Speculating on low-liquidity cryptocurrencies is risky but sometimes rewarding. A crypto trader recently beat the risk of ruin, turning $3,000 to more than $651,000 in 19 hours.

Lookonchain reported this successful trading story on X (formerly Twitter) on January 25 at 06:25 am (UTC). At that time, the trader held 314.9 trillion SNOW worth around $535,000.

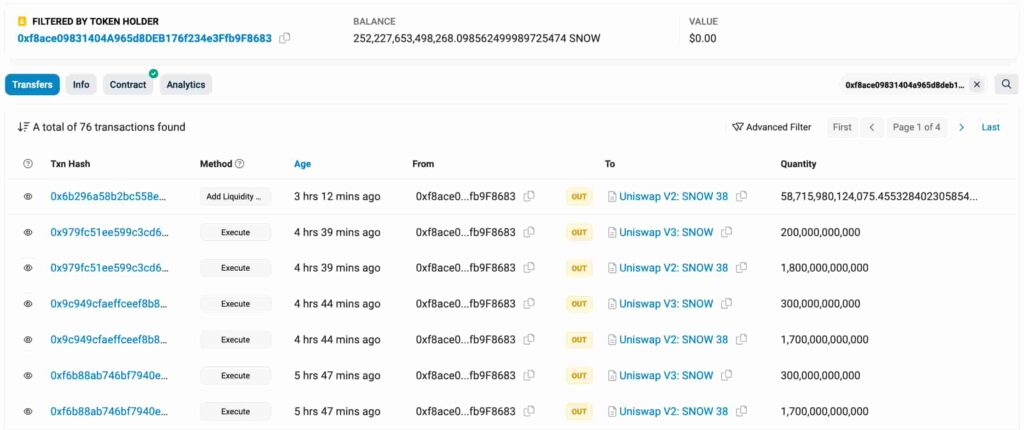

Notably, the address ‘0xf8a…F8683’ started with a purchase of 386.94 trillion SNOW for 1.31 ETH, worth $2,931. First, he sold 72 trillion tokens for 53.4 ETH, worth $119,000. Thus, realizing a profit of 52.09 ETH ($116,000).

Picks for you

Since then, the trader has sold more SNOW while adding liquidity to Uniswap’s (UNI) pool. He currently holds 252.2 trillion liquid tokens, ready to dump at any moment.

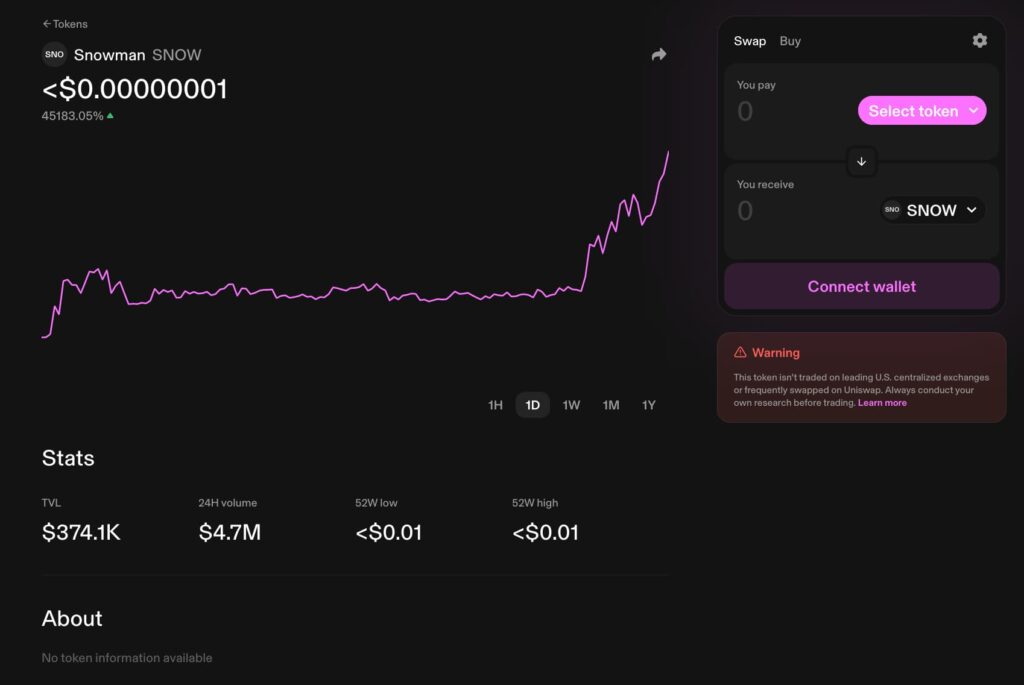

Snowman (SNOW) analysis on Uniswap

Snowman (SNOW) is a low-liquidity and low-cap ERC-20 token only traded on Uniswap. In particular, no token information is available on the decentralized exchange, suggesting a purely speculative memecoin. It exists under the smart contract ‘0xD1f…a557f’.

Additionally, the token has a TVL of $374,100 in its liquidity pools, making over $4.7 million 24-hour volume. Its circulating supply is 888.888 trillion SNOW, and the price is sub $0.00000001.

Interestingly, the trader’s first purchase was equivalent to 43.5% of the circulating supply. Meanwhile, the address’s current balance equals 28.3% of all Snowman tokens, more than the available liquidity.

This trade could have been a lucky strike, a successful operation by a smart trader, or even an internal job. Still, it illustrates the high volatility of low-liquidity tokens – this time favoring the speculators.

Nevertheless, these trades often do not have a happy ending. Speculators might find it difficult to realize any meaningful profit in a low-liquidity environment, while volatility could quickly shift, resulting in massive losses and an investor’s ruin.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.