Despite hitting its new all-time high (ATH) this year, Bitcoin (BTC) has recently been struggling, particularly evident in its occasional dips below the critical price level of $60,000 and pulling the rest of the cryptocurrency market down with it, leaving crypto traders baffled over the reasons.

As it happens, Bitcoin has been trending bearishly for weeks, dropping well below its recent record-breaking price of $73,738, failing to meet expectations stemming from positive developments like the approval of spot Bitcoin exchange-traded funds (ETFs) and the halving event.

Bitcoin price analysis

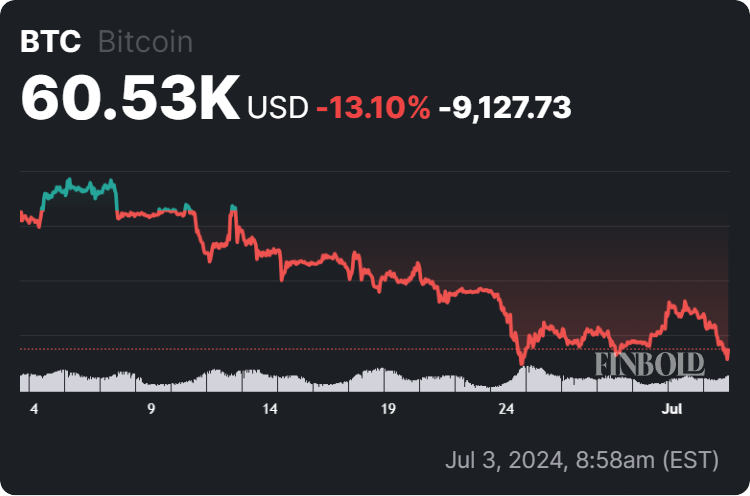

Indeed, the flagship decentralized finance (DeFi) asset was at press time changing hands at the price of $60,530, which suggests it has declined 3.35% in the last 24 hours, adding up to the weekly loss of 2.30%, and accumulating a dip of 13.10% on its monthly chart, as per the most recent data on July 3.

In this context, some factors emerge as potentially related, if not directly causative, to Bitcoin’s recent lack of success and unfavorable price performance, including the current macroeconomic atmosphere, lack of liquidity, miner capitulation, and possible start of Mt. Gox creditor repayments.

Why is Bitcoin crashing?

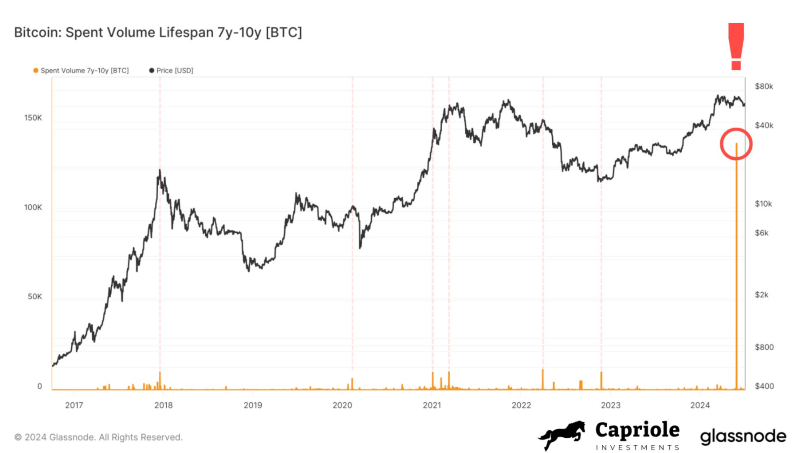

Specifically, the crypto community is expecting a dump of Bitcoin worth around $9 billion as the defunct crypto exchange Mt. Gox announced its plans to begin with the repayments in July 2024, marking the end of a decade-long ordeal for creditors since the company shuttered its operation following a hacking incident.

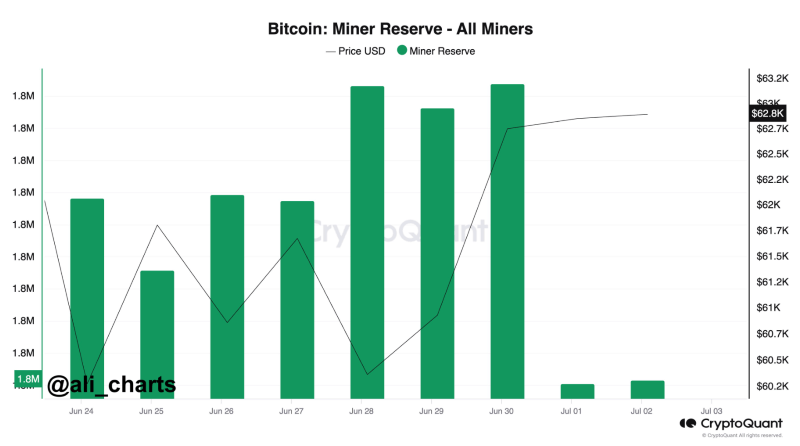

With such a massive amount of the maiden crypto asset about to flood the market, its participants are rightfully concerned, including Bitcoin miners, who have recently been showing signs of capitulation, selling their reserves equivalent to five mining days in a three-day period.

