For investors, 2025 offers another opportunity to get involved in the stock market, and companies demonstrating strong growth potential are the ideal place to start.

To this end, investment strategist Shay Boloor, in an X post on December 30, identified five stocks worth watching in the new year.

Notably, one underlying factor in his selections revolves around these companies’ focus on releasing products centered on unique technological offerings.

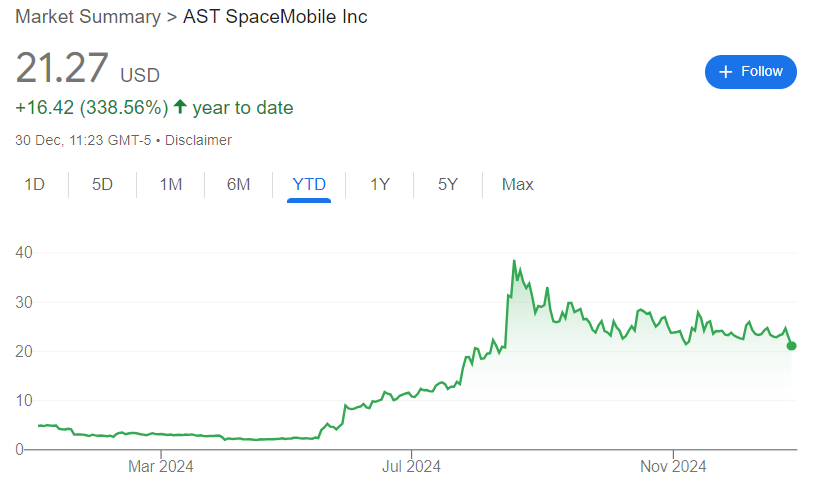

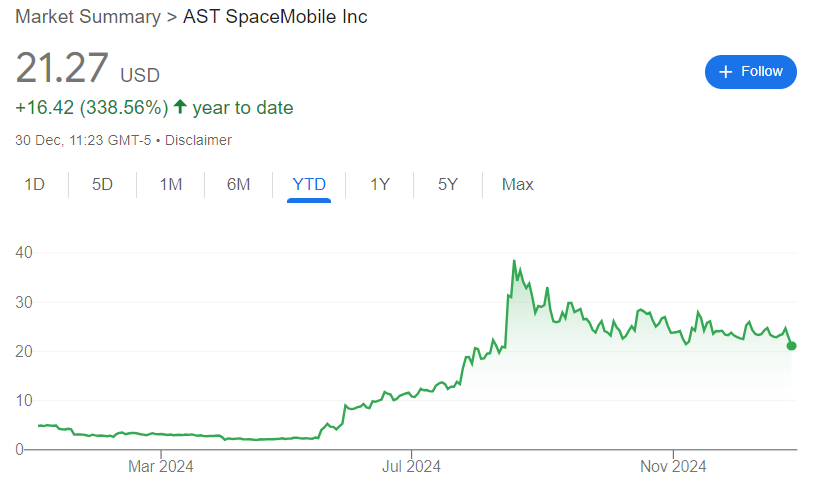

AST SpaceMobile (NASDAQ: ASTS)

According to Boloor, AST SpaceMobile (NASDAQ: ASTS) is a top pick due to the company’s development of SpaceMobile satellites and Direct-to-Cell technology, aiming to provide global satellite-to-cellphone connectivity for underserved regions.

The stock is poised to benefit from the growing demand for connectivity in remote areas. The company’s venture could be a game-changer for global communication systems by offering affordable mobile connectivity to regions traditionally lacking reliable service options.

ASTS is currently trading at $21.27, a whopping 338% growth year-to-date.

Advanced Micro Devices (NASDAQ: AMD)

Advanced Micro Devices (NASDAQ: AMD) is another standout company in 2024, thanks to its role in the artificial intelligence semiconductor space.

Boloor highlighted AMD’s potential for further growth due to its product lineup, particularly the MI300 GPUs and EPYC processors, which are pivotal for driving performance in data centers and AI workloads.

As reported by Finbold, some analysts foresee a possible 40% spike in AMD’s stock value in 2025, driven by its continued market expansion in AI.

Currently, AMD is experiencing short-term volatility. The stock was trading at $122.75 at press time, having plunged almost 12% year-to-date.

ARM Holdings (NASDAQ: ARM)

ARM Holdings (NASDAQ: ARM) remains a key enabler of the global tech ecosystem, licensing its advanced chip architectures—including the popular Cortex CPUs and Mali GPUs.

These designs power various devices, from smartphones to Internet of Things (IoT) gadgets and next-generation data centers. This foundational role prompted Boloor’s recommendation.

For forward-thinking investors, ARM will likely attract more interest as AI workloads and IoT continue to grow.

Regarding price movements, ARM had an impressive run in 2024, gaining 82% to trade at $126.08 as of press time.

Meta Platforms (NASDAQ: META)

Meta Platforms (NASDAQ: META) made the list, with Boloor citing the social media giant’s focus on augmented reality (AR) and virtual reality (VR) technologies as fundamental growth drivers. These innovations are set to redefine how users engage with the internet.

Already, Meta is showcasing dominance in this segment. For instance, it maintained a 65% share of the global VR market in Q3 2024, while Apple’s (NASDAQ: AAPL) Vision Pro shipments doubled quarter-over-quarter following its international launch in China, Europe, and APAC, according to Counterpoint’s Global XR Headset Model Tracker.

Meta’s stock has rallied 71% year-to-date, valued at $589.94 as of the latest market update.

Cameco Corporation (NYSE: CCJ)

Cameco Corporation (NYSE: CCJ) is a key player in the nuclear energy sector, supplying enriched uranium for nuclear power plants worldwide.

Boloor emphasized the company’s advancement in Small Modular Reactor (SMR) technology, which could play a pivotal role in the future of energy production.

Additionally, Cameco’s joint venture with Brookfield Renewable provides exposure to the entire nuclear value chain—from uranium mining to energy generation.

Nuclear energy stocks have garnered attention for powering the ballooning AI sector, particularly data centers. In 2024, major AI players like Amazon and Microsoft signed nuclear power deals for their AI data centers.

Cameco’s stock was valued at $51.58 at the time of reporting, reflecting over 22% growth in 2024.

In conclusion, while the highlighted companies offer promising opportunities, caution is needed as their performance will be influenced by broader market sentiment, which can be volatile. Therefore, it’s important to balance optimism with an awareness of potential market fluctuations.

Featured image via Shutterstock