2024 has been nothing but bad news for Tesla (NASDAQ: TSLA) as its stock took a heavy beating in the markets, declining nearly 30% since the start of the year, and with the news of increased competition in the form of Xiaomi (OTC: XIACF), the tough period persists.

On March 28, Chinese smartphone maker Xiaomi launched a sporty electric car on Thursday with styling cues drawn from Porsche and priced at 215,900 yuan ($29,872) below Tesla’s Model 3 which is priced at 245,900 ($29,902), highlighting the stiff competition from new entrants in an already crowded EV market in China.

The news seemed to negatively impact TSLA stock as it decreased -2.25% since the previous closing.

Weakening demand and lower delivery numbers speak against Tesla

Tesla is expected to report sluggish first-quarter deliveries next week as the impact of its price cuts fades and it faces stiff competition in a slowing electric-vehicle market.

Despite years of rapid sales growth, Tesla is anticipating a slowdown in 2024, exacerbated by its slow response in updating its aging models amidst high-interest rates dampening consumer spending.

Delivery estimates in China have dropped by 3% to 4% year-over-year this quarter, leading to sluggish growth and squeezed margins, particularly in China.

Will Xiaomi’s low prices be sustainable in the EV war?

Analysts hold differing views on Xiaomi’s car project amidst the challenging landscape of the current EV industry, which has already seen casualties.

While some view it as a natural extension for the company, given its widespread presence in Chinese homes with products like rice cookers and air purifiers, others see it as a departure from Xiaomi’s image as an affordable brand.

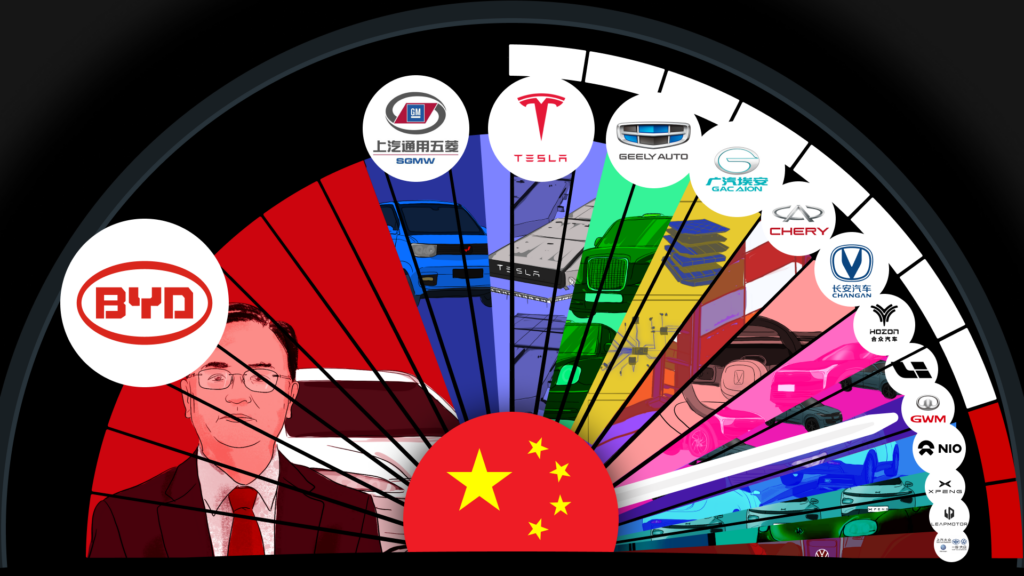

Additionally, the launch of the car coincides with a challenging period in China’s auto market, with established players continuously expanding their market share.

On the positive side, Xiaomi benefits from revenue generated by its other businesses, as analysts believe that Xiaomi’s expertise in smartphones gives it an advantage over traditional automakers.

Analysts aren’t convinced by Tesla price cuts

In its most recent note, Deutsche Bank highlighted concerns about Tesla’s margins and earnings, noting the company’s recent price cuts in China and Europe to stimulate vehicle purchases. While Tesla plans to raise prices in the US and China in April, Deutsche Bank sees this as an effort to boost sales in March rather than a reflection of strong demand.

The firm also expressed apprehension about Tesla’s deliveries, suggesting a potential risk to earnings for the quarter. Looking ahead to the full year, Deutsche Bank sees significant downside risk to volume and pricing expectations, which could further dampen investor sentiment and place considerable pressure on the stock.

Tesla appears to be facing the challenging task of fending off competition, particularly in China, while also striving to maintain profitability, which poses a precarious balancing act.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.