Not long after the United States Securities and Exchange Commission (SEC) charged Citron Research’s Andrew Left with securities fraud of at least $16 million from manipulating the stock market, data has surfaced on how much an investment in his hedge fund 2018 would be worth today.

Indeed, the SEC has accused Left and the activist short seller’s hedge fund of “engaging in a $20 million multi-year scheme to defraud followers by publishing false and misleading statements regarding his supposed stock trading recommendations” from 2018 to 2023, as per court documents filed on July 26.

According to the SEC’s complaint:

“Left bragged to colleagues that some of these statements [he made] were especially effective at inducing retail investors to trade based on his recommendations and said that it was like taking ‘candy from a baby.’”

Andrew Left’s hedge fund returns

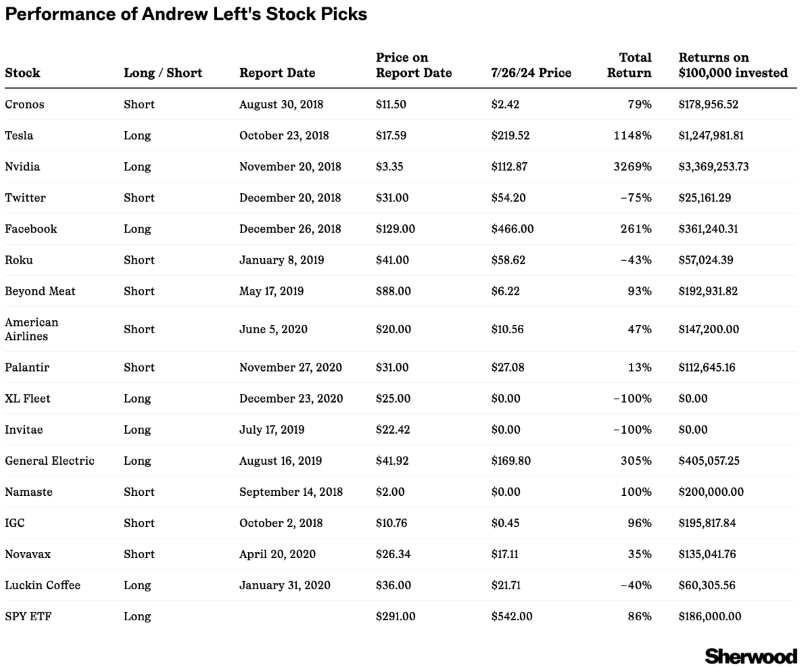

As it happens, from 2018 until today, a trader invested in Left’s hedge fund would have “netted 318% returns (ignoring fees) vs. an 86% gain in the S&P 500,” according to the data shared by Jack Raines, the author of Substack publication Young Money, in an X post on July 29.

In other words, this means that taking into account the returns of 318% since that time, an investment of just $1,000 in Andrew Left’s hedge fund in 2018 would today be worth a whopping $4,180 vs. the $1,860 from returns in the S&P 500 investments in six years, as of July 26, 2024.

Andrew Left and GameStop short squeeze

As a reminder, Left became a well-known figure during the GameStop (NYSE: GME) short squeeze back in 2021, in which hedge funds, including Melvin Capital, lost billions against retail investors from the r/WallStreetBets subreddit, later revealing that his fund covered most of its short at a 100% loss.

At the time, however, Left mocked Keith Gill, a.k.a Roaring Kitty, who started the GME stock surge by rallying the retail investors on Reddit against hedge funds shorting the shares, highlighting that prominent hedge fund managers like Gabe Plotkin and Steve Cohen were still thriving.

More recently, in May this year, Left announced he had resumed shorting GameStop stock despite the 100% loss on a previous short during the 2021 squeeze in the week after GME shares surged again due to Roaring Kitty’s cryptic posts on X, which signaled another retail buying spree.

Meanwhile, Left is currently waiting for the trial in which, if convicted, he could face a maximum possible sentence of 25 years in prison for the securities fraud scheme that involved stocks like Nvidia (NASDAQ: NVDA), Palantir (NYSE: PLTR), American Airlines (NASDAQ: AAL), Tesla (NASDAQ: TSLA), and others.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.