Intel’s (NASDAQ: INTC) stock price slipped more than 10% after missing estimates for data-centric revenue and slowing demand for PC markets. The price target downgrades from analysts added to bearish sentiments. Its third-quarter revenue slipped 4% year over year while data-centric revenue plunged 10%.

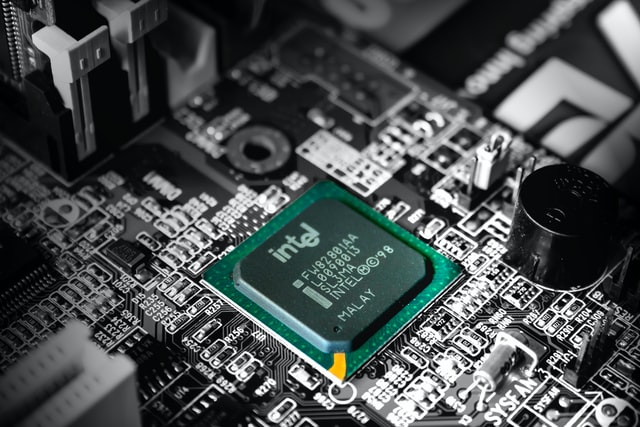

The fierce market competition from Advanced Micro Devices (NASDAQ: AMD) has also been putting pressure on Intel’s financial numbers. Moreover, consumer’s focus on cloud markets has slashed demand for INTC’s profitable enterprise PC/server markets.

Market competition is a big headwind for Intel stock

The shares of the chipmaker are also under pressure due to increasing market competition from Advanced Micro Devices.

AMD is selling seven-nanometer chips for graphics cards and PCs, while Intel has delayed manufacturing its latest chips. Intel now relies on a third-party for chip manufacturing. Meanwhile, AMD has been seeing robust demand for its Ryzen and Epyc chips as sales doubled in the latest quarter from the past year period.

“We have the decision to make about whether to build that next generation of products on Intel’s manufacturing footprint, on third party manufacturing footprint, or on a mix of both. We’ve been designing our products to have the inherent flexibility to make those decisions over time,” Intel CEO Bob Swan said.

Analyst’s downgrades added to bearish sentiments

Intel stock price is down almost 20% so far this year. The share price decline accelerated since the company announced to delay manufacturing the latest chips in July. Intel stock is currently trading around $48, down significantly from the 52-weeks high of $70 a share.

Bank of America analyst Vivek Arya downgraded the price target to $45 from the previous target of $60. The analyst has raised concerns about market competition, manufacturing problems, and slowing demand from end markets. BofA has dropped its fiscal 2021 earnings per share estimates by 1-2% to $4.65.