The price of Cardano (ADA) is showing impressive strength in line with the broader cryptocurrency market as it records its second consecutive week of gains.

Sitting at its highest level since March 2024, ADA has soared by almost 120% from its lowest point this year, with some analysts projecting that this strong performance means Cardano could be gearing up for its next major move, with a target of $1.40 in sight.

Technical indicators point to a bullish breakout

In a recent TradingView post, TradingShot highlighted that Cardano has recently tested the resistance at $0.8200, a critical level that aligns with its March 2024 high.

This resistance has emerged as a key hurdle for ADA’s continued rally, with the price currently consolidating near this zone.

The token’s bullish momentum is further validated by the formation of a one-day Golden Cross, a significant technical signal that occurs when the 50-day moving average crosses above the 200-day moving average.

Historically, this pattern has preceded major rallies. The last 1D Golden Cross for ADA was in November 2023, which subsequently led to a breakout beyond resistance levels and a move toward the 2.0 Fibonacci extension.

Adding to the bullish sentiment, the Relative Strength Index (RSI) is currently showing favorable momentum. TradingShot’s analysis points out that ADA’s RSI is following a similar fractal pattern to previous bullish cycles, suggesting there is room for additional gains before hitting overbought territory.

This confluence of factors indicates that ADA could be gearing up for its next major move, provided it successfully breaks through the resistance at $0.8.

Should a breakout occur, analysts project a rally toward the $1.40 mark, which aligns with the 2.0 Fibonacci extension and serves as the next major target for bullish investors.

Additional bullish factors

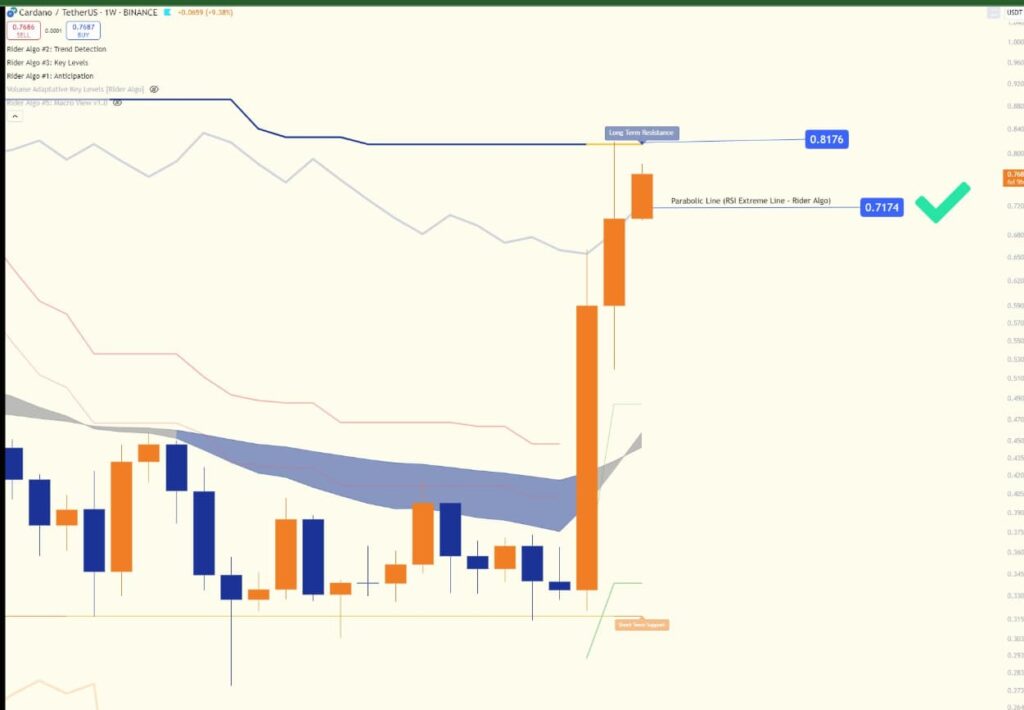

Meanwhile, Trend Rider’s analysis suggested that ADA has entered a pivotal stage by closing above the Parabolic Line, marking a critical resistance break at $0.7174.

This milestone could catalyze a sustained bull run as it aligns with broader bullish indicators and secures a foundation for upward momentum.

According to the analysis, the weekly close breaching the long-term resistance at $0.8176 signals renewed investor confidence. Moreover, this move solidifies the $0.7174 level as an essential support, providing a safety net during potential pullbacks.

As the market consolidates, ADA’s ability to maintain levels above the Parabolic Line could invite increased buying pressure, reinforcing its bullish outlook.

The confluence of these bullish indicators could attract further buying pressure, bolstered by reports of a potential collaboration between Charles Hoskinson, the founder of Cardano, and President-elect Trump.

Moreover, Trump is expected to introduce crypto-friendly policies, sparking speculation about a blockchain-based election voting system leveraging Cardano.

Derivatives market and investor sentiment

Investor enthusiasm for ADA is evident in the derivatives market, where open interest has exceeded $550 million for the first time since March, reaching $582.9 million, according to CoinGlass

This surge reflects increased buying pressure as exchange net flows further highlight heightened interest from bulls.

Cardano price analysis

At the time of writing, ADA is trading at $0.7283, reflecting a 30% gain over the past week. The token has also experienced substantial growth in the last month, surging by 103%.

In summary, Cardano’s recent rally, driven by strong technical indicators, a favorable derivatives market, and growing investor confidence, highlights its potential to break out toward the $1.40 mark.

However, traders should remain cautious, closely monitoring macroeconomic developments and RSI dynamics to evaluate the sustainability of this bullish trend.

With solid support levels and growing ecosystem interest, ADA shows promise for near-term gains, with some projecting a potential all-time high of $6 by 2025.

Featured image via Shutterstock