripple Labs is doing everything in its power to ensure a good launch ramp for the long term — most of these developments will likely leverage XRP, which could in turn see more equity flowing into the token.

For now, the bearish side of the aisle is still dominant — while XRP does have the occasional limited rally, like after Elon Musk mentioned the token in a Pittsburgh event, a decisive reversal to the upside has not yet occurred.

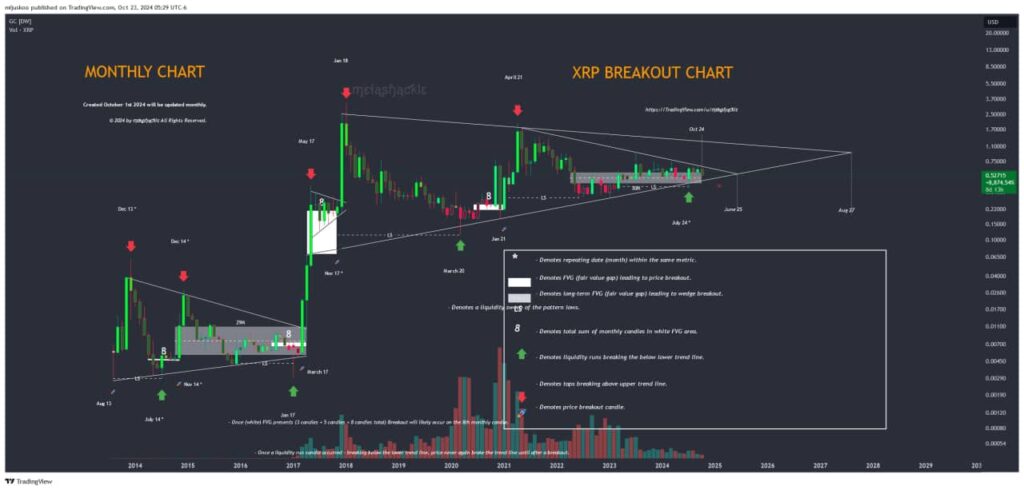

It might be relatively close, however — as shown by a multi-year chart shared on October 23 by a renowned technical analyst.

XRP breakout chart hints at 2025 rally

The chart in question is detailed and shows a clear pattern stretching back to 2014. It demonstrates that sudden increases in XRP price have been preceded four consecutive times by a specific set of events — a fair value gap, a single liquidation candle that breaks trendlines, and a breakout on the 8th monthly candle.

This July, a liquidation candle was printed — in previous instances, the price never broke below trendlines after printing such a candle. On the flip side, the fair value gap has not yet materialized, as per the author of the chart, trading expert MetaShackle.

XRP is currently in a wedge pattern — the analyst noted that the general consensus is that this signals a breakout will occur in late February to early March.

However, if this analysis is correct, then we’re going to have to wait a little while longer — as the earliest breakout can occur around August or July, roughly 8 months away at the time of writing.

Although no profit-taking targets were shared, previous instances of this pattern have sent prices parabolic — but we do have to note a steep decline in XRP trading volume, which could serve to delay or prevent another rally.