In addition to her Nvidia (NASDAQ: NVDA) stock trades, Nancy Pelosi’s purchase of Palo Alto Networks (NASDAQ: PANW) stock options is one of her most exciting trades in 2024.

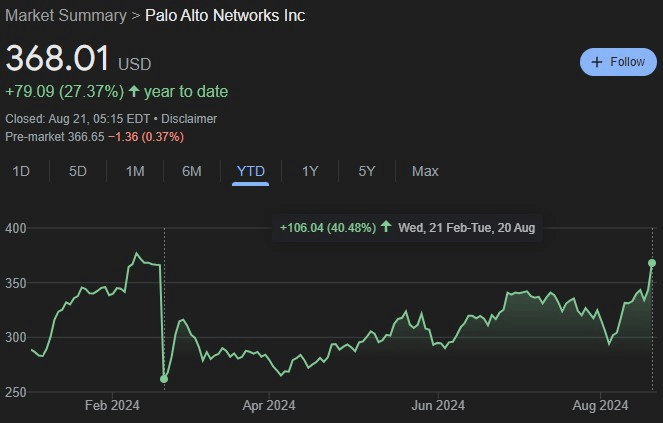

Namely, Pelosi managed to perfectly time her second purchase of PANW stock options worth up to $250,000 on February 21 at $261.97 per share. Since then, PANW shares have risen over 40%.

Interestingly, PANW shares were trading at their highest valuation for 2024 just weeks before Pelosi’s purchase and have managed to surpass the $366 valuation just recently after they achieved it first on February 20, making this trade perfectly timed.

Pelosi’s first purchase of PANW stock didn’t go so well

On February 12, Pelosi conducted a much larger stock options purchase of PANW, where she bought up to $1 million worth of 50 call options with a $200 strike price, expiring on January 17 as well.

However, this trade has been less successful, as PANW stock recorded a negative performance since it decreased by 1.06%, and its price was $371.97.

But, if the positive trend for PANW shares continues in the upcoming months, Pelosi will break even or potentially record profits on this trade.

How much in profit is Nancy Pelosi on her PANW stock trade?

Assuming that the Former House Speaker bought $250,000 worth of strike options on February 21 and the subsequent price movement of PANW stock, her profit would be around $86,000 so far.

However, considering that the strike options expire on January 17, 2025, it is normal to assume that the California Democratic representative will continue to hold these options for the upcoming period, potentially extending her profits even more.

It is important to understand that Pelosi could have bought less than $250,000 of Palo Alto Network shares. According to the filings, Nancy Pelosi purchased between $100,001 and $250,000.

PANW stock experienced its largest drop on February 21 since its IPO

After reducing its full-year revenue guidance on February 20, PANW shares dropped 28.44% in a single trading session, marking their worst performance since its initial public offering (IPO) in 2012.

However, Pelosi, a member of the U.S. Congress, decided to trust this cybersecurity firm and bet on potential cyber-attacks that may intensify due to rising Middle East tensions and thus drive the demand for security solutions.

And her bet paid off handsomely, with Palo Alto Networks reporting a double beat on estimates and rising guidance in its latest Q4 report on August 19.

Now, investors are left wondering whether Pelosi’s trade on February 21 was pure skill or luck or whether insider information, potentially on the rising cybersecurity threats, made her realize that PANW stock was a bargain.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.