After a period of not buying any Bitcoin (BTC), raising concerns that one of the maiden cryptocurrency’s largest bulls might be losing confidence, Michael Saylor’s MicroStrategy (NASDAQ: MSTR) has broken the streak by purchasing 18,300 BTC and increasing its stash to a whopping 244,800 BTC.

As it happens, MicroStrategy bought Bitcoin in the value of around $1.11 billion on September 12, at an average price of $60,408, and has reached a BTC yield of 4.4% quarter-to-date (QTD) and 17% since the year’s start, Saylor said in an X post he published on September 13.

Furthermore, the MicroStrategy co-founder and executive chairman stressed that, with the most recent purchase of the flagship decentralized finance (DeFi) asset, his company currently owned 244,800 BTC acquired for $9.45 billion at an average price of $38,585 per Bitcoin.

MicroStrategy breaks the streak

Interestingly, just a week ago, trading expert Alan Santana pointed out that Saylor “hasn’t been buying any Bitcoins” lately, wondering if the people who base their bullish or bearish sentiment on MicroStrategy’s Bitcoin trading habits might be losing confidence in BTC’s ability to maintain its current price.

At the time, the analyst highlighted the indicators signaling Bitcoin’s potential crash toward $42,000 but also observed that “once the correction is over, we will be sharing bullish charts, LONG, until late 2025” and that “it will be awesome,” as Finbold reported on September 4.

As a reminder, Saylor led MicroStrategy to adopt the Bitcoin strategy in August 2020, praising BTC as an “economic engine based on a truth machine poised to emerge as a freedom machine.” However, some, like Hal Press, the founder of the crypto investment fund North Rock Digital, criticized this as “comically stupid.”

Since that time, the American business intelligence and software firm has been continually buying Bitcoin, using every opportunity to increase its holdings, and has become one of the biggest corporate holders of the largest asset in the crypto sector by market capitalization.

Bitcoin price analysis

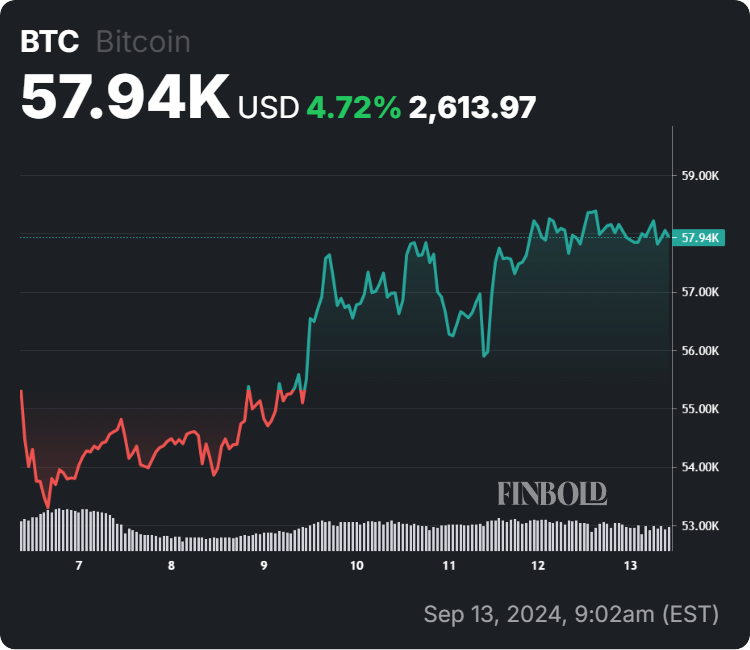

Meanwhile, the original cryptocurrency was at press time changing hands at the price of $57,940, which indicates an increase of 1.09% in the last 24 hours, adding to the 4.72% gain across the previous seven days and reducing the monthly losses to 1.46%, as per the most recent charts.

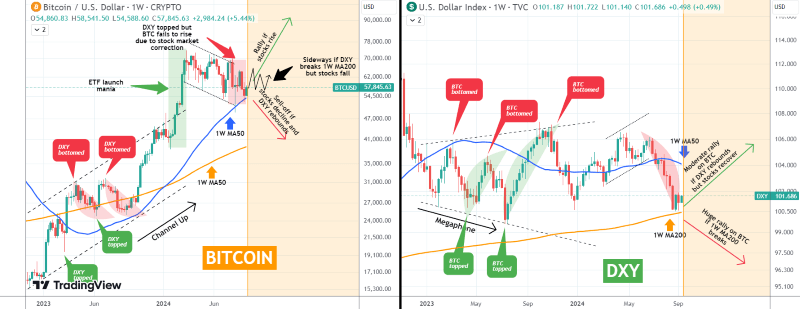

It is also worth noting that pseudonymous markets analyst TradingShot has recently argued that Bitcoin’s natural negative correlation against the United States dollar index (DXY) might lead to a bullish rally for the crypto asset, outlining several scenarios that also factor in the stock market performance, in a TradingView post on September 13.

All things considered, Michael Saylor’s MicroStrategy has resumed its Bitcoin buying practices, demonstrating persistently strong confidence in the digital asset’s future performance and viability. That said, doing one’s own research is critical when investing, as trends in the crypto market can easily change.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.