BlackRock (NYSE: BLK) has actively accumulated Bitcoin (BTC), especially for the exchange-traded fund (ETF) managed by its subsidiary, iShares (IBIT). Yet, investors wonder if BlackRock is selling its BTC in the face of the recent crash that suddenly shifted the cryptocurrency market‘s sentiment.

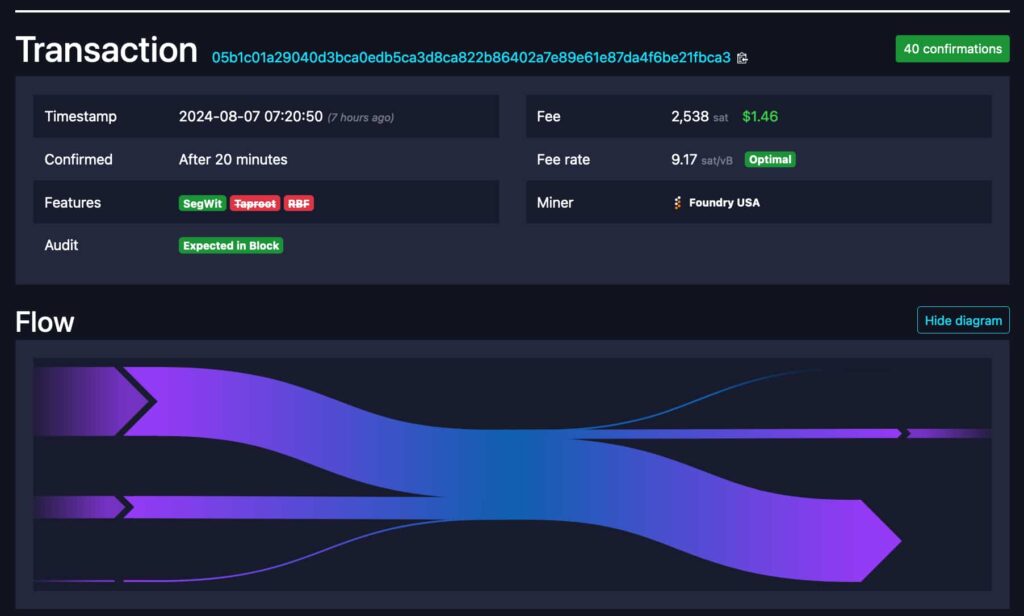

According to the on-chain analyst known as Maartun, BlackRock could indeed be selling Bitcoin today, on August 7. As reported, monitored BlackRock wallets moved 632 BTC to a recently created wallet. However, the analyst explained that he is unsure whether this is a selling activity on Coinbase or an internal transaction.

BlackRock’s “not selling” previous behavior

Previously, Maartun surprisingly pointed out that BlackRock’s wallets remained untouched despite the crash, following up with the recent analysis.

Other prominent analysts, like Eric Balchunas, have also highlighted the lack of disclosed outflows from iShares during BTC’s crash. Nevertheless, it is important to understand that this does not mean IBIT investors are not selling—just that the fund manager is not offloading its own holdings.

BlackRock’s iShares (IBIT) Bitcoin holdings

Essentially, BlackRock’s iShares buy BTC when demand increases for IBIT, generating inflows to the trust, while selling Bitcoin from iShares’s holdings when investors sell their ETFs, generating outflows from its wallets.

It is possible, however, that BlackRock could be absorbing the sold shares itself, to avoid selling Bitcoin.

IBIT has registered the largest inflows among its competitors since the Securities and Exchange Commission (SEC) approved Bitcoin spot ETFs. During this time, the trust acquired over 344,010 BTC, worth over $19 billion at current prices.

Notably, data from CoinGlass shows an outflow of 59 BTC in one day, representing 0.02% of the total holdings.

BlackRock’s Bitcoin inflow and outflow (buying and selling)

Alistair Milne, CIO at Altana Digital, reported only one day of outflows to the iShares Bitcoin trust. The executive explained that “someone” could have been “taking the risk of keeping the shares” IBIT investors sold.

Data from CoinGlass indeed show BlackRock so far registering zero flows from its Bitcoin ETF in the past two days. This same behavior was observed in previous BTC dips when most ETFs were selling.

Now, the market awaits today’s flow disclosure to see if BlackRock is selling part of its Bitcoin holdings. Finbold recently reported Robert Mitchnick, Head of Digital Assets for BlackRock, revealing Bitcoin and Ethereum (ETH) as the only two cryptocurrencies driving interest from the company’s clients.

Given the company’s size and influence, investors could see an outflow as a bearish signal moving forward. Conversely, iShares holding or buying BTC broadcasts a strong bullish signal that Bitcoin enthusiasts welcome during these uncertain times.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.