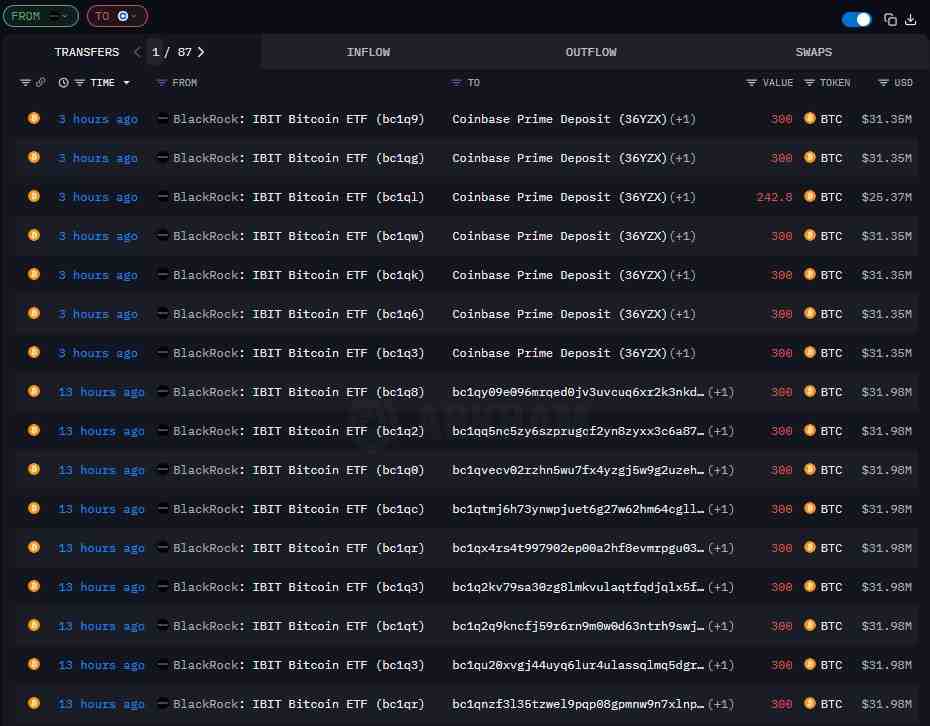

BlackRock, the world’s largest asset manager, deposited approximately 2,043 Bitcoin (BTC) and 22,681 Ethereum (ETH) into Coinbase Prime on Tuesday, November 4.

The transfer was worth $213 million in Bitcoin and $80 million in Ethereum, or $293 million in total, according to data Finbold reviewed on Arkham.

As of the time of writing, BlackRock holds $97 billion in crypto, of which 86% are in BTC and around 14% in ETH.

As usual, the deposit has sparked significant interest among traders regarding potential shifts in institutional flows, as well as fear that the asset manager could begin dumping the two flagship currencies.

The move could potentially be a preparation for some upcoming market plays, most likely with short-term volatility spikes now that BlackRock has announced a new exchange-traded fund (ETF) launch in Australia.

Blackrock Bitcoin ETF in Australia

The recent transactions to Coinbase coincide with the fund’s newly announced plans to launch the iShares Bitcoin ETF (IBIT) on the Australian Securities Exchange (ASX) in mid-November.

With the new listing, Australia will join the United States, Germany, and Switzerland as a country that allows active spot Bitcoin ETFs.

Last week, the Australian Securities and Investments Commission (ASIC) reclassified most digital assets, including stablecoins, as financial products.

Although “digital gold” does not count as a financial product per se, products that include it can be considered as such, as per the new guidance.

Accordingly, the debut is expected to solidify the country’s status as a center for regulated crypto investment products in the region.

Bitcoin and Ethereum price action

At press time, both Bitcoin and Ethereum were in the red on the daily chart, the former dropping 3.31% and the latter 4.75%.

Far from being an isolated incident, the drop reflects the state of the broader market, which is likewise down some 3.5%, wiping more or less $230 billion in less than 24 hours.

The two assets were not the biggest losers, as virtually all of the top ten cryptocurrencies by market cap saw similar drops. XRP, for instance, was down 4.7% at publication time, while Solana (SOL) had dropped 6.5%.

What’s more, $1.27 billion in leveraged futures across cryptocurrencies were wiped out, while BTC struggles as the Fear & Greed Index drops to 27, deep in the “Fear” category.

Featured image via Shutterstock