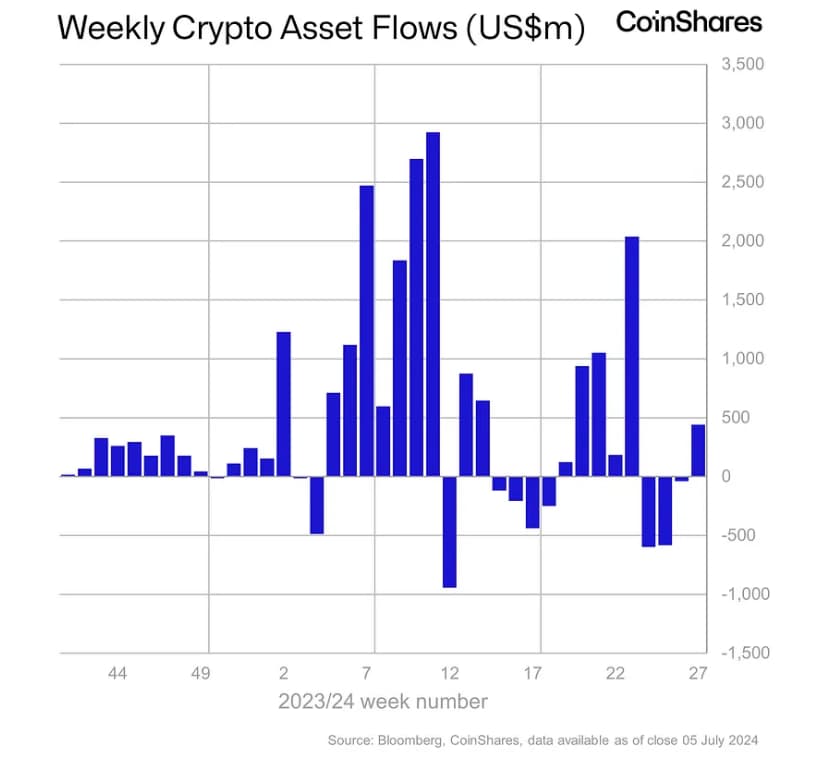

In the week ending July 5, digital asset investment products experienced significant inflows totaling $441 million, marking the first positive inflows in a month.

This shift suggests that recent price weaknesses, driven by events like the Mt. Gox and German Government selling pressures, are now seen as buying opportunities.

The week saw a substantial rebound from the $39 million outflows recorded previously, with Bitcoin (BTC) leading the inflows with nearly $400 million.

This reversed a three-week trend of outflows that totaled over $1.2 billion. The inflows occurred as Bitcoin prices briefly dipped to $54,000, their lowest level since February.

Notably, Bitcoin funds from Fidelity and ProShares had the highest inflows at about $200 million and $100 million, respectively, while Grayscale Bitcoin Trust (GBTC) continued to see outflows, losing around $90 million as per Cionshares report.

The United States was the primary contributor, accounting for $384 million in inflows. Other notable regions included Hong Kong with $32 million, Switzerland with $24 million, and Canada with $12 million.

Conversely, Germany experienced $23 million in outflows. This distribution highlights opportunistic buying across a broad set of countries, with the leading the charge.

Volumes in Exchange Traded Products (ETPs) remained relatively low at $7.9 billion for the week, reflecting the typical seasonal pattern of lower volumes during the summer months and representing a 17% lower participation rate compared to the total market for trusted exchanges.

Diversification in digital assets

Bitcoin dominated with $398 million in inflows, marking a significant turnaround from the previous three weeks of substantial outflows. Investors also showed increased interest in a broader set of altcoins.

Solana (SOL) stood out with $16 million in inflows last week, a remarkable 900% increase compared to the previous week, bringing its year-to-date (YTD) inflows to $57 million.

This surge followed asset manager VanEck’s appeal to the United States Securities and Exchange Commission (SEC) for approval of a Solana-backed ETF.

Additionally, the Sentinel Action Fund recently doubled its Solana donations to a pro-crypto political action committee supporting four pro-crypto Senate candidates according to reports.

Ethereum (ETH) saw inflows of $10 million last week, although it remains the only ETP to have experienced net outflows YTD. The improved sentiment towards Ethereum could signal a shift in investor confidence despite its overall YTD performance.

Broader trends and blockchain equities

While digital asset investment products experienced significant inflows, blockchain equities saw an additional $8 million in outflows last week, bringing the YTD outflows to $556 million.

This ongoing trend suggests that investors remain cautious about blockchain equities despite broader optimism in the digital asset market.

The significant inflows into digital asset investment products indicate that investors are capitalizing on recent price weaknesses, viewing them as opportunities for potential gains. Bitcoin remains the primary choice, but there is also notable interest in altcoins, particularly Solana and Ethereum.

However, the positive sentiment in digital asset products has not translated into the blockchain equities market, which continues to see outflows.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.