There aren’t many people in the stock market who haven’t heard of Nancy Pelosi, a former House Speaker, leader of the House Democrats for 20 years, and one of the most active stock traders among United States politicians, and following her example would’ve made one very rich.

Indeed, it is no secret that Pelosi and her husband, Paul, own a selection of stocks and that investors are taking lessons from their trading success. With this in mind, Finbold has analyzed how much $1,000 invested in top stocks in Pelosi’s portfolio at the start of 2024 would be worth now.

Returns from splitting $1,000 investment

Specifically, her top stocks by portfolio allocation include predominantly technology-focuses assets, including Nvidia (NASDAQ: NVDA), Apple (NASDAQ: AAPL), Microsoft (NASDAQ: MSFT), Alphabet (NASDAQ: GOOGL), and Crowdstrike (NASDAQ: CRWD).

Assuming an equal distribution of $1,000 across these five stocks in Nancy Pelosi’s investment portfolio, each would receive an allocation of $200, so investing in them at year’s turn and selling at press time would bring a total profit of $586.20, with the total result standing at $1,586.20.

#1 Nvidia (NVDA)

Since January 1, 2024, the shares of semiconductor behemoth Nvidia have increased in price by a whopping 163.39%, thanks to its efforts in the field of artificial intelligence (AI), as well as a broader influx of money into companies associating themselves with AI technology.

At the moment, they are changing hands at $126.87, reflecting an increase of 2.71% on the day, 3.47% across the week, and 10.49% in the past month, which means an investment of $200 in NVDA shares at the time would today be worth $526.78, as per most recent data.

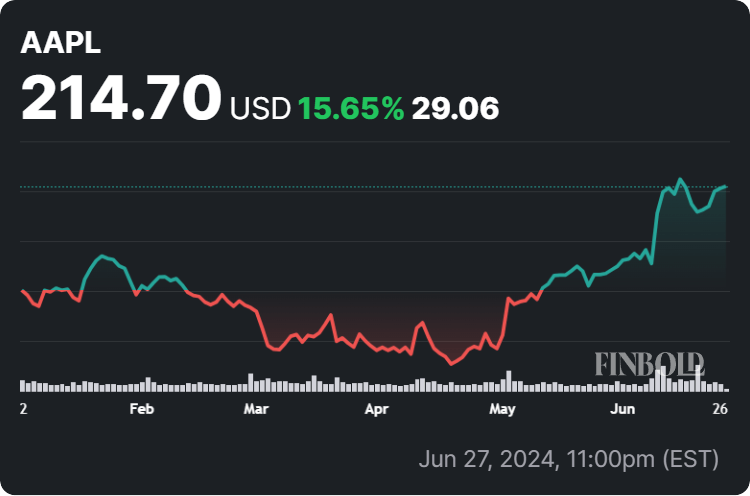

#2 Apple (AAPL)

At the same time, investing $200 in Pelosi’s second choice, blue-chip giant Apple, would result in turning that into $231.3, taking into account that the AAPL shares grew by 15.65% since the year’s beginning and are currently trading at $214.70.

Their current price also demonstrates an increase of 0.10% on the day, 2.90% in the last week, and 12.87%, having picked up the pace due to the company’s recent partnership with OpenAI to integrate its AI technology into Apple’s upcoming products and operating systems.

#3 Microsoft (MSFT)

As for Microsoft, the price of its stocks at the moment stands at $454.50, having advanced 22.55% this year, which would equal a profit of $245.1 if sold right now. At the same time, this suggests an increase of 0.52% on the day, 1.02% this week, and 5.84% on its monthly chart.

Notably, the price of MSFT shares has continued to increase amid close cooperation with OpenAI, and in spite of Microsoft facing antitrust charges from the European Union (EU) and revelations that Russian hackers have been spying on its clients’ emails.

#4 Alphabet (GOOGL)

Meanwhile, the stocks of Google parent Alphabet have recently hit a new all-time high (ATH) after analysts upgraded its price targets and reports came out that Alphabet was developing a product for creating and conversing with customizable chatbots modeled after user-made celebrities.

In line with these positive influences, having invested $200 earlier this year in GOOGL shares would turn these $200 into $267.32, and they currently stand at $184.65, up 0.64% today, 2.58% on its weekly chart, growing 4.90% in the last month, and advancing 33.66% year-to-date (YTD).

