Since early 2022, the Federal Reserve has taken a hawkish approach to the United States economy. Thus, it has implemented “anti-inflation” policies, such as increasing the interest target rate, in the face of unprecedented money issuance and a relevant surge in the Consumer Price Index (CPI).

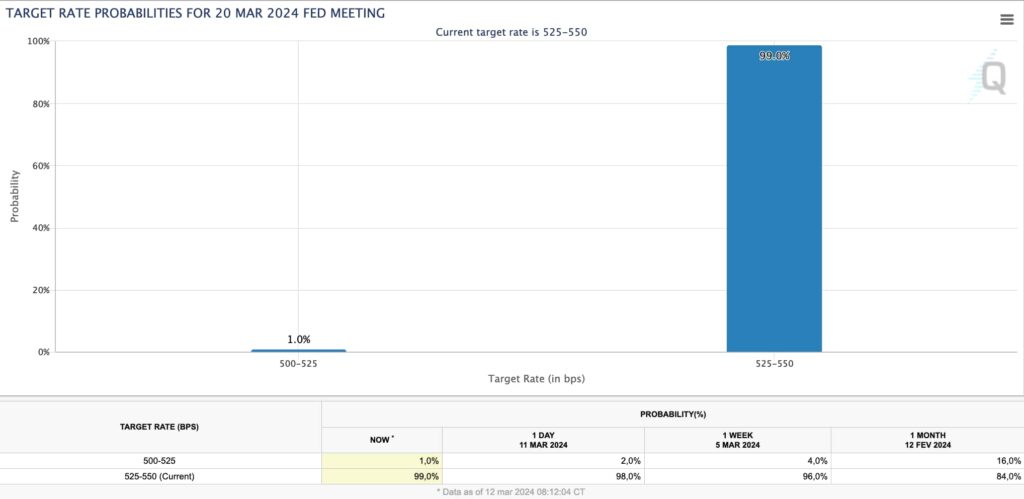

Two years later, the Federal Reserve has lacked in its promises to ease the tight monetary policy imposed. Recently, the Fed hinted at further delays in starting the interest target rate cuts, which were previously expected by March.

However, inflation indexes show these hawkish policies may take longer than current finance market expectations.

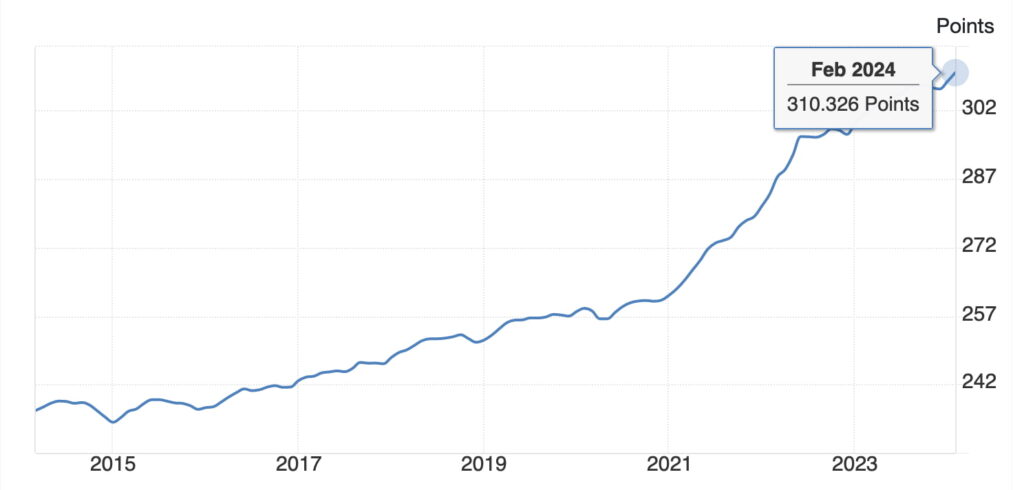

Notably, CPI data from February shows an increase of 3.2% in consumer prices year-over-year (YoY) to 310.326 points. This is a worse result than January’s YoY CPI of 3.1%, which the market expected to see repeating.

Why is inflation increasing?

According to the Austrian School of Economics, what the Federal Reserve calls inflation is one of the effects of inflation. Consumer prices increase due to the loss of purchasing power of a country’s base currency, like the dollar.

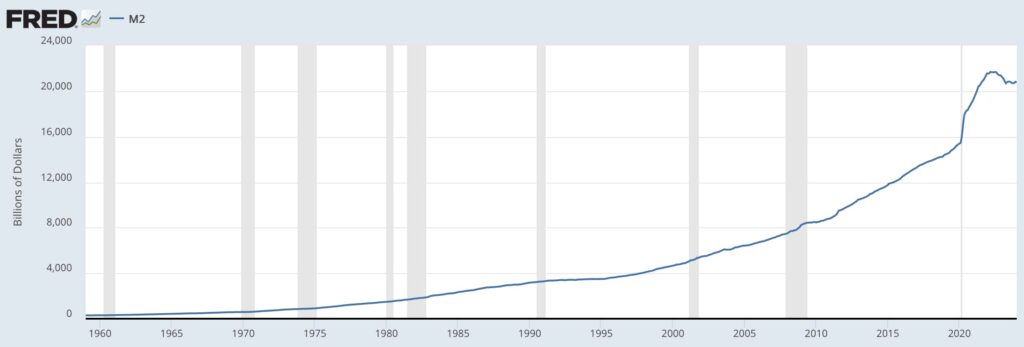

“In theoretical investigation there is only one meaning that can rationally be attached to the expression inflation: an increase in the quantity of money (in the broader sense of the term, so as to include fiduciary media as well), that is not offset by a corresponding increase in the need for money (again in the broader sense of the term), so that a fall in the objective exchange value of money must occur.”

– Ludwig Von Mises in The Theory of Money and Credit (1953)

Interestingly, this description can be observed by comparing the CPI historical data and the Federal Reserve’s money supply historical chart. In the latter, it is evident how the central bank massively increased the money issuance to unprecedented levels since 2020.

This caused a similar movement in the Consumer Price Index, which is still suffering from these inflationary policies as of this writing.

Federal Reserve’s interest rate policies to fight inflation

Therefore, the Federal Reserve’s current “anti-inflation” policies do not necessarily address inflation but price rises, as measured by the CPI. The Fed has increased interest rates in the United States to slow down the economy and the data that compose the Index.

With a still-rising CPI, the market fears this hawkish policy may last longer than expected. As a result, non-cut probabilities for the next Fed meeting on March 20 surged to an impressive 99%. Previously, on February 12, 16% of traders were betting on an interest rate cut, now down to 1%.

In summary, the Federal Reserve continues to defend “anti-inflation” measures that target the CPI after unprecedented years of supply inflation. So far, interest rate hikes have had a low impact on keeping price indexes low.

“First of all there is no longer any term available to signify what inflation used to signify. It is impossible to fight a policy you cannot name.”

– Ludwig Von Mises in Human Action (1998)

On that note, Peter Schiff believes the past 2 years of disinflation trend has ended. Yet, Schiff expects even higher interest target rates by the Federal Reserve in the coming months.

At one point, however, people will have to start asking if the Fed’s “anti-inflation” policies are working and what it takes to improve the economy moving forward.