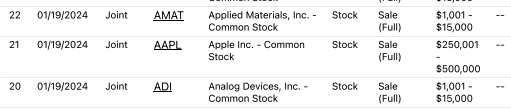

Two months before the United States Department of Justice (DOJ) opened a lawsuit against Apple (NASDAQ: AAPL) for monopolizing smartphone markets, US Senator Tommy Tuberville sold his entire Apple stock, which was worth around half a million dollars.

Indeed, on January 19, Senator Tuberville sold all of his $500,000 stake in Apple, and the price of the AAPL stock has declined by 10% since he did so, according to the observations by the Nancy Pelosi Stock Tracker powered by the Autopilot app on March 21.

This information has added to the negative sentiment on politicians’ stock trades, which many believe have an unfair advantage over the other investors due to being privy to the information affecting the stock market, including decisions such as the DOJ’s lawsuit against Apple.

However, the X user also pointed out that Apple was one of the largest positions of Congresswoman and former Speaker of the US House of Representatives Nancy Pelosi, which should be a good sign for Apple bulls as her portfolio has been the topic of much discussion among stock traders due to its success.

Apple stock price analysis

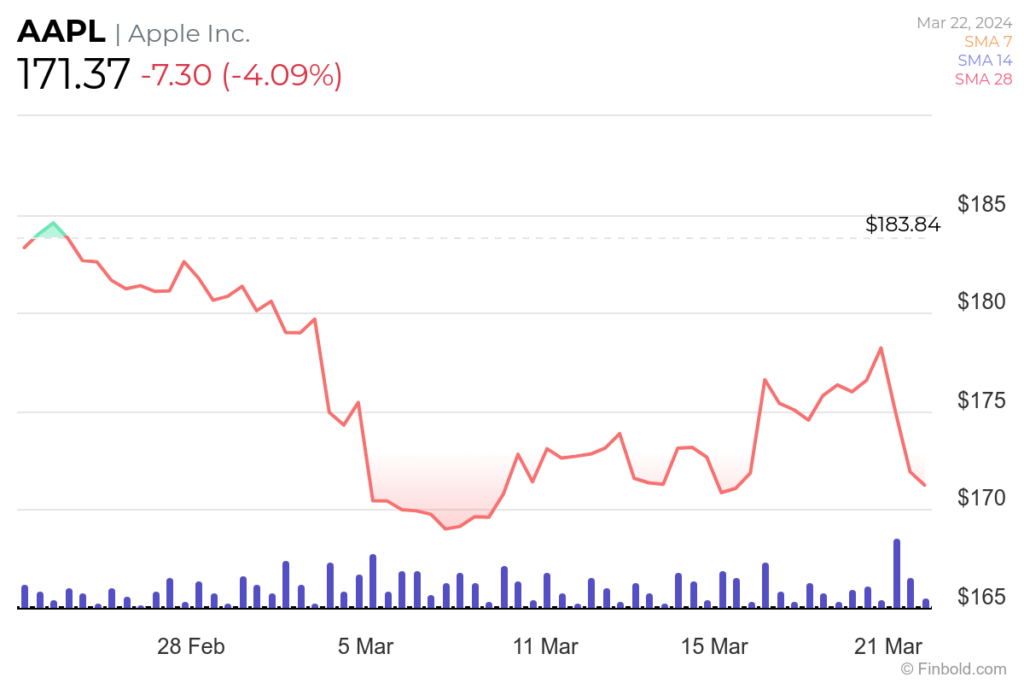

Meanwhile, the Apple stock was at press time trading at the price of $171.37, which suggests a decline of 4.09% on the day, a very modest increase of 0.12% across the previous week, and a 5.73% drop in the last month, according to the most recent data on March 22.

In terms of its short and long-term trends, Apple has been making negative actions, with 71% of all other assets in the stock market performing better in the past year, and 74% of the stocks in the technology hardware, storage, and peripherals industry doing better than Apple.

Why is Apple stock down?

As it happens, the DOJ, joined by 16 other state and district attorneys general, have filed a civil antitrust lawsuit against Apple to break up its ‘smartphone monopoly,’ arguing that the technology giant violated Section 2 of the Sherman Act, as per the press release on March 21.

According to the department’s explanation:

“Apple’s broad-based, exclusionary conduct makes it harder for Americans to switch smartphones, undermines innovation for apps, products, and services, and imposes extraordinary costs on developers, businesses, and consumers.”

All things considered, the lawsuit may continue to negatively impact the sentiment around, and therefore the performance of AAPL stock, although the fact that Congresswoman Pelosi is still holding onto it should provide some reassurance of a brighter Apple stock forecast.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.