Palantir (NYSE: PLTR) continues to dominate headlines, reaching a new record high of $66.00 as it prepares to switch its stock listing from the New York Stock Exchange (NYSE) to the Nasdaq.

The move, set for November 26, positions the company for potential inclusion in the Nasdaq-100 Index, a catalyst for institutional buying and increased investor interest.

By the close of trading on November 15, Palantir’s stock was priced at $65.77, up 11% in just 24 hours. Over the past week, the stock gained more than 9%, and with a year-to-date increase of 296%, it has secured its spot as one of 2024’s top performers.

Key factors driving Palantir’s future growth

Palantir’s strong momentum is underpinned by its impressive Q3 earnings, which reported a 30% year-over-year revenue increase and raised full-year guidance.

This growth has been fueled by robust demand for the company’s AI products and extensive government contracts.

At the heart of Palantir’s success is its AI Platform (AIP), which enables advanced data processing and real-time insights across industries such as defense, healthcare, logistics, and finance.

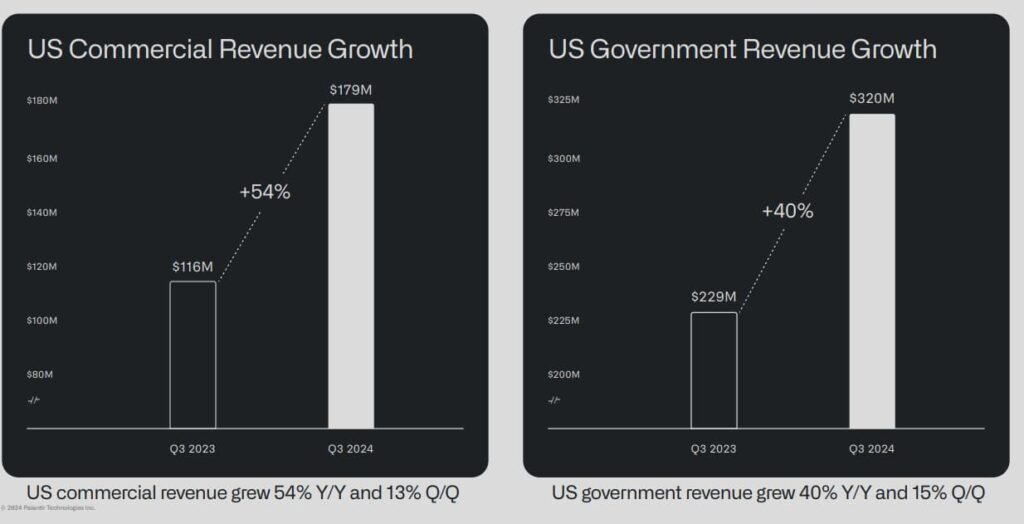

The government sector remains a cornerstone of its revenue, with U.S. government revenues growing 40% year-over-year in Q3 2024, driven by high-profile initiatives like the Department of Defense’s Open DAGIR project.

On the commercial side, U.S. revenues surged by 54% in the same period, reflecting the growing adoption of AIP by corporate clients.

Palantir also projected strong financials, reporting a 183% year-over-year increase in operating income and a 900-basis-point improvement in adjusted operating margin, benefiting from cost management and high-margin government contracts.

Financially, the company is in a solid position, holding $4.6 billion in cash with no debt as of Q3 2024. This provides it with the flexibility to invest in growth opportunities, pursue acquisitions, and innovate further.

Moreover, Palantir’s inclusion in the S&P 500 in September, along with its potential addition to the Nasdaq-100, has further elevated its market visibility and attracted institutional investment.

These factors collectively position Palantir as a leader in AI adoption and provide a strong foundation for continued growth across sectors.

Analysts warn about high valuation

Despite Palantir’s stellar performance, concerns about valuation persist. The stock trades at elevated levels, leading Jefferies analyst Brent Thill to downgrade it to “Underperform.”

Thill cited not only Palantir’s high premiums but also significant insider selling by CEO Alex Karp, who has offloaded over $1.2 billion worth of shares in the past three months.

Such activity raises questions about whether the current rally is sustainable, particularly given that some of the price gains may be driven more by market mechanics, such as index inclusions, than fundamental growth.

“While we believe fundamentals remain intact, sustaining the current valuation would require PLTR to accelerate growth to 40% for four consecutive years and trade at 12x CY28E revenue, which we view as unlikely,” the analyst said

Moreover, while Nasdaq-100 inclusion could fuel more institutional buying, it doesn’t directly impact Palantir’s operational performance.

High expectations for future growth are already baked into its market capitalization, now nearing $150 billion, making the stock vulnerable to sharp corrections if growth targets aren’t met.

Is Palantir stock a buy?

Palantir is undoubtedly a leader in the AI and data analytics space, with solid government and commercial revenues. However, its valuation poses a key risk.

At current levels, Palantir is among the most expensive software stocks, with a forward P/E ratio of 144.42, according to StockAnalysis.

This elevated valuation indicates that investors are paying a substantial premium for the company’s anticipated future earnings, reflecting that high growth expectations are already factored into the stock price.

While Palantir’s long-term growth prospects remain promising, its sharp rally has made it more vulnerable to heightened volatility.

For investors evaluating PLTR, the potential for further gains must be carefully weighed against the risk of a significant pullback, especially if the company’s growth fails to meet these lofty expectations.

Featured image via Shutterstock