On top of that, market optimism has been declining since Jerome Powell, the chairman of the United States Federal Reserve, signaled no imminent interest rate cuts, and liquidity is concentrated below $60,000, with traders noting order ‘spoofing’ (i.e., buying or selling, then canceling orders) on crypto exchanges.

Signs of hope for Bitcoin?

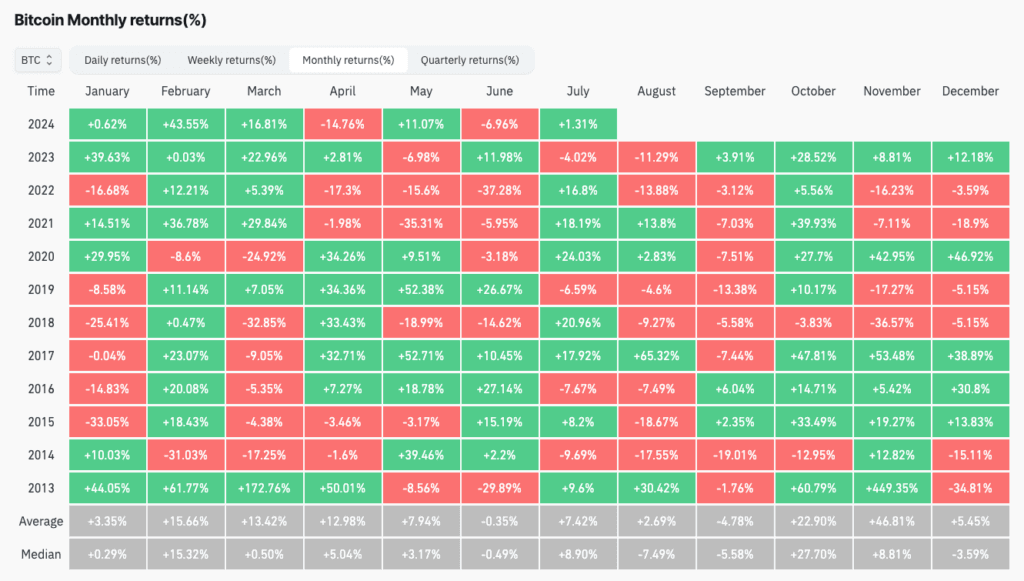

On the other hand, July has traditionally been a bullish month for Bitcoin, particularly following a bearish June, which suggests that there’s still a chance for the largest asset in the crypto sector by market capitalization to turn things around and skyrocket in July 2024.

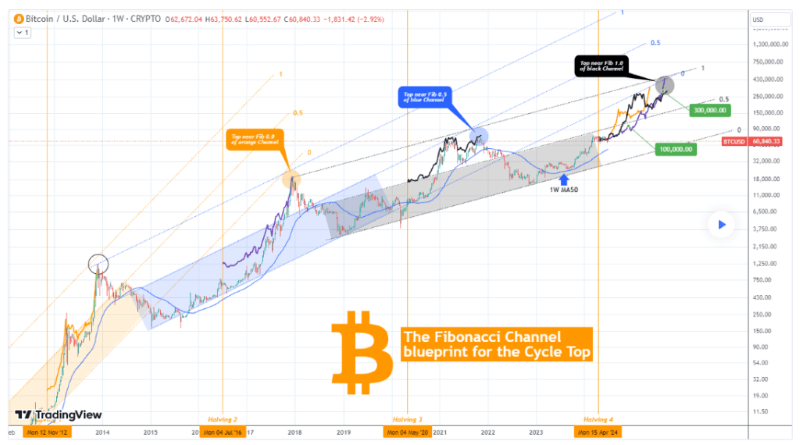

At the same time, some analysts are confident that Bitcoin will recover and continue to increase in price toward $100,000 after this temporary hiccup, including pseudonymous crypto expert TradingShot, who has observed a historical chart pattern that typically precedes a parabolic rally.

All things considered, Bitcoin’s current price action is pessimistic, but zooming out on the pioneer cryptocurrency demonstrates consistent growth over time, and many experts agree that this is just a temporary setback, believing in its long-term success. However, investing in crypto assets is risky, so doing one’s own research is necessary.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.