Ethereum (ETH) is the second most valuable cryptocurrency and the leading infrastructure for Web3 and decentralized finance (DeFi). However, a recent indicator’s all-time high suggests the token may be overvalued in relation to the network activity.

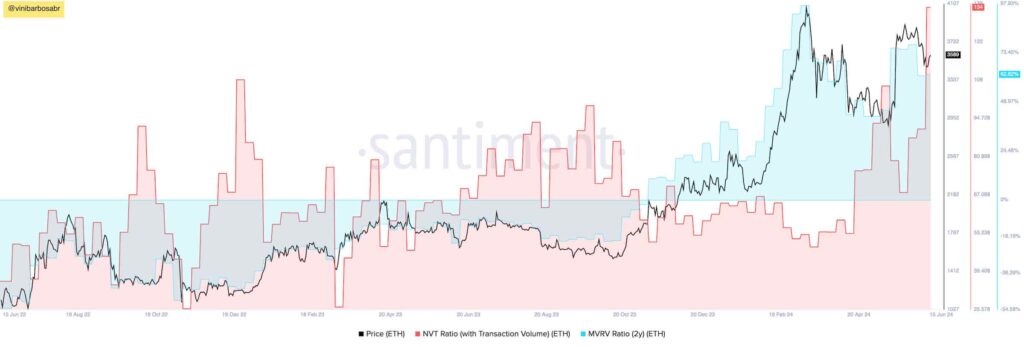

Finbold retrieved premium data from Santiment’s Sanbase Pro on June 16, highlighting a network value indicator making bearish new highs. For validation, we also compared it to another solid network value indicator, both in a two-year time frame.

Notably, the NVT metric raised concerns with an all-time high 134 ratio. This result indicates ETH’s daily capitalization is 134 times higher than the daily volume transacted on the Ethereum network. Santiment explained that this metric provides insights into overvalued cryptocurrencies similar to stocks’ Price-to-Earning (P/E) ratio.

Moreover, the Market Value to Realized Value (MVRV) ratio shows that current prices are nearly 63% higher than the dollar-cost average of the whole network in the last two years.

The bullish case for a not-overvalued Ethereum

As of this writing, ETH trades at $3,590, sustaining higher grounds in the expectation of an altcoin season. According to a cryptocurrency trader and analyst who goes by Yoddha, ETH is the “most bullish altcoin right now.” Finbold covered this analysis in a report highlighting other positive indicators as a counterpoint to the aforementioned network value metrics.

Furthermore, Ethereum investors await the Securities and Exchange Commission (SEC) approval of exchange-traded funds (ETFs) indexed to spot market Ether.

Eric Balchuas, Senior ETF analyst for Bloomberg, expects the Ethereum spot ETFs approval for July 2. ETH could regain momentum then, seeking higher price levels despite the bearish indicators.

All things considered, is Ethereum overvalued?

In conclusion, the conflicting signals from on-chain indicators and market sentiment leave Ethereum’s valuation in a state of uncertainty.

While the NVT and MVRV ratios suggest that ETH may be overvalued in relation to its network activity, the bullish outlook from analysts and the anticipation of Ethereum spot ETFs provide a counterargument.

As the cryptocurrency market continues to evolve, investors should exercise caution and consider multiple factors when assessing the value of Ethereum. The upcoming weeks, particularly with the potential approval of spot ETFs, may provide more clarity on the direction of ETH’s price.

Ultimately, the market will determine whether Ethereum’s current valuation is justified or if a correction is on the horizon.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.