As the stock market rallies, led by the benchmark S&P 500, Moody’s Analytics chief economist Mark Zandi is sounding a note of caution.

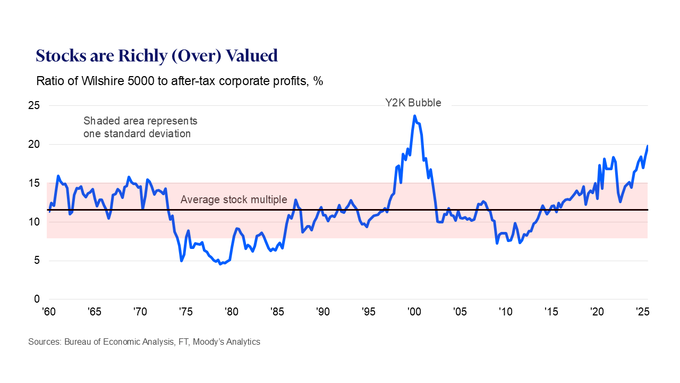

Specifically, Zandi has warned that market valuations are approaching levels last seen during the height of the Dot-com bubble, according to an X post on September 29.

He pointed to revisions in U.S. GDP that showed stronger consumer spending than initially estimated, driven largely by affluent households.

This spending is closely tied to rising asset values, particularly equities. Zandi cautioned that the rally is being fueled more by investor enthusiasm than by fundamentals, raising concerns of an overheated market.

Notably, his preferred gauge, the ratio of the Wilshire 5000 to after-tax corporate profits, is near historic highs, surpassed only once in the past 75 years during the Y2K bubble.

The analyst added that while artificial intelligence has given investors reasons for optimism, parallels to past market manias cannot be ignored.

“While there are good reasons for stock prices to be up a lot – yes, AI – but investors appear to be getting ahead of themselves,” Zandi said.

Wealthy consumers threat to economy

Zandi stressed that a correction in stock prices could prompt wealthier consumers to pull back, threatening broader economic momentum.

Although the revised GDP data suggest recession risks have eased, Zandi stressed they remain elevated as markets stretch into historic territory.

Interestingly, he has repeatedly highlighted underlying risks, estimating nearly a 50% chance of a downturn within the next year.

Notably, the economist has described the current environment as a “jobs recession,” with payroll growth weakening and several states already in contraction.

By his assessment, one-third of the U.S. economy is already in recession or at high risk, while another third is stagnating.

Zandi has also cited uneven regional performance, inflation pressures that could intensify, and a housing market still under strain.

While recent data points to resilience, he warned that the same forces lifting growth, soaring asset values, and concentrated consumer strength, could quickly destabilize if sentiment shifts.

Featured image via Shutterstock