Tesla’s (NASDAQ: TSLA) share price is primed to extend its recent momentum in a potential price movement that an analyst has termed ‘unstoppable.’

The stock has consistently formed higher highs in recent weeks, indicating bullish momentum, according to stock trading expert Klejdi Cuni in a TradingView post on September 19.

Notably, shares of the electric vehicle manufacturer recently rallied, ranking among the best-performing S&P 500 equities, buoyed by the impact of the Federal Reserve’s interest rate cut.

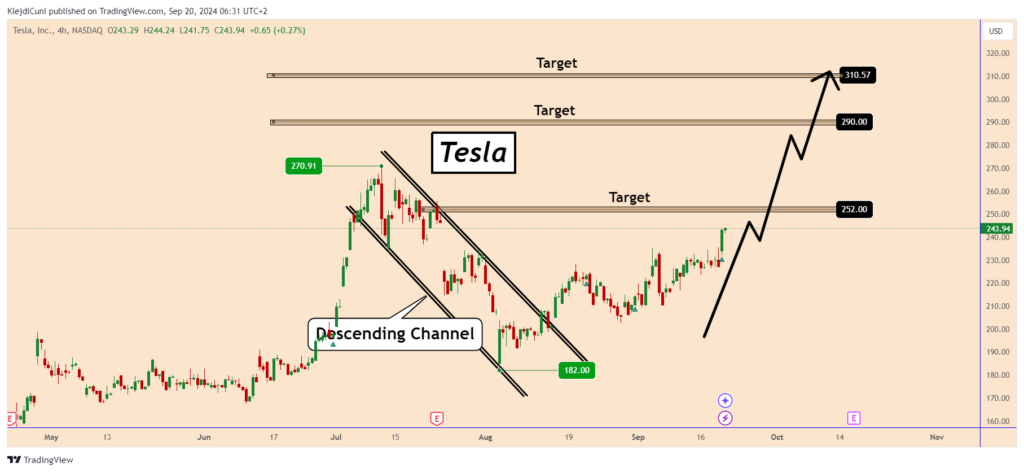

According to the expert, Tesla’s technical setup looks favorable as the stock has broken key levels, forming new targets. In a four-hour chart analysis provided by the trading analyst, Tesla is pushing past previous price ceilings, making a case for substantial further gains.

Cuni observed that TSLA’s shares, which had been consolidating within a descending channel over the past months, broke out as the market responded positively to the Fed’s rate cut. The rate cut can be assumed to have been viewed as a positive economic signal, with Tesla investors considering it an opportune time to buy the equity.

Tesla’s price levels to watch

At the same time, Cuni’s analysis outlined three key possible price targets: $252, $290, and $310. With the stock trading just below the $240 mark, breaking through the $252 resistance would open the door to the $290 and $310 targets.

“TESLA Looks Unstoppable This time. <…> It looks even better after the FED supported the economy by decreasing the rates by 50bps,” the expert noted.

Elsewhere, based on Tesla’s recent price movement, another trading analyst with the pseudonym Prof noted through an X post on September 21 that TSLA is attempting its first monthly close outside a prolonged pennant consolidation pattern, suggesting a price breakout could be imminent.

Therefore, if the stock can reclaim and maintain its position above the $265 level, further upside potential could target $281, $300, and even $370 in the long term. The stock surged 11% in September, marking a strong month for Tesla.

Tesla stock fundamentals

Besides the technical outlook, Tesla’s internal fundamentals look promising, especially regarding the number of new vehicle deliveries. For Q3 2023, the Texas-based firm is projected to deliver 460,000 units, which aligns closely with market estimates 461,000, as per Wolfe Research analyst Emmanuel Rosner.

There is also an underlying belief that Tesla still has upside potential over the company’s role in the growing artificial intelligence (AI) sector. To this end, Mark Newton, a technical analyst at Fundstrat Global Advisors, opines that once investors realize the Elon Musk-led company’s capabilities in AI through initiatives such as the upcoming Robotaxi, the humanoid robot, and Full Self-Driving (FSD), TSLA will likely see a surge in value.

Although Tesla has maintained bullish sentiment in recent weeks, the stock closed the latest trading session in the red, plunging 2.3% for the day to a value of $238. On the weekly chart, TSLA is still up almost 4%.

In summary, Tesla’s stock appears to be at a pivotal moment, with technical indicators and market momentum suggesting the potential for further gains. However, short-term volatility remains a factor that investors need to watch out for.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.