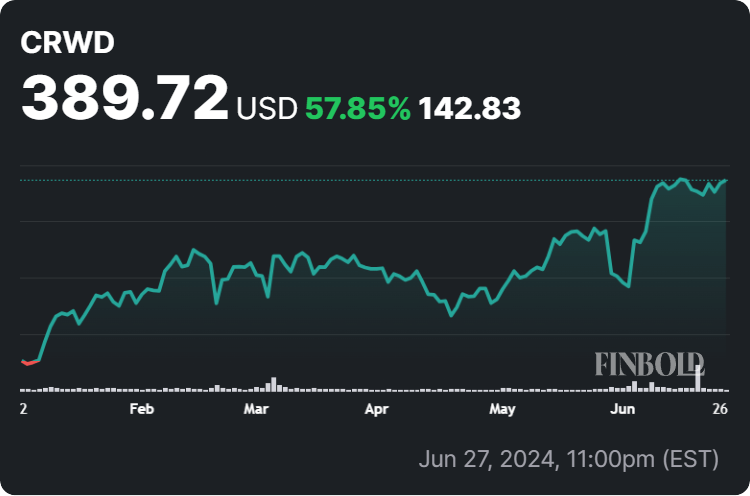

#5 Crowdstrike (CRWD)

Finally, investing $200 in cybersecurity tech company Crowdstrike on January 1 would result in turning that amount into $315.7, since CRWD shares have grown by 57.85% since that time. Their price now amounts to $389.72, which is also an increase of 0.67% on the day, 2.78% last week, and 11.66% on the month.

As it happens, Crowdstrike stock owes its significant price increases to the continuous success of the company since its initial public offering (IPO) five years ago, as demonstrated in this year’s Q1 financial results that beat Wall Street estimates.

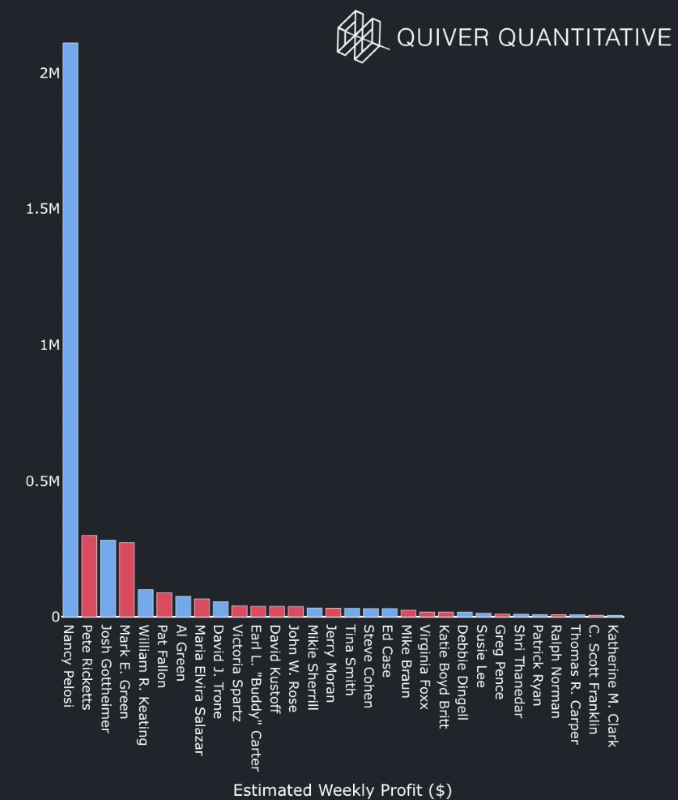

Nancy Pelosi’s exceptional success

As it happens, Pelosi has made approximately $22 million so far this year, and her portfolio has recently hit an all-time high (ATH), as she is currently worth about $253.81 million, according to the latest information shared by investment research firm Quiver Quantitative in an X post on June 27.

She also stands out in her estimated weekly profit among all other members of the US Congress, making substantially more money from stock trading than anyone else, including the second-best Pete Ricketts from the Republican benches, as per Quiver Quantitative data.

All things considered, Pelosi is an impressive stock trader who seems to understand the market very well, as demonstrated by her exceptionally successful trading portfolio. Therefore, following her trades alongside one’s own detailed research would make for a profitable investing strategy in 2024.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.