By the close of markets on March 15, the general stock market ended the day on a downturn, marking a second consecutive week of losses, with major indices experiencing declines. These losses have coincided with a higher-than-expected inflation rate, causing concern among investors.

The inflation report has potentially unsettled investors, prompting a reassessment of expectations regarding a possible interest rate cut in June.

As most stocks saw declines, heading into the new week, several equities merit attention due to bullish and bearish fundamentals underlying them. In light of this, Finbold has identified three stocks that investors should monitor closely in the upcoming week.

Picks for you

Meta Platforms

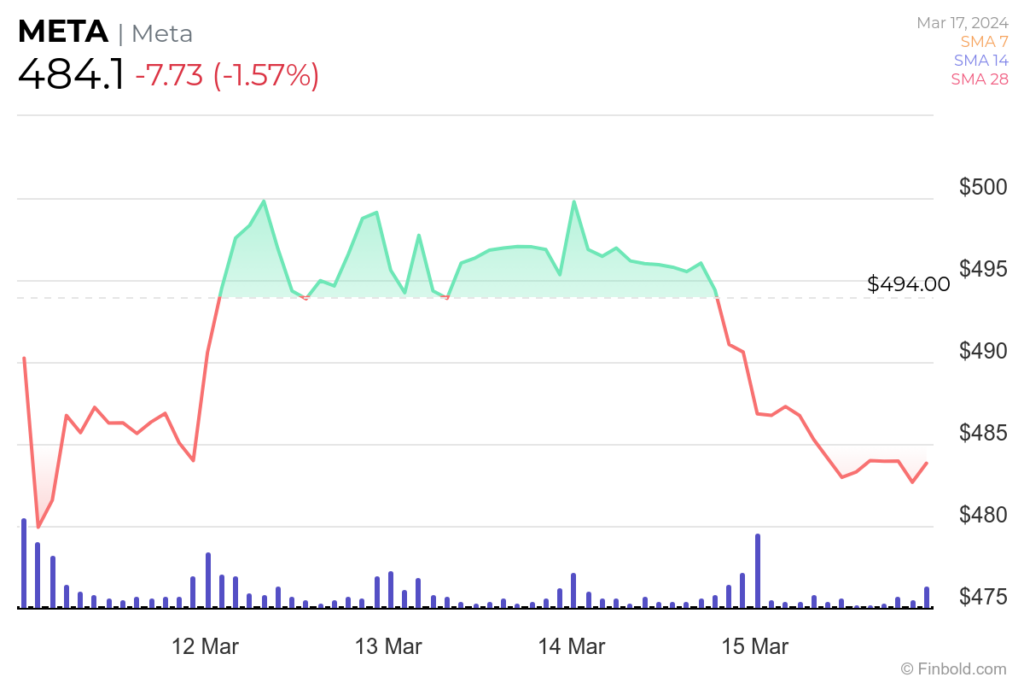

Social media giant Meta Platforms (NASDAQ: META) has been one of the standout performers of 2024, gaining almost 40% year-to-date. However, over the past week, the stock has faced additional headwinds amid the broader bearish market sentiment.

Initially, the stock fell after former US president Donald Trump labeled Facebook as ‘an enemy of the people,’ causing an immediate retreat. These comments added to existing uncertainty, particularly after it emerged that CEO Mark Zuckerberg had unloaded almost $500 million worth of Meta Platforms stock. Moving into the new week, investors will be closely watching how they react to these bearish developments.

On the other hand, Meta is also facing some bullish sentiments. Momentum is building regarding the possibility of the US banning the short video-sharing platform TikTok, a campaign led by Congress. This sentiment is compounded by the fact that data shows Instagram is now the world’s most downloaded app, surpassing TikTok, following the success of its copied video feature, Reels.

The developments around TikTok hold the potential to boost Meta, which has been riding high following its fourth-quarter earnings report showing record sales and the company’s venture into artificial intelligence (AI).

As of press time, Meta was valued at $484, with weekly losses of about 1.57%.

FedEx

The upcoming week warrants close attention to FedEx (NYSE: FDX) stock due to several pivotal factors that are worth monitoring from the scheduled financial results release slated for March 21. Notably, FedEx has encountered a significant trend over the past nine quarters, marked by year-over-year declines in the average daily volume of FedEx Express packages handled in the U.S. This trend is indicative of shifts in consumer behavior and market demand, making it a key metric to monitor.

Additionally, revenue is another critical indicator to watch, considering that FedEx experienced a surge in revenue to record highs during the pandemic. However, subsequent quarters have seen either declines or slower growth rates.

The company’s ongoing restructuring plan, announced in April 2023 to cut $4 billion in costs by 2025, consolidates operations under Federal Express Corp. Investors await updates on its long-term impact on efficiency and profitability.

To address current challenges, FedEx has been actively cutting costs, with total adjusted operating expenses anticipated to decrease by 3.4% compared to the previous year. These efforts are expected to improve bottom-line performance.

Overall, the key elements addressed in the earnings release will likely influence the performance of FedEx stock in the coming days. By press time, FDX was valued at $253.29 having recorded year-to-date gains of about 0.40%.

Apple

Apple (NASDAQ: AAPL) stock is worth watching next week due to several developments affecting the company. Firstly, Apple has agreed to settle a class action lawsuit by paying $490 million, alleging that CEO Tim Cook misled investors in 2018 by overstating demand for iPhones in China. This settlement could influence investor sentiment in the coming days, especially as concerns about declining sales in China persist for the tech giant.

With competitors like Xiaomi and Huawei on the rise, enhancing sales in other regions is crucial for Apple’s long-term growth. Notably, Europe and Japan have experienced significant revenue growth in recent quarters, offering potential offsets to losses in China.

Overall, investors will be keen on how Apple addresses these challenges and reassures the market about its Chinese market strategy

Additionally, Apple needs to stage a bullish reversal after declining almost 8% in 2024, especially as its position as the world’s second most valuable company is threatened by semiconductor giant Nvidia (NASDAQ: NVDA). Nvidia’s rapid growth driven by artificial intelligence technology could divert investor attention and affect Apple’s stock performance.

As of press time, Apple was valued at $172.62, with losses of less than 1% in a week.

Overall, the mentioned stocks warrant caution as they are also likely to be influenced by general market sentiment.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.