The stock market is experiencing a predominantly positive trend in May, with most equities trading in the green zone despite prevailing uncertainties surrounding elements such as interest rate decisions.

As most equities exhibit resilience, Finbold has identified two stocks deserving close attention in May 2024. Notably, these stocks are guided by robust fundamentals, evidenced by solid financial strength and an edge over competitors. Moreover, they have demonstrated strong growth potential throughout 2024.

Meta Platforms

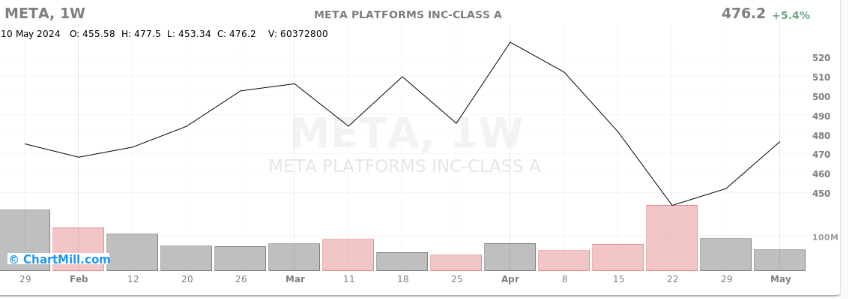

The social media giant has experienced robust growth in 2024, surging by nearly 40% year-to-date. Meta Platforms (NASDAQ: META) presents an attractive investment opportunity, particularly as it demonstrates promising growth prospects. This is underscored by the company’s strong financial performance in the year’s first quarter.

For instance, Meta reported a 27% year-over-year revenue growth in Q1 2024, accompanied by a more than doubled net income compared to last year. Additionally, total user numbers increased by 7% year-over-year, offering the potential for enhanced advertising revenue generation.

Meta’s ability to expand revenue while managing costs highlights its financial resilience. This strong performance favors Meta, with investors closely watching its trajectory amidst evolving market sentiments.

Moreover, the stock is bolstered by other bullish signals, particularly its significant interest in the artificial intelligence (AI) revolution, further enhancing its appeal.

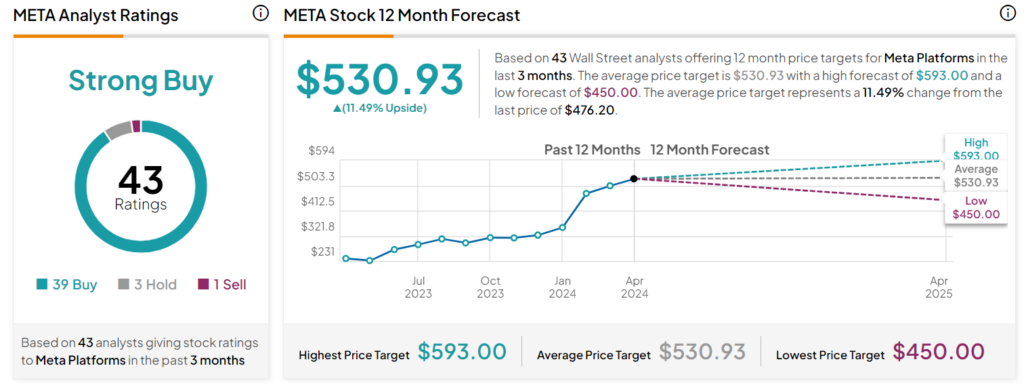

At the same time, Wall Street analysts at TipRanks have given the stock a ‘strong buy’ rating. The analysts provided an average price target of $530 for the next 12 months, indicating an upside of nearly 12% from the current valuation.

As of the latest market close, META was trading at $476.20, gaining 37% year-to-date.

Walmart

Walmart’s (NYSE: WMT) stock has demonstrated resilience over the years, weathering numerous economic uncertainties. As May unfolds, investors aim to gauge its performance based on underlying factors such as upcoming results announcements and business expansion initiatives.

In line with this, the company is slated to report its first-quarter earnings on May 16, 2024. Analysts anticipate an adjusted profit of 52 cents per share, reflecting a 6% year-over-year increase. Revenue is expected to climb by 4.5% to reach $159.2 billion.

Notably, these forthcoming results follow a robust performance in the holiday quarter, where earnings and revenue for the January-ended period surged by 7% and 6%, respectively. During this timeframe, the retailer’s global e-commerce revenue soared by an impressive 23%, surpassing the $100 billion mark.

Additionally, Walmart has announced plans to acquire smart TV maker Vizio, alongside intentions to open or expand more than 150 stores across America within the next five years.

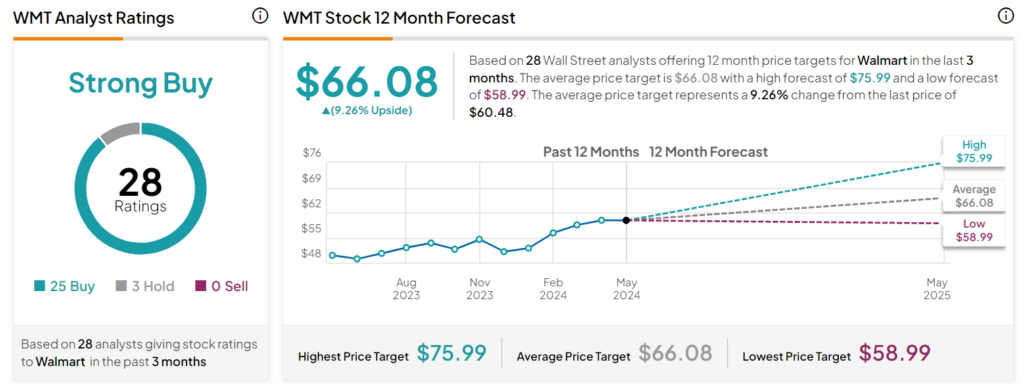

Meanwhile, Wall Street analysts maintain a ‘strong buy’ rating for the equity, projecting an average price target of $66.08 over the next 12 months.

As of the latest update, Walmart’s stock was valued at $60.48, with year-to-date gains of 13.9%.

In summary, the mentioned stocks are also likely to be influenced by the stock market’s overall trajectory, which currently heavily depends on the economic outlook.